The Silicon Singularity: How Chip Wars Are Reshaping Global Finance Forever

The Final Chapter - From Geopolitical Flashpoint to Multi-Asset Revolution

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

This is the 13th and final installment of our comprehensive primer on the semiconductor industry. Through this series, we've explored everything from the technical foundations of chip manufacturing to the complex geopolitical dynamics that now define this critical sector. In this concluding piece, we examine how the "chip wars" are fundamentally transforming investment landscapes and reshaping portfolio allocation strategies across all asset classes.

Introduction: The New Digital Gold Rush

The semiconductor industry stands at an unprecedented inflection point in 2025. What began as a technical revolution has evolved into the defining geopolitical and economic battleground of our era. With global semiconductor sales reaching $57.0 billion in April 2025 alone—a 22.7% increase from the previous year—and projections pointing toward a $700.9 billion market by year-end, we're witnessing more than just cyclical growth. We're observing the emergence of semiconductors as the "new oil" of the digital economy, a transformation that's sending shockwaves through traditional portfolio management and asset allocation strategies.

The implications extend far beyond technology stocks. As chips become increasingly critical to everything from artificial intelligence and autonomous vehicles to defense systems and consumer electronics, their strategic importance has elevated semiconductor supply chains to matters of national security. Taiwan's dominance in advanced chip manufacturing—producing 92% of the world's most sophisticated semiconductors—has created what experts call a "silicon shield" that's reshaping international relations and investment flows.

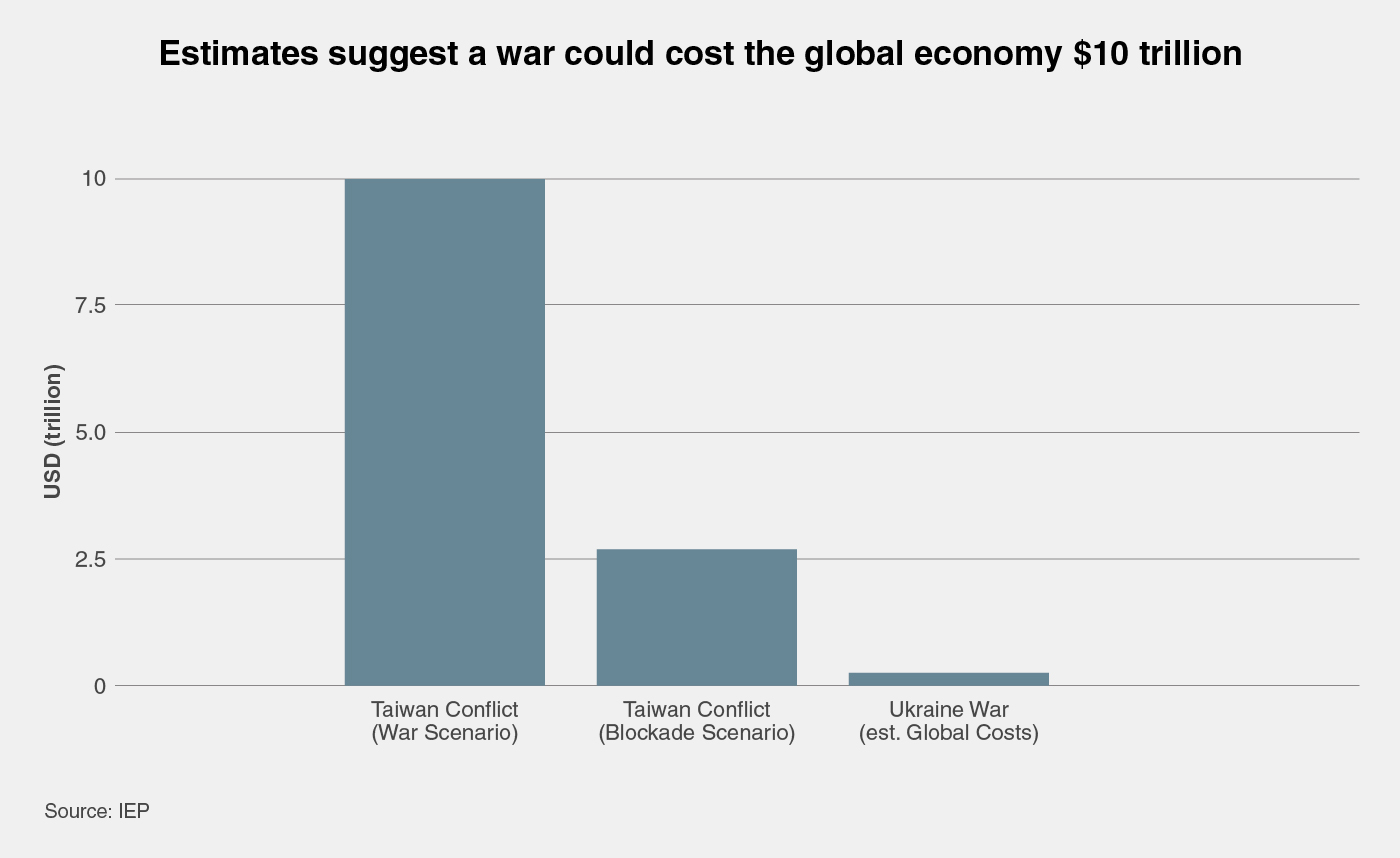

This isn't merely about technological advancement; it's about a fundamental restructuring of global economic power dynamics. The semiconductor industry has transcended its traditional boundaries to become a lens through which we must now view geopolitical risk, portfolio construction, and long-term wealth preservation strategies. As one analysis notes, "a conflict between China and Taiwan could result in a $10 trillion loss to the global economy," underscoring how deeply chip dependencies have become embedded in our financial systems.

The story we're witnessing unfold represents the final chapter in our semiconductor primer—not because the industry's evolution is complete, but because we've reached the point where semiconductor dynamics must be understood as foundational to modern investment strategy rather than merely sectoral considerations.

The Geopolitical Chessboard: Taiwan, China, and the Silicon Shield

The semiconductor industry has become the epicenter of a new form of economic warfare that transcends traditional geopolitical boundaries. Taiwan's TSMC, controlling approximately 64% of global contract chip manufacturing, sits at the heart of this transformation. The company's Arizona expansion, backed by a $165 billion U.S. investment commitment, represents more than corporate growth—it's a strategic realignment of global supply chains driven by national security imperatives.

China's response has been equally dramatic. Through its "Made in China 2025" initiative, Beijing has invested over $250 billion annually in building domestic semiconductor capabilities, far exceeding the U.S. CHIPS Act's $250 billion spread over several years. This massive capital deployment reflects a fundamental shift from efficiency-driven globalization to security-driven regionalization. As one expert observes, "the shift from a logic of efficiency, which prioritized globalized, just-in-time supply chains, to a logic of security, where resilience and redundancy now drive strategic industrial planning" has become the defining characteristic of semiconductor geopolitics.

The implications for investors are profound. Traditional supply chain optimization, which sought to minimize costs through geographic concentration, is giving way to supply chain resilience strategies that prioritize redundancy and security. This transformation is creating both risks and opportunities across asset classes. Companies dependent on Taiwan-manufactured chips face elevated geopolitical risk premiums, while those investing in semiconductor manufacturing capacity outside of Asia are positioned to benefit from reshoring trends.

The weaponization of semiconductor technology has introduced a new category of investment risk that portfolio managers must now consider. U.S. export controls on advanced chips to China, coupled with China's retaliatory measures, exemplify how semiconductor policies can rapidly reshape competitive landscapes. These policy shifts create what researchers call "hybrid warfare" scenarios, where economic tools are deployed as instruments of geopolitical pressure, fundamentally altering the risk-return profiles of technology investments.

Perhaps most significantly, the semiconductor industry's geopolitical evolution is forcing a rethinking of correlation assumptions that underpin modern portfolio theory. Traditional diversification strategies assumed that geographic distribution would reduce political risk. However, when 90% of advanced chips come from a single region facing elevated geopolitical tension, geographic diversification becomes concentrated risk exposure.

Consolidation vs. Fragmentation: Two Visions of the Future

The semiconductor industry faces a fundamental strategic choice between consolidation and fragmentation, with each path carrying distinct implications for investors and global economic stability. This tension reflects broader questions about how critical technologies should be organized in an increasingly fragmented world.

The consolidation narrative centers on scale economics and technological efficiency. Major semiconductor mergers and acquisitions reached new heights in 2024, with transactions like AMD's $4.9 billion acquisition of ZT Systems and Synopsys's $35 billion purchase of Ansys demonstrating the industry's drive toward vertical integration. These deals reflect the reality that developing cutting-edge semiconductor capabilities requires enormous capital investments—often exceeding $20 billion for a single advanced fabrication facility.

Proponents of consolidation argue that the semiconductor industry's technical complexity demands concentrated expertise and resources. Moore's Law's continuation requires R&D investments that only the largest companies can sustain. The transition to 3nm and 2nm process technologies, for instance, demands capabilities that fewer companies can afford to develop independently. This dynamic suggests a natural evolution toward a smaller number of highly capable firms dominating the global semiconductor landscape.

However, a compelling counter-narrative emphasizes fragmentation as a strategic advantage. China's semiconductor strategy exemplifies this approach, deliberately fostering competition among multiple domestic suppliers rather than creating national champions. As one analysis notes, "fragmentation is the point. Forget national champions, China's semiconductor ecosystem thrives on fragmentation, not consolidation". This approach prioritizes resilience over efficiency, ensuring that no single point of failure can cripple the entire system.

From an investment perspective, the consolidation versus fragmentation debate creates distinct portfolio implications. Consolidation scenarios favor large-cap semiconductor leaders with the resources to navigate increasing technical complexity and regulatory requirements. Companies like TSMC, NVIDIA, and Intel benefit from their ability to make the massive investments required for next-generation capabilities.

Fragmentation scenarios, conversely, create opportunities for specialized players and regional alternatives. The emergence of multiple semiconductor ecosystems—one serving Chinese domestic needs and others serving markets aligned with U.S. technology standards—creates parallel value chains that investors must navigate. This bifurcation potentially reduces overall systemic risk while creating new forms of geographic and technological specialization.

The resolution of this tension will likely determine not just the semiconductor industry's structure but also the broader organization of critical technology sectors. For portfolio managers, this means maintaining flexibility to capitalize on both consolidation plays and fragmentation opportunities while carefully managing exposure to potential structural shifts.

Chips as the New Oil: Strategic Resource Implications

The comparison between semiconductors and oil has evolved from metaphor to analytical framework, fundamentally reshaping how investors must approach resource allocation and geopolitical risk assessment. Like oil in the 20th century, semiconductors have become critical inputs for virtually all economic activity, creating dependencies that extend far beyond their immediate applications.

The strategic parallel becomes clear when examining supply concentration. Just as oil production concentrated in specific geographic regions created chokepoints that could influence global economics, semiconductor manufacturing's concentration in East Asia—particularly Taiwan's dominance in advanced chips—has created similar vulnerabilities5. However, semiconductors present unique characteristics that make them potentially even more strategically significant than oil.

Unlike oil, which represents stored energy that can be stockpiled, semiconductors embody active intelligence and functionality that rapidly becomes obsolete. This creates what experts call "temporal vulnerability"—the inability to build meaningful strategic reserves of cutting-edge chips. A six-month disruption in advanced chip supply could cripple technology sectors in ways that equivalent oil disruptions might not affect energy markets, simply because semiconductor technology evolves so rapidly that stockpiling becomes impractical.

The investment implications of this "new oil" dynamic are reshaping portfolio construction across asset classes. Energy sector allocations, which dominated emerging market portfolios in previous decades, are giving way to technology and semiconductor exposures. As one analysis notes, "the information-technology, communication-services and consumer-discretionary sectors have seen their roles in emerging markets expand dramatically over the past 10 years".

This transition creates both opportunities and risks for investors. Countries and companies that control semiconductor design and manufacturing capabilities are positioned to capture value similar to how oil-rich nations benefited in the 20th century. However, the technological complexity of semiconductors means that advantages can be more sustainable—it's easier to discover new oil fields than to replicate TSMC's advanced manufacturing capabilities.

The "new oil" framework also helps explain the massive capital flows into semiconductor infrastructure. Global semiconductor capital expenditures are projected to reach $185 billion in 2025, with manufacturing capacity expected to expand by 7%. These investments reflect recognition that semiconductor capabilities represent strategic assets that countries and companies cannot afford to lack.

For portfolio managers, the semiconductor-as-oil analogy suggests treating chip exposure not merely as technology sector allocation but as strategic resource positioning. This perspective elevates questions about semiconductor supply chain exposure to the level of energy security considerations, requiring new frameworks for assessing geopolitical and operational risks across seemingly unrelated sectors.

Structural Alpha in Long-Horizon Tech Investing

The semiconductor industry's transformation is creating opportunities for what investment professionals call "structural alpha"—excess returns that arise from systematic market inefficiencies rather than superior stock selection or market timing. In the context of semiconductor investing, these inefficiencies stem from the fundamental mismatch between short-term market dynamics and long-term technological and geopolitical trends.

Long-horizon investors possess distinct advantages in capturing semiconductor-related alpha that shorter-term participants cannot access. The industry's development cycles—typically spanning 5-10 years from research to commercialization—create opportunities for patient capital to invest in trends before they become apparent to quarterly-focused market participants. Research demonstrates that "stocks largely held by long-horizon funds outperform stocks largely held by short-horizon funds by more than 3% annually, adjusted for risk, over the following five-year period".

The structural nature of semiconductor alpha arises from several persistent market inefficiencies. Traditional valuation models struggle to capture the strategic value of semiconductor capabilities, often treating them as cyclical technology assets rather than strategic resources comparable to energy reserves. This analytical gap creates opportunities for investors who understand the geopolitical and strategic dimensions of chip capabilities.

Supply chain positioning represents another source of structural alpha. Companies with secure access to advanced semiconductors command strategic premiums that traditional financial analysis doesn't fully capture. These advantages compound over time as semiconductor dependencies deepen across industries, creating sustainable competitive moats that markets are slow to recognize and price efficiently.

The geographic and regulatory arbitrage opportunities in semiconductors provide additional sources of structural alpha. Policy-driven investments like the U.S. CHIPS Act and China's semiconductor initiatives create predictable capital flows that long-term investors can anticipate and position for ahead of market recognition. These government commitments often span decades, providing visibility into future investment flows that patient investors can exploit.

Technology roadmap visibility offers another structural advantage for long-horizon semiconductor investors. Moore's Law and related technological progressions provide frameworks for anticipating future capability requirements years in advance. Investors who understand these technological trajectories can identify companies positioned to benefit from inevitable transitions, such as the move to 3nm and 2nm manufacturing processes.

The behavioral aspects of semiconductor investing create additional structural opportunities. The industry's complexity creates informational advantages for investors willing to develop specialized knowledge. Most market participants lack the technical background to evaluate semiconductor technologies, creating opportunities for those who invest in developing this expertise. Research suggests that "human expertise, always" remains essential even as systematic strategies leverage data and technology.

Private market opportunities in semiconductors offer particularly attractive structural alpha prospects. The long development cycles and capital intensity of chip technologies create venture capital and private equity opportunities that public markets cannot efficiently price. These investments often provide exposure to technological innovations years before they reach public markets, creating potential for outsized returns for patient institutional capital.

Geopolitical Hedging and Crisis Investing

The semiconductor industry's strategic importance has created new requirements for geopolitical hedging that extend far beyond traditional international diversification strategies. As chips become the "new oil" of the digital economy, investors must develop sophisticated approaches to managing geopolitical risk that account for the unique characteristics of semiconductor supply chains and dependencies.

Traditional geopolitical hedging focused primarily on currency exposure and country-specific risks. However, semiconductor dependencies create systemic risks that can simultaneously affect multiple countries and regions. A Taiwan Strait crisis, for instance, would impact not just Asian markets but global technology supply chains, creating correlations that traditional hedging strategies cannot address. This requires what experts call "geopolitical hedging" strategies that account for supply chain vulnerabilities rather than just geographic exposure.

The weaponization of semiconductor technology creates new categories of policy risk that require specialized hedging approaches. Export controls, supply chain restrictions, and technology transfer limitations can rapidly alter competitive landscapes in ways that traditional political risk insurance doesn't cover. Companies and investors are developing what researchers term "operational repositioning" strategies that build supply chain resilience through geographic diversification and vendor redundancy.

Crisis investing in the semiconductor sector requires understanding both cyclical and structural factors that influence chip market dynamics. Cyclical downturns create opportunities to acquire semiconductor assets at discounted valuations, but structural shifts toward national semiconductor independence create permanent changes in industry organization. Successful crisis investors must distinguish between temporary dislocations and permanent structural changes.

The development of bifurcated technology ecosystems—one serving Chinese domestic needs and another serving U.S.-aligned markets—creates both hedging opportunities and additional complexity. Investors can potentially reduce geopolitical risk by maintaining exposure to both ecosystems, but this requires understanding the different technological standards and competitive dynamics that govern each system.

Commodity-based hedging strategies provide some protection against semiconductor-related geopolitical risks. Materials like rare earth elements, silver, and specialized chemicals maintain value during semiconductor supply disruptions and can provide portfolio protection during crisis periods. However, these hedges require careful calibration to avoid over-hedging that reduces returns during normal market conditions.

Alternative asset hedging through real estate and infrastructure investments offers another approach to semiconductor geopolitical risk management. Data centers, digital infrastructure, and semiconductor manufacturing facilities provide exposure to chip industry growth while offering some protection against supply chain disruptions through their strategic importance and government support.

Financial hedging instruments specifically designed for geopolitical semiconductor risks are beginning to emerge. These include catastrophe bonds tied to semiconductor supply disruptions, political risk insurance for chip manufacturing investments, and derivative instruments that provide protection against Taiwan Strait scenarios. While these markets remain nascent, they represent important developments for institutional investors seeking comprehensive geopolitical risk management.

Multi-Asset Allocation Shifts Toward Digital Infrastructure

The semiconductor revolution is driving fundamental changes in optimal asset allocation models that extend far beyond traditional technology sector considerations. Digital infrastructure is emerging as a distinct asset class that requires specialized allocation frameworks combining characteristics of technology, real estate, and strategic commodities investments.

Infrastructure allocations are experiencing their most significant evolution since the emergence of renewable energy as an investment category. Traditional infrastructure focused on transportation, utilities, and communications networks. However, the digital economy's infrastructure requirements—data centers, fiber networks, semiconductor manufacturing facilities, and edge computing nodes—represent new categories that don't fit conventional infrastructure definitions

The optimal allocation to digital infrastructure appears significantly higher than traditional models suggest. Research indicates that theoretical optimal allocations to infrastructure range from 7.9% to 9.5% for institutional portfolios with 30% private market constraints, but digital infrastructure may warrant additional allocation beyond these traditional limits. The unique characteristics of digital infrastructure—including shorter depreciation cycles, higher growth potential, and strategic importance—suggest distinct allocation parameters.

Multi-asset strategies are increasingly incorporating semiconductor exposure not as technology sector allocation but as strategic resource positioning. This approach treats chip capabilities similar to energy reserves or rare earth minerals—as strategic assets that provide portfolio protection and growth opportunities across multiple scenarios. The diversification benefits of this approach stem from semiconductors' broad economic applications rather than traditional sector diversification logic.

The rise of multi-asset allocation funds reflects institutional recognition that traditional asset class boundaries are becoming less relevant. These funds, which must invest at least 10% in three asset classes, are increasingly incorporating digital infrastructure and semiconductor-related investments as separate allocation categories. This evolution suggests that optimal portfolio construction now requires frameworks that account for technological dependencies across traditional asset classes.

Real asset allocations are shifting toward assets with semiconductor dependencies and digital infrastructure characteristics. Traditional real assets like commodities and real estate are being supplemented with digital infrastructure, data centers, and technology supply chain investments that provide exposure to semiconductor industry growth while maintaining real asset diversification benefits. This evolution reflects recognition that digital capabilities represent real, productive assets comparable to traditional infrastructure.

The geographic distribution of multi-asset allocations is being influenced by semiconductor manufacturing and digital infrastructure positioning. Regions investing heavily in chip manufacturing capabilities—including the U.S., Europe, and Asia—are attracting disproportionate capital flows that reflect their strategic positioning in digital infrastructure development. This geographic reallocation represents a shift from traditional emerging market diversification toward strategic technology positioning.

Alternative asset allocations within multi-asset strategies are increasingly focused on semiconductor ecosystem investments. Private equity, venture capital, and infrastructure debt focused on chip industry supply chains are gaining allocation preference over traditional alternative investments. These allocations reflect recognition that semiconductor dependencies create investment opportunities across the entire technology ecosystem.

Conclusion: Navigating the Silicon Future

As we conclude our comprehensive journey through the semiconductor industry, we stand at a remarkable inflection point where technological innovation, geopolitical strategy, and investment fundamentals converge in unprecedented ways. The transformation we've witnessed throughout this series—from the technical intricacies of chip manufacturing to the complex geopolitical dynamics that now define the sector—culminates in a fundamental restructuring of how we must approach portfolio construction and risk management in the modern economy.

The semiconductor industry has transcended its traditional boundaries to become what we might call the "central nervous system" of the global economy. Every major economic sector—from automotive and healthcare to finance and defense—now depends on advanced chip technologies in ways that create both opportunities and vulnerabilities that traditional investment frameworks struggle to capture. This transformation demands new analytical approaches that treat semiconductor capabilities not as sector-specific considerations but as systematic factors that influence risk and return across all asset classes.

The investment implications of this transformation extend far beyond technology stock selection. As we've explored, the emergence of semiconductors as strategic resources comparable to oil in the 20th century requires rethinking fundamental assumptions about diversification, correlation, and risk management. Geographic diversification provides less protection when 92% of advanced chips come from a single region facing elevated geopolitical tensions. Sector diversification offers limited risk reduction when semiconductor supply disruptions can simultaneously impact automotive, consumer electronics, industrial, and financial services companies.

Perhaps most significantly, the semiconductor revolution is creating new sources of structural alpha for investors willing to develop the expertise and patience required to capitalize on long-term technological and geopolitical trends. The mismatch between short-term market dynamics and long-term industry development cycles creates opportunities for patient capital that traditional quarterly-focused strategies cannot access. These opportunities span the entire investment spectrum, from public equity and fixed income to private markets and alternative investments.

The geopolitical dimensions of semiconductor investing introduce both risks and opportunities that require sophisticated hedging strategies extending far beyond traditional international diversification. The weaponization of chip technology creates policy risks that can rapidly alter competitive landscapes, while the development of bifurcated technology ecosystems creates parallel value chains that investors must navigate. Success in this environment requires understanding not just financial metrics but also technological capabilities, supply chain dynamics, and geopolitical strategies.

Looking toward the future, several key themes will likely define the semiconductor investment landscape. The tension between consolidation and fragmentation will continue to create opportunities for both large-scale platform investments and specialized niche players. The expansion of digital infrastructure will drive new categories of investment opportunities that combine characteristics of technology, real estate, and strategic commodities. The ongoing development of AI and quantum computing will create new semiconductor requirements that may favor different players and technologies than current market leaders.

For individual investors and institutional portfolio managers alike, the semiconductor revolution requires fundamental changes to asset allocation frameworks. Multi-asset strategies must account for digital infrastructure as a distinct asset class. Risk management systems must incorporate supply chain analysis and geopolitical risk assessment. Performance measurement must evolve to capture the long-term value creation from strategic positioning and technological capabilities.

The transformation we've documented throughout this series represents more than an industry evolution—it's a restructuring of economic power relationships that will influence investment returns for decades to come. Countries, companies, and investors who understand and position for these changes will be best placed to capture the opportunities they create. Those who continue to rely on traditional frameworks may find themselves increasingly disadvantaged as semiconductor dependencies deepen and geopolitical risks intensify.

As we look ahead, the semiconductor industry will undoubtedly continue to evolve in ways that challenge our current understanding and assumptions. New technologies will emerge, geopolitical relationships will shift, and market structures will adapt to changing realities. However, the fundamental importance of semiconductor capabilities to modern economic activity seems certain to persist and likely intensify.

The silicon singularity—the point at which semiconductor capabilities become so central to economic activity that they transcend traditional industry boundaries—may already be upon us. For investors, this reality demands not just portfolio adjustments but fundamental changes to how we think about risk, return, and opportunity in an increasingly digital world. The future belongs to those who can navigate this complexity with the sophistication it demands while maintaining the patience required to capture its long-term rewards.

The chip wars have begun reshaping global finance forever. The question is not whether this transformation will continue, but how quickly investors will adapt their strategies to capitalize on the opportunities it creates. In this new era, success will require combining deep technical understanding with sophisticated financial analysis, long-term strategic thinking with tactical implementation capability, and traditional investment disciplines with new frameworks appropriate for the digital age.

Our journey through the semiconductor industry concludes, but the investment implications we've explored will continue to unfold for years to come. Those who have followed this series from its technical foundations to its strategic implications are better positioned to navigate the opportunities and challenges ahead. The silicon future is here—and it's transforming everything we thought we knew about investing.

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

This concludes our 13-part primer on the semiconductor industry. For readers who have followed the complete series, you now possess a comprehensive understanding of how chip technologies, manufacturing processes, market dynamics, and geopolitical factors combine to create one of the most important investment themes of our time. The semiconductor revolution continues to unfold—and those who understand its implications will be best positioned to benefit from the opportunities it creates.

Sources

https://www.semiconductors.org/global-semiconductor-sales-increase-2-5-month-to-month-in-april/

https://www.wsts.org/76/WSTS-Semiconductor-Market-Forecast-Spring-2025

https://www.marketsandmarkets.com/blog/SE/semiconductors-are-the-new-oil-for-a-data-driven-economy

https://globalalphacapital.cclgroup.com/insight/are-semiconductors-the-new-oil/

https://finance.yahoo.com/news/semiconductors-oil-major-implications-business-080000193.html

https://www.barrons.com/articles/tsmc-stock-taiwan-semi-ai-chips-china-efe6d1ec

https://smallwarsjournal.com/2025/04/16/chip-war-and-the-battle/

https://johnclements.com/the-looking-glass/business-strategy/taiwan-semiconductor-geopolitics/

https://www.microchipusa.com/industry-news/important-semiconductor-industry-acquisitions

https://securityconference.org/assets/user_upload/EconPol-PR54_Global_Semiconductor_Value_Chain.pdf

https://www.tessolve.com/blogs/semiconductor-industry-outlook-for-2025/

https://pursuit.unimelb.edu.au/articles/how-chinas-chip-strategy-outsmarts-trumps-tariff-trap

https://www.man.com/insights/views-from-the-floor-2025-May-27

https://wasatchglobal.com/wp-content/uploads/2021/02/Semiconductors-The-New-Oil-2021.02.19-FNL.pdf

https://www.infosys.com/iki/research/semiconductor-industry-outlook2025.html

https://www.idaireland.in/latest-news/insights/semiconductor-industry-outlook

https://www.cbreim.com/insights/articles/infrastructure-quarterly-q2-2025

https://www.infrastructureinvestor.com/digital-infrastructure-report/

https://www.alphaglider.com/blog/2015/12/6/long-time-horizons

https://www.blackrock.com/institutions/en-zz/insights/alpha-reimagined

https://www.linkedin.com/pulse/geopolitical-hedgingthe-new-mantra-globalization-jerry-haar-n5boe

https://www.linkedin.com/pulse/geopolitical-hedging-new-mantra-globalization-ml50e

https://www.sciencedirect.com/science/article/pii/S1544612322003981

https://www.mastertrust.co.in/blog/10-best-multi-asset-allocation-funds-in-india-2025