The Chip Paradigm: How Next-Generation Semiconductors Are Rewriting Asset Class Rules

Silicon Dreams and Portfolio Realities in the Age of Artificial Intelligence

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

The semiconductor industry stands at an unprecedented crossroads in 2025, where the convergence of artificial intelligence, quantum computing, and next-generation connectivity technologies is fundamentally reshaping not just how chips are designed and manufactured, but how entire asset classes correlate and perform in modern portfolios. This transformation extends far beyond the traditional boundaries of technology investing, creating ripple effects that challenge conventional wisdom about diversification, risk management, and asset allocation strategies.

The emergence of specialized chips for artificial intelligence has created a market segment that barely existed a decade ago but is now projected to exceed $500 billion by 2028, according to AMD's latest projections1. Meanwhile, the integration of semiconductors into automotive systems has reached a tipping point where electric vehicles use two to three times more chips than traditional vehicles, fundamentally altering the relationship between technology and industrial sectors. These developments are not merely technological milestones; they represent a structural shift in how value is created, distributed, and captured across the global economy.

As we enter what Google has termed the "age of inference", where AI systems move from responsive to proactive generation of insights, the semiconductor technologies enabling this transition are creating new investment paradigms that traditional portfolio construction methods struggle to accommodate. The quantum computing sector, celebrating its centennial year with the UN's designation of 2025 as the International Year of Quantum Science and Technology, promises computational capabilities that could render current encryption methods obsolete while simultaneously creating entirely new asset classes around quantum-resistant technologies.

This transformation is occurring against a backdrop of unprecedented geopolitical tensions, with the US-China technology rivalry driving investment flows worth tens of billions of dollars into domestic chip manufacturing capabilities. The CHIPS Act's $52 billion commitment6 and China's $47.5 billion state investment fund represent just the visible portion of a global reorganization of semiconductor supply chains that is reshaping how investors evaluate geographic exposure, supply chain risks, and sovereign technology capabilities.

The Current Landscape: Specialized Computing Reshapes Everything

Artificial Intelligence Accelerators: The New Gold Rush

The artificial intelligence chip market has evolved from a niche segment to the primary growth driver of the entire semiconductor industry. NVIDIA's continued dominance in this space has created a market dynamic where a single company's quarterly earnings can move entire indices, with the company's market capitalization approaching $3 trillion. This concentration of value in AI-specific hardware represents a fundamental shift from the commodity-like nature of traditional semiconductors to highly specialized, application-specific integrated circuits that command premium pricing and margins.

Google's recent introduction of Ironwood, its seventh-generation Tensor Processing Unit, exemplifies this trend toward specialized AI hardware. Designed specifically for inference workloads rather than training, Ironwood represents the industry's maturation from general-purpose AI acceleration to task-specific optimization. The chip scales up to 9,216 liquid-cooled units with breakthrough Inter-Chip Interconnect networking, demonstrating how AI infrastructure is becoming increasingly sophisticated and capital-intensive.

The competitive landscape in AI chips has intensified significantly in 2025, with AMD's MI350 series offering up to 40 percent more tokens per dollar than NVIDIA's B200 for inference tasks. This competition is driving rapid innovation cycles that compress traditional semiconductor development timelines from years to months, creating both opportunities and risks for investors attempting to time market entries and exits.

5G and IoT Integration: The Connectivity Revolution

The transition to 5G and preparation for 6G networks is creating demand for semiconductors that support high-speed, low-latency communications across an expanding array of connected devices. The 5G chipset market alone grew from $16.88 billion in 2024 to $22.38 billion in 2025, representing a compound annual growth rate that reflects the technology's rapid deployment.

Particularly significant is the development of low-power Wi-Fi 6 chips by companies like Qualcomm and Silicon Labs, which address a critical gap in IoT device connectivity. These advances enable battery-powered devices to maintain Wi-Fi connectivity without the power consumption penalties that previously limited their deployment, opening new markets for industrial sensors, asset tracking, and smart building applications.

The integration of 5G technology with Internet of Things applications is creating semiconductor demand that extends far beyond traditional telecommunications infrastructure. Industrial automation, smart cities, and autonomous vehicle communications all require specialized chips that can handle the computational and communication demands of real-time, low-latency applications.

Automotive and Autonomous Systems: Computing on Wheels

The automotive sector's transformation into a technology-driven industry has created one of the fastest-growing markets for semiconductor applications. Modern vehicles contain between 1,000 and 3,500 semiconductors, with advanced driver assistance systems requiring sophisticated sensing, processing, and communication capabilities.

The progression toward autonomous driving is driving demand for specialized chips that can process data from multiple sensor modalities—radar, lidar, and cameras—in real-time while maintaining the safety-critical reliability requirements of automotive applications. Texas Instruments' automotive processor portfolio exemplifies this trend, integrating high-performance computing with automotive-grade reliability standards.

Electric vehicle adoption is accelerating this semiconductor integration, as battery management systems, power electronics, and charging infrastructure all require specialized chip solutions. The convergence of electrification and automation in vehicles is creating semiconductor content growth rates that far exceed traditional automotive industry growth patterns.

Quantum and Neuromorphic Computing: The Next Frontier

The quantum computing sector is experiencing a critical transition from research curiosity to practical application. Microsoft's introduction of the Majorana 1 chip, built on topological quantum computing architecture, represents a fundamental departure from traditional quantum approaches by building fault tolerance directly into the hardware. This development could accelerate the timeline for practical quantum applications significantly.

IBM's deployment of quantum systems to over 250 customers, including Wells Fargo and E.ON, demonstrates that quantum computing is moving beyond experimental phases toward commercial applications. The semiconductor requirements for quantum systems—including specialized control electronics, cryogenic interfaces, and error correction hardware—are creating entirely new markets for specialized chip solutions.

Neuromorphic computing, which mimics brain-like neural architectures, offers an alternative approach to AI acceleration that could complement traditional von Neumann processors. These chips enable parallel processing and event-based computation that could prove particularly valuable for edge AI applications where power efficiency is critical.

Historical Context: Learning from Semiconductor Cycles

The Cyclical Nature of Innovation

The semiconductor industry has historically exhibited pronounced cyclical behavior driven by the interplay between capacity investments, demand fluctuations, and inventory dynamics. The 1980s semiconductor cycles, particularly the dramatic downturn of 1985, provide instructive examples of how rapid capacity expansion can lead to oversupply and price collapses when demand fails to materialize as expected.

The 2020-2023 global chip shortage demonstrated how tightly coupled the semiconductor supply chain has become with global economic activity. Initially triggered by COVID-19 disruptions, the shortage was exacerbated by sudden demand shifts as consumers and businesses adapted to remote work and digital services. The automotive industry's experience during this period—where production cuts led to chip allocation priorities that favored higher-margin consumer electronics—illustrates how semiconductor supply constraints can reshape entire industry value chains.

The recovery from the chip shortage provides insights into how modern semiconductor cycles differ from historical patterns. Unlike previous downturns driven primarily by oversupply, the recent cycle was characterized by supply chain fragility and geopolitical disruptions that traditional economic models struggled to predict or explain.

Geopolitical Factors Reshape Market Dynamics

The current semiconductor landscape is increasingly shaped by geopolitical considerations that extend far beyond traditional market forces. The US-China technology rivalry has created parallel investment streams as both countries seek to develop domestic semiconductor capabilities. The CHIPS Act's $52 billion investment program and China's corresponding state-led investments represent a fundamental shift from market-driven to strategically-driven capacity allocation.

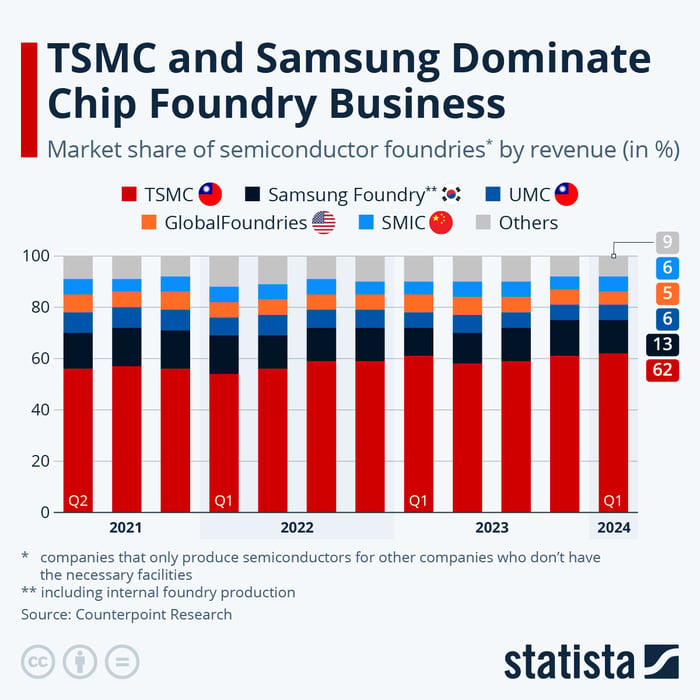

Taiwan's central role in advanced semiconductor manufacturing has become a critical geopolitical vulnerability, with companies like TSMC producing 92% of the world's most advanced chips. Natural disasters, such as the 7.4-magnitude earthquake that temporarily disrupted TSMC operations in April 2025, serve as reminders of the concentrated risks in current supply chain configurations.

The emergence of alternative semiconductor hubs in countries like India and Vietnam reflects efforts to diversify supply chains and reduce dependence on traditional manufacturing centers20. These developments are creating investment opportunities in frontier markets while simultaneously challenging established players to maintain their technological advantages.

Multi-Asset Implications: Redefining Portfolio Construction

Equity Markets: Technology Sector Dominance and Correlation Shifts

The semiconductor industry's evolution is fundamentally altering equity market dynamics, particularly the relationship between technology stocks and broader market indices. NVIDIA's market capitalization growth to nearly $3 trillion has created a concentration risk in major indices that mirrors the dot-com era's technology stock concentration. However, unlike the speculative valuations of the late 1990s, current semiconductor valuations are supported by measurable revenue growth and expanding addressable markets.

The correlation between semiconductor stocks and broader equity markets has increased significantly during periods of economic uncertainty, challenging traditional diversification assumptions. During the 2022 semiconductor stock collapse, correlation with broader markets approached levels that limited the sector's portfolio diversification benefits. This increased correlation during stress periods suggests that semiconductor investments may provide less downside protection than historically assumed.

The emergence of quantum computing stocks has created a new category of technology equity investments with fundamentally different risk-return characteristics. Following Google's Willow quantum chip announcement, quantum computing stocks experienced average gains exceeding 100% as investors reassessed the commercial viability of quantum technologies.

Fixed Income: Interest Rate Sensitivity and Credit Risk Dynamics

Semiconductor companies' capital-intensive business models create unique relationships with fixed income markets that extend beyond typical interest rate sensitivity. The industry's requirement for massive upfront investments in fabrication facilities means that changes in interest rates can significantly impact project economics and expansion timing.

The Great Correlation Reset: Markets Break the Rules in 2025

As we move deeper into 2025, the complex interplay of monetary policy adjustments, geopolitical tensions, and economic growth concerns continues to reshape traditional asset relationships. The recent negative turn in equity-bond correlations suggests a potential return to historical norms, but evidence indicates this relationship remains fragile and sub…

The correlation between stock and bond returns varies significantly based on the underlying drivers of market movements. During periods when inflation concerns drive market volatility, semiconductor stocks may exhibit positive correlation with bond yields as investors anticipate that higher rates will constrain capital-intensive expansion projects. Conversely, during growth scares, semiconductor stocks may benefit from lower rates even as bond prices rise.

Credit markets are increasingly focused on semiconductor companies' ability to maintain cash flows during cyclical downturns while funding ongoing research and development investments. Companies that derive significant revenue from China face additional credit considerations related to geopolitical risks and potential export restrictions.

The development of green bonds and sustainability-linked financing is becoming increasingly relevant for semiconductor companies as environmental, social, and governance considerations gain prominence. Advanced semiconductor manufacturing processes require significant energy and water resources, making sustainability financing an important component of future capital structures.

Commodities: Raw Materials and Energy Dependencies

Semiconductor manufacturing requires a complex array of raw materials and commodities, from high-purity silicon and rare earth elements to specialized gases and chemicals. The industry's growth is creating increasing demand for these inputs, potentially creating supply constraints and price pressures that affect broader commodity markets.

The energy intensity of semiconductor manufacturing, particularly for advanced node production, is creating new linkages between chip demand and energy markets. The shift toward more powerful AI chips is driving data center electricity consumption to levels that could influence regional power grid planning and energy commodity pricing.

Geopolitical tensions affecting commodity supplies can have disproportionate impacts on semiconductor production. China's export restrictions on gallium and germanium, critical materials for advanced chip production, demonstrate how commodity market disruptions can propagate through technology supply chains26.

The development of recycling and circular economy approaches in semiconductor manufacturing is creating new commodity flows as companies seek to recover valuable materials from electronic waste. This trend could reduce dependence on primary commodity extraction while creating new investment opportunities in recycling infrastructure.

Real Estate: Data Centers and Manufacturing Facilities

The growth of AI and cloud computing is driving unprecedented demand for data center real estate, with implications that extend far beyond traditional technology real estate investment trusts. Modern AI workloads require data centers with specialized cooling systems, power infrastructure, and connectivity that command premium lease rates and valuations.

Semiconductor manufacturing facilities represent some of the most capital-intensive real estate investments globally, with advanced fabrication plants costing tens of billions of dollars. The geographic distribution of these facilities is increasingly influenced by government incentives and national security considerations rather than pure economic factors.

The emergence of edge computing is creating demand for smaller, distributed data centers that bring computation closer to end users. This trend is driving real estate demand in secondary and tertiary markets while reducing the concentration of technology infrastructure in major metropolitan areas.

PropTech innovations, including AI-powered property management and blockchain-based transactions, are creating new connections between semiconductor advances and real estate market efficiency. These technologies are enabling more sophisticated real estate analytics and automated property management systems.

Alternative Investments: Thematic ETFs and Venture Capital

Thematic exchange-traded funds focused on artificial intelligence, robotics, and semiconductor technologies have become increasingly popular vehicles for accessing technology sector growth. The Global X Artificial Intelligence & Technology ETF (AIQ) and similar funds provide diversified exposure to technology themes while reducing single-stock concentration risks.

The performance of AI-focused ETFs has been mixed in 2025, with the Themes Generative Artificial Intelligence ETF (WISE) showing a year-to-date decline of 11.89% despite strong underlying technology trends. This performance dispersion highlights the challenges of translating technology advancement into consistent investment returns.

Venture capital and private equity investments in semiconductor companies reached record levels, with over $6 billion invested globally in 2022. The focus has shifted toward "fabless" semiconductor companies that design chips but outsource manufacturing, reducing capital requirements while maintaining intellectual property ownership.

Robotics ETFs, such as the ROBO Global Robotics & Automation Index ETF, provide exposure to the broader automation trends driving semiconductor demand. These funds typically include semiconductor companies alongside robotics manufacturers, automation software providers, and industrial equipment companies.

Intellectual Property as an Asset Class

The semiconductor industry's intellectual property landscape is evolving into a distinct asset class with measurable economic value and investment characteristics. Global semiconductor patent filings increased 22% from 2022/23 to 2023/24, reflecting the industry's innovation intensity and the growing importance of IP protection.

The semiconductor intellectual property market was valued at $6.50 billion in 2022 and is projected to reach $13.10 billion by 2033, representing a compound annual growth rate of 6.6%. This growth is driven by increasing specialization in chip design and the emergence of IP licensing as a standalone business model.

Patent portfolios are increasingly being monetized through licensing agreements, litigation settlements, and direct sales to third parties. Companies like Lumenci are developing specialized strategies for transforming patent portfolios from cost centers to revenue generators, particularly in the semiconductor sector.

The open-source hardware movement, exemplified by RISC-V architecture, is creating alternative models for intellectual property development and monetization34. While reducing licensing costs for adopters, open-source approaches require different investment strategies focused on service provision and customization rather than traditional IP licensing.

Currency and International Exposure Considerations

The global nature of semiconductor supply chains creates significant currency exposure for companies and investors. TSMC's dominance in advanced manufacturing means that companies requiring cutting-edge chips have substantial exposure to Taiwan dollar fluctuations.

The US dollar's role as the primary currency for semiconductor transactions creates natural hedging opportunities for US-based investors but adds currency risk for international portfolios. European and Japanese semiconductor companies face ongoing translation risks as they compete in dollar-denominated markets.

Emerging market semiconductor investments, particularly in India and Southeast Asia, carry additional currency considerations as these countries develop their domestic chip industries. Currency volatility can significantly impact the returns of these investments when translated back to developed market currencies.

The development of digital currencies and central bank digital currencies could create new payment mechanisms for international semiconductor transactions, potentially reducing currency conversion costs and settlement risks in global supply chains.

Future Outlook and Investment Implications

Emerging Technologies and Market Evolution

The semiconductor industry is approaching several technological inflection points that could reshape investment opportunities over the next decade. The transition to 2nm process technology represents not just a incremental improvement but a fundamental shift in manufacturing complexity and capital requirements. Only a handful of companies globally have the technical and financial resources to compete at these advanced nodes, suggesting continued market concentration.

Quantum computing's progression from experimental to commercial applications could create entirely new categories of semiconductor demand while potentially obsoleting current encryption and security technologies. The timing of this transition remains uncertain, but the potential impact on cybersecurity, financial services, and defense applications is substantial enough to warrant investor attention.

The integration of AI capabilities directly into semiconductor hardware, rather than relying on separate AI accelerators, represents another significant trend44. This integration could reduce system complexity and power consumption while enabling new applications that require real-time AI processing capabilities.

Investment Strategy Adaptations

Traditional portfolio construction methods may require modification to account for the changing correlation patterns and risk characteristics of semiconductor investments. The increased correlation between technology stocks during market stress periods suggests that sector diversification within technology may be less effective than previously assumed.

Multi-asset allocation strategies that explicitly account for technology sector concentration risks may be necessary for investors with significant semiconductor exposure. These strategies should consider the cyclical nature of semiconductor markets while maintaining exposure to long-term growth trends.

Thematic investing approaches that focus on specific technology applications rather than broad semiconductor exposure may provide more targeted risk-return profiles8. AI, automotive, and quantum computing themes each have different risk characteristics and may perform differently across market cycles.

Global Economic Implications

The semiconductor industry's growth trajectory suggests that it will become an increasingly important component of global economic activity. McKinsey's projection that the industry will reach $1 trillion by 2030 implies that semiconductor performance could have macroeconomic implications similar to those currently associated with oil or financial services33.

The geographic redistribution of semiconductor manufacturing capacity, driven by national security considerations and government incentives, is creating new patterns of international trade and investment flows20. These shifts may affect currency relationships and international capital allocation patterns.

The energy intensity of advanced semiconductor manufacturing is creating new linkages between technology growth and environmental sustainability. The industry's ability to improve energy efficiency while scaling production capacity will influence both investment returns and regulatory acceptance of continued growth.

Conclusion

The semiconductor industry's transformation from a cyclical manufacturing sector to the foundation of the global digital economy represents one of the most significant investment paradigm shifts of the modern era. The convergence of artificial intelligence, quantum computing, 5G connectivity, and autonomous systems is creating semiconductor demand patterns that traditional analytical frameworks struggle to accommodate. For investors and asset managers, this transformation requires a fundamental reconsideration of how technology sector investments fit within diversified portfolios.

The multi-asset implications of semiconductor evolution extend far beyond technology stock selection. The sector's increasing influence on equity market correlation patterns, its capital-intensive relationship with fixed income markets, its commodity input requirements, and its infrastructure demands across real estate and alternative investments create interconnections that challenge traditional asset class boundaries. The emergence of intellectual property as a measurable asset class and the development of new thematic investment vehicles further complicate the landscape for asset allocators.

Perhaps most significantly, the semiconductor industry's evolution is occurring against a backdrop of intensifying geopolitical competition that adds layers of risk and opportunity beyond traditional business cycle considerations. The US-China technology rivalry, the strategic importance of Taiwan's manufacturing capacity, and the global race to develop domestic semiconductor capabilities are reshaping investment flows and creating new categories of sovereign risk that investors must navigate.

As we look toward the remainder of 2025 and beyond, several critical factors will determine whether current semiconductor investments deliver on their ambitious valuations. The successful commercial deployment of quantum computing applications, the sustained growth of AI workloads that require specialized chip architectures, the continued expansion of electric vehicle adoption, and the resolution of geopolitical tensions around technology trade will all influence sector performance.

For portfolio managers and individual investors, the semiconductor sector's complexity suggests that diversified exposure through multiple asset classes and investment vehicles may be more prudent than concentrated bets on individual companies or technologies. The sector's cyclical history reminds us that even the most promising technologies can experience dramatic valuation corrections when expectations exceed reality or when macroeconomic conditions shift unexpectedly.

The semiconductor industry's role as the enabler of virtually every major technological advancement means that its continued evolution will likely remain central to global economic growth and investment opportunities. However, the increasing concentration of value in a relatively small number of companies and the growing importance of geopolitical factors in sector performance suggest that investors must balance enthusiasm for long-term growth prospects with careful attention to risk management and portfolio diversification.

As Part 9 of our semiconductor industry exploration, this analysis reveals how deeply integrated these technologies have become in modern financial markets. The chips that power our devices are increasingly powering our investment returns as well, creating both unprecedented opportunities and new categories of risk that define the modern investment landscape. Understanding these dynamics is no longer optional for serious investors—it has become essential for navigating the technology-driven economy of the 21st century.

Sources

https://www.idaireland.in/latest-news/insights/semiconductor-industry-outlook

https://blog.google/products/google-cloud/ironwood-tpu-age-of-inference/

https://quantum2025.org

https://www.semiconductors.org/wp-content/uploads/2022/11/SIA_State-of-Industry-Report_Nov-2022.pdf

https://money.usnews.com/investing/articles/best-ai-etfs-to-buy

https://www.vmsconsultants.com/top-8-trends-shaping-semiconductor-manufacturing-in-2025/

https://www.regions.com/-/media/pdfs/AssetManagement-The-Semiconductor-Cycle.pdf

https://en.wikipedia.org/wiki/2020%E2%80%932023_global_chip_shortage

https://www.acuitykp.com/blog/impact-of-macro-economic-factors-on-global-semiconductor-sales/

https://www.linkedin.com/pulse/geopolitics-chips-how-emerging-markets-reshaping-nii-simmonds-zmj1e

http://www.diva-portal.org/smash/get/diva2:1878404/ATTACHMENT01.pdf

https://www.angelone.in/news/best-semiconductor-stocks-in-india-may-2025

https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2025/global-semiconductor-industry-outlook-2025.pdf

https://www.techrepublic.com/article/global-chip-shortage-cheat-sheet/

https://www.aurumproptech.in/pulse/blog/top-10-proptech-companies-revolutionising-real-estate

https://www.nasdaq.com/articles/3-etfs-invest-robotics-stocks

https://henry.law/blog/semiconductor-technology-an-overview-of-the-global-patent-landscape/

https://www.futuremarketinsights.com/reports/semiconductor-intellectual-property-market

https://www.infosys.com/iki/research/semiconductor-industry-outlook2025.html

https://www.rbcwealthmanagement.com/en-us/insights/the-chip-industrys-reshoring-revolution

https://www.tessolve.com/blogs/semiconductor-industry-outlook-for-2025/

https://www.newelectronics.co.uk/content/features/challenging-times-1

https://www.angelone.in/news/why-semiconductor-stocks-crashed-us-export-curbs-and-taiwan-remarks

https://www.ig.com/en/trading-strategies/are-these-the-best-ai-etfs-to-watch--240319

https://www.investopedia.com/investing/6-asset-allocation-strategies-work/

https://techcrunch.com/2025/06/19/a-timeline-of-the-u-s-semiconductor-market-in-2025/

https://www.microchipusa.com/industry-news/5g-and-semiconductors

https://www.startus-insights.com/innovators-guide/semiconductors-trends-innovation/

https://www.spinquanta.com/news-detail/top-quantum-chips-companies-in20250109063010

https://www.semiconductors.org/policies/intellectual-property/

https://www.einfolge.com/blog/Patents-play-a-crucial-role-in-the-semiconductor-industry

https://www.semi.org/en/global-advocacy/intellectual-property

https://www.smallcase.com/collections/what-are-semiconductor-stocks/

https://luckboxmagazine.com/techniques/intermediate/the-semiconductor-trade-correlation-volatility/

https://www.tandfonline.com/doi/full/10.1080/0015198X.2024.2317333

https://www.investopedia.com/news/how-hedge-plunge-chip-stocks/

https://www.cbre.co.in/insights/articles/revolutionizing-real-estate-the-impact-of-technology

https://www.dusuniot.com/blog/iot-chips-enabling-connectivity-and-advanced-functionality/

https://ijcttjournal.org/2024/Volume-72%20Issue-1/IJCTT-V72I1P115.pdf

https://www.intel.com/content/www/us/en/research/quantum-computing.html

https://www.eisneramper.com/insights/technology/dealmaking-technology-sector-0325/

https://sourceability.com/post/planning-for-the-future-2025-semiconductor-market-outlook

https://www.tickertape.in/stocks/collections/semiconductor-stocks

https://www.miraeassetmf.co.in/knowledge-center/types-of-asset-allocation