The Great Correlation Reset: Markets Break the Rules in 2025

Traditional Portfolio Theory Shatters as Asset Relationships Transform

As we move deeper into 2025, the complex interplay of monetary policy adjustments, geopolitical tensions, and economic growth concerns continues to reshape traditional asset relationships. The recent negative turn in equity-bond correlations suggests a potential return to historical norms, but evidence indicates this relationship remains fragile and subject to rapid shifts. This evolving landscape demands sophisticated diversification strategies beyond conventional approaches, particularly as we face the prospect of mild economic slowdowns amid a monetary easing cycle.

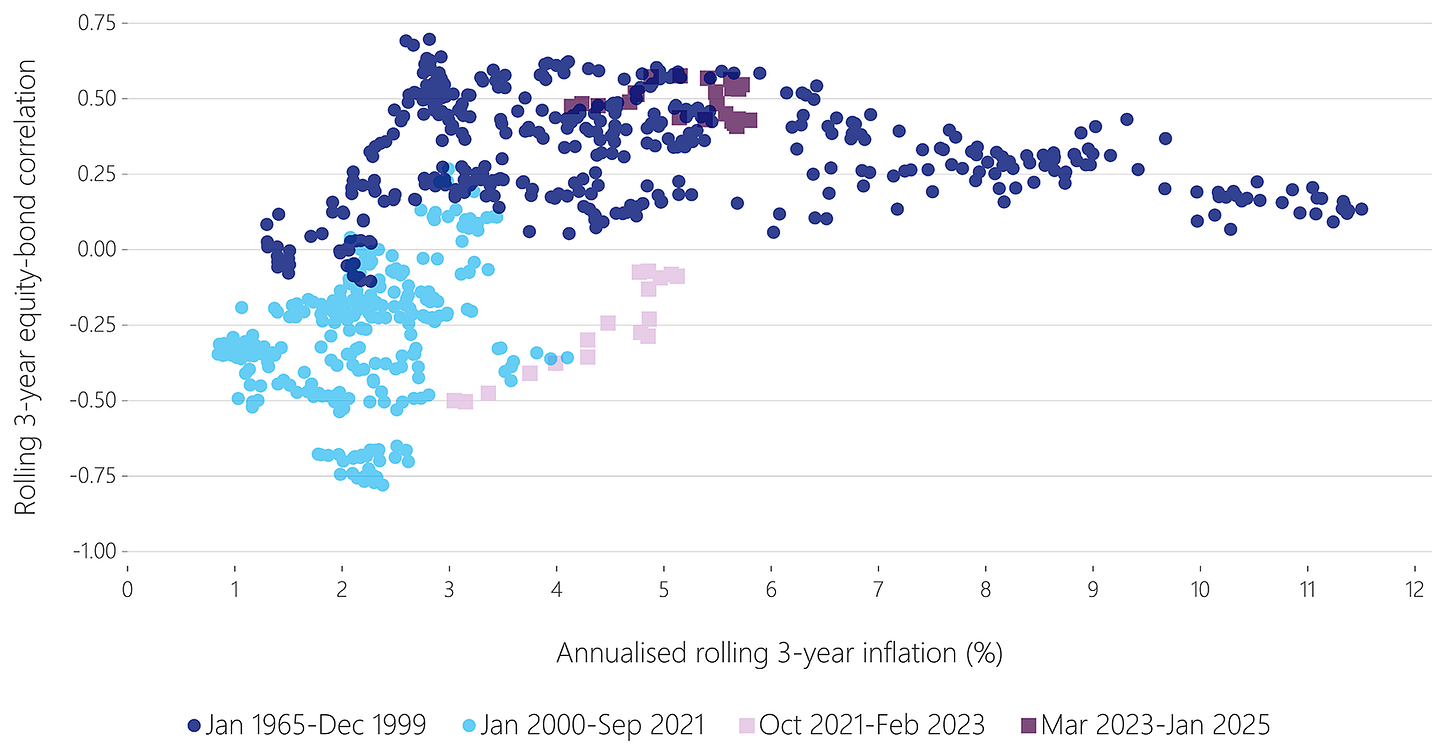

The Shifting Sands of Equity-Bond Correlations

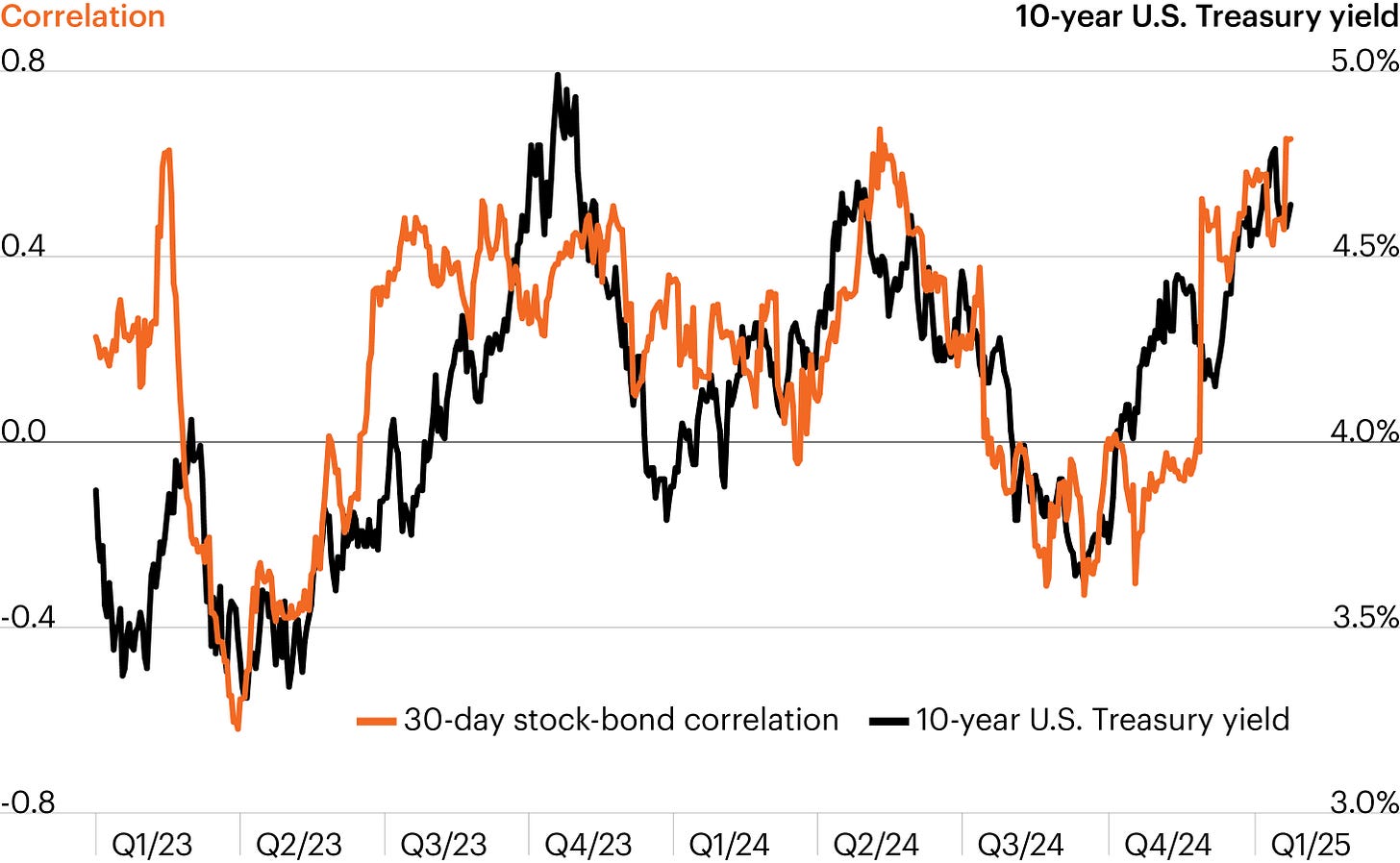

The correlation between equities and bonds has historically been negative, with bonds traditionally serving as a portfolio hedge during equity market downturns. However, this relationship has proven increasingly unstable in recent years. As recently as fall 2024, we observed the 3-month equity-bond correlation turning negative again, representing a potential return to more traditional market dynamics. This shift is significant as it occurs amid changing central bank priorities.

The Federal Reserve and other central banks have begun pivoting from their inflation-fighting stance toward a greater focus on supporting economic growth. As Fed Chair Powell indicated in late 2024, "The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data". This transition in monetary policy focus is crucial to understanding current correlation patterns.

When economic growth becomes the primary concern, equity prices tend to fall on negative growth news while bond yields decline (and prices rise), reinforcing the negative correlation that benefits multi-asset portfolios. This mechanism allows bonds to once again fulfill their traditional role as portfolio stabilizers.

However, investors should approach this apparent normalization with caution. Market pricing may reflect overly optimistic expectations regarding the pace and magnitude of interest rate cuts, potentially setting the stage for disappointment and renewed correlation instability. The fragility of this relationship underscores the need for broader diversification approaches beyond the traditional equity-bond mix.

Understanding Correlation Dynamics

To properly assess the significance of these shifting relationships, it's important to recognize that correlation coefficients measure the strength and direction of relationships between variables. A correlation coefficient of -1 indicates a perfect negative relationship (ideal for diversification), while +1 represents a perfect positive relationship (providing no diversification benefit).

The effectiveness of bonds as a diversifier depends on maintaining a sufficiently negative correlation with equities. When this correlation weakens or turns positive, the traditional 60/40 portfolio becomes more vulnerable to synchronized drawdowns across both components.

Multi-Asset Implications: Navigating the New Correlation Regime

The evolving correlation landscape has significant implications across major asset classes. Understanding how these dynamics affect each component of a multi-asset portfolio is essential for developing robust investment strategies in 2025 and beyond.

Equities

Despite recession concerns, the global economy appears positioned for a mild slowdown rather than a severe contraction. Household and corporate balance sheets remain relatively strong in most regions, with many sectors showing limited evidence of financial imbalances or excesses that typically precede deep recessions. This backdrop supports a constructive outlook for equity returns, though with important nuances.

As monetary policy eases, we expect continued rotation across sectors, market capitalizations, and geographic regions. Value stocks may benefit from moderating interest rates, while quality growth companies with strong balance sheets and sustainable cash flows should prove resilient if economic conditions deteriorate more than anticipated.

Geopolitical tensions and trade disputes remain significant risk factors for equity markets, potentially triggering episodic volatility and sector-specific disruptions. The ongoing transformation of global supply chains in response to these pressures creates both challenges and opportunities for equity investors with selective exposure.

Bonds

Fixed income assets are experiencing a significant shift in their portfolio role. After years of providing inadequate diversification benefits, bonds may once again serve as effective hedges against equity market stress. However, this renewed hedging capability comes with important caveats.

The higher interest rate environment generally favors higher-yielding fixed income instruments that can provide meaningful income while preserving capital. Corporate credit, particularly in the investment-grade space, offers attractive risk-adjusted returns for investors seeking both income and moderate diversification benefits.

Duration management becomes increasingly important as central banks navigate the delicate balance between supporting growth and preventing inflation resurgence. Investors should consider strategic duration positioning to capitalize on the normalizing yield curve while maintaining sufficient exposure to benefit from bonds' renewed hedging properties.

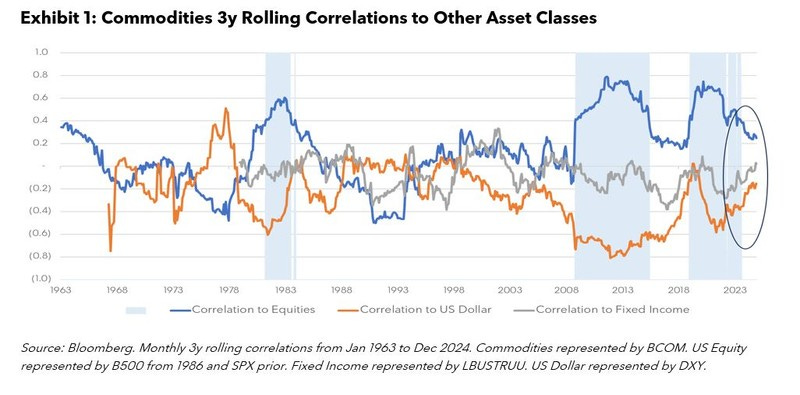

Commodities

Commodities represent an increasingly valuable diversification tool in the current environment. They generally maintain low correlations with traditional equities and bonds, providing alternative sources of returns during periods of market stress. This characteristic makes them particularly valuable when equity-bond correlations become unstable.

Energy commodities remain highly sensitive to geopolitical developments and supply chain disruptions, while agricultural products respond to seasonal factors and weather conditions. This diverse set of drivers creates opportunities for strategic allocation across the commodity spectrum.

Gold continues to serve as a traditional hedge against inflation and currency debasement, while also providing portfolio protection during acute geopolitical crises. Industrial metals offer exposure to infrastructure development and technological trends, including the ongoing transition to renewable energy sources and electric vehicles.

Real Estate

Real estate assets offer distinctive portfolio benefits through both direct and listed vehicles. Direct real estate provides relative stability and income generation, while listed real estate vehicles (REITs) deliver liquidity and access to professional management expertise.

Both forms of real estate exposure maintain low to moderate correlations with traditional asset classes, enhancing portfolio diversification. Listed real estate vehicles enable investors to access specialized sectors like data centers, storage facilities, healthcare properties, and infrastructure projects that may be difficult to invest in directly.

REITs and Infrastructure Investment Trusts (InvITs) generate additional yield while diversifying portfolio risk, making them valuable components of multi-asset strategies in the current environment. Geographic diversification through listed real estate vehicles further enhances their portfolio utility by reducing concentration risk associated with local market conditions.

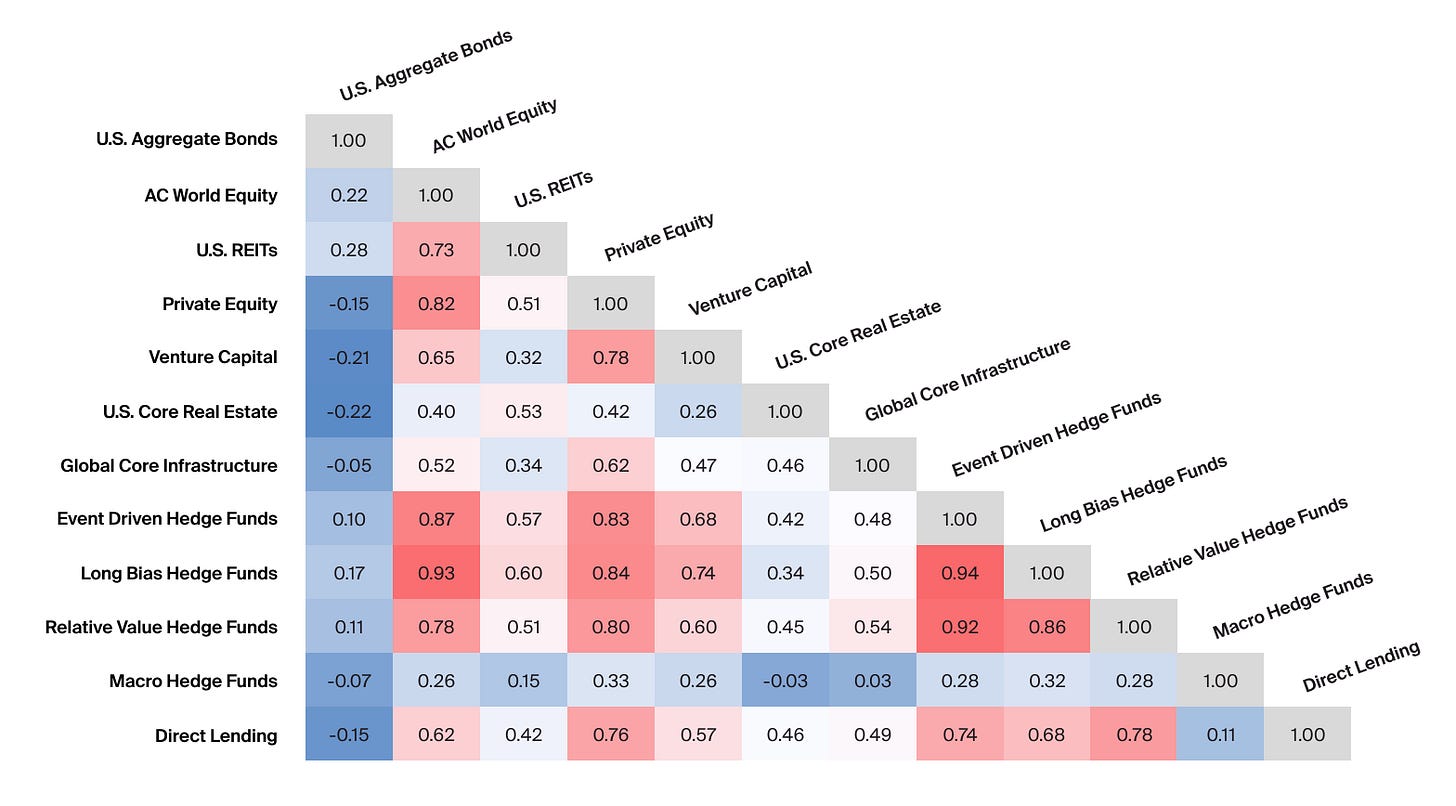

Alternative Assets

Beyond traditional alternatives like commodities and real estate, sophisticated investors should consider allocations to strategies with genuinely different return drivers. Private equity, venture capital, hedge funds, and private credit can provide complementary exposures with limited correlation to public markets, though liquidity constraints must be carefully evaluated.

Structured products and derivatives-based strategies can create customized risk-return profiles designed to perform well in specific correlation regimes. These approaches require greater expertise but may offer substantial diversification benefits when traditional relationships break down.

Adapting Multi-Asset Portfolios to the New Correlation Regime

The evolving correlation landscape demands a thoughtful recalibration of portfolio construction approaches. Several strategies merit consideration for investors navigating this complex environment.

Dynamic Asset Allocation

Static allocations are increasingly vulnerable in an environment of shifting correlations. Implementing dynamic asset allocation frameworks that adjust exposures based on changing correlation patterns can enhance portfolio resilience. This approach requires ongoing monitoring of correlation trends and economic indicators to identify potential regime shifts.

Professional asset managers employ tactical allocation strategies to capitalize on cyclical opportunities while maintaining strategic diversification. This flexibility allows portfolios to adapt to changing market conditions while preserving their fundamental risk management characteristics.

Risk-Based Portfolio Construction

Rather than focusing exclusively on asset class labels, investors should consider constructing portfolios around risk factors and return drivers. This approach recognizes that correlations between nominal asset classes can mask more fundamental relationships at the risk factor level.

By decomposing traditional assets into their underlying risk factors, investors can build more robust portfolios designed to weather shifting correlation regimes. This methodology requires sophisticated analysis but offers substantial benefits in managing the true drivers of portfolio risk.

Alternative Diversifiers

As traditional correlations become less reliable, alternative diversifiers take on increased importance. Commodities, real estate, inflation-linked securities, and absolute return strategies can each play valuable roles in multi-asset portfolios.

The selection and weighting of alternative diversifiers should be customized based on the investor's existing exposures, liquidity requirements, and tolerance for complexity. Creating a deliberate allocation to assets specifically chosen for their diversification properties can significantly enhance portfolio resilience.

Conclusion

The shifting correlation between equities and bonds represents a fundamental challenge to traditional portfolio construction approaches. While the recent negative turn in this relationship offers encouragement, investors should recognize its potential fragility and prepare accordingly.

Multi-asset investors who understand these dynamics can build more resilient portfolios by incorporating a broader range of diversifiers and implementing more sophisticated allocation approaches. Commodities, real estate, and alternative strategies offer valuable complements to traditional equity and bond allocations, particularly when correlations become unstable.

As we navigate the remainder of 2025, the ongoing monetary easing cycle and evolving geopolitical landscape will continue to test established market relationships. Investors who adapt their diversification strategies to this new environment will be better positioned to achieve their long-term objectives while managing short-term volatility.

The multi-asset approach, with its emphasis on diversification across imperfectly correlated assets, remains the most effective strategy for navigating uncertainties while pursuing sustainable returns[5]. By understanding the implications of shifting correlations and implementing appropriate adaptations, investors can transform this challenge into an opportunity for enhanced portfolio construction.

Sources

https://www.invesco.com/uk/en/insights/multi-asset-outlook.html

https://www.linkedin.com/pulse/diversifying-commodity-markets-strategies-success-cmsfinancial-vtz1f

https://blog.elearnmarkets.com/why-you-should-know-multi-asset-trading/

https://www.aqr.com/Insights/Research/Journal-Article/A-Changing-Stock-Bond-Correlation

https://hdfcsky.com/sky-learn/commodity/role-of-commodities-in-investment-portfolios

https://www.tatacapitalmoneyfy.com/blog/investment-guide/multi-asset-funds-and-its-benefits/

https://permutable.ai/portfolio-analysis-cross-asset-correlation/

https://ifaglobal.net/research-report/multi-asset-weekly-newsletter/71

https://www.kredx.com/investment/invoice-discounting/multi-asset-investing

https://www.luxalgo.com/blog/ultimate-guide-to-correlation-in-technical-analysis/

https://www.jainam.in/glossary/multi-asset-allocation-funds/

https://www.oliverwyman.com/our-expertise/insights/2025/jan/asset-management-trends-for-2025.html

https://www.cambridgeassociates.com/en-eu/insight/2025-outlook-cross-asset/

https://discoveryalert.com.au/news/commodities-investment-2025-market-bull-run-diversification/