The Silicon Iron Curtain: How the Great Chip Divide is Reshaping Global Markets

China's Stumbling Sprint, India's Ambitious Gamble, and Intel's Phoenix Rise Trigger a Multi-Trillion Dollar Asset Realignment

The year 2025 has crystallized into a defining moment for the global semiconductor industry—one that will be remembered as the year the world's technology landscape permanently fractured along geopolitical lines. As nations scramble to achieve the holy grail of semiconductor self-sufficiency, three distinct narratives have emerged from the silicon trenches: China's increasingly evident internal struggles despite massive state investment, India's bold leap into chip manufacturing through strategic international partnerships, and Intel's determined resurgence across both American and European markets. These parallel storylines are not merely industrial developments; they represent a fundamental reshaping of global supply chains that is sending shockwaves through every corner of the financial markets.

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

This is Part 11 of our comprehensive semiconductor industry series, designed to transform novices into informed observers of one of the world's most critical sectors.

China's $300 Billion Mirage: When State Capital Meets Silicon Reality

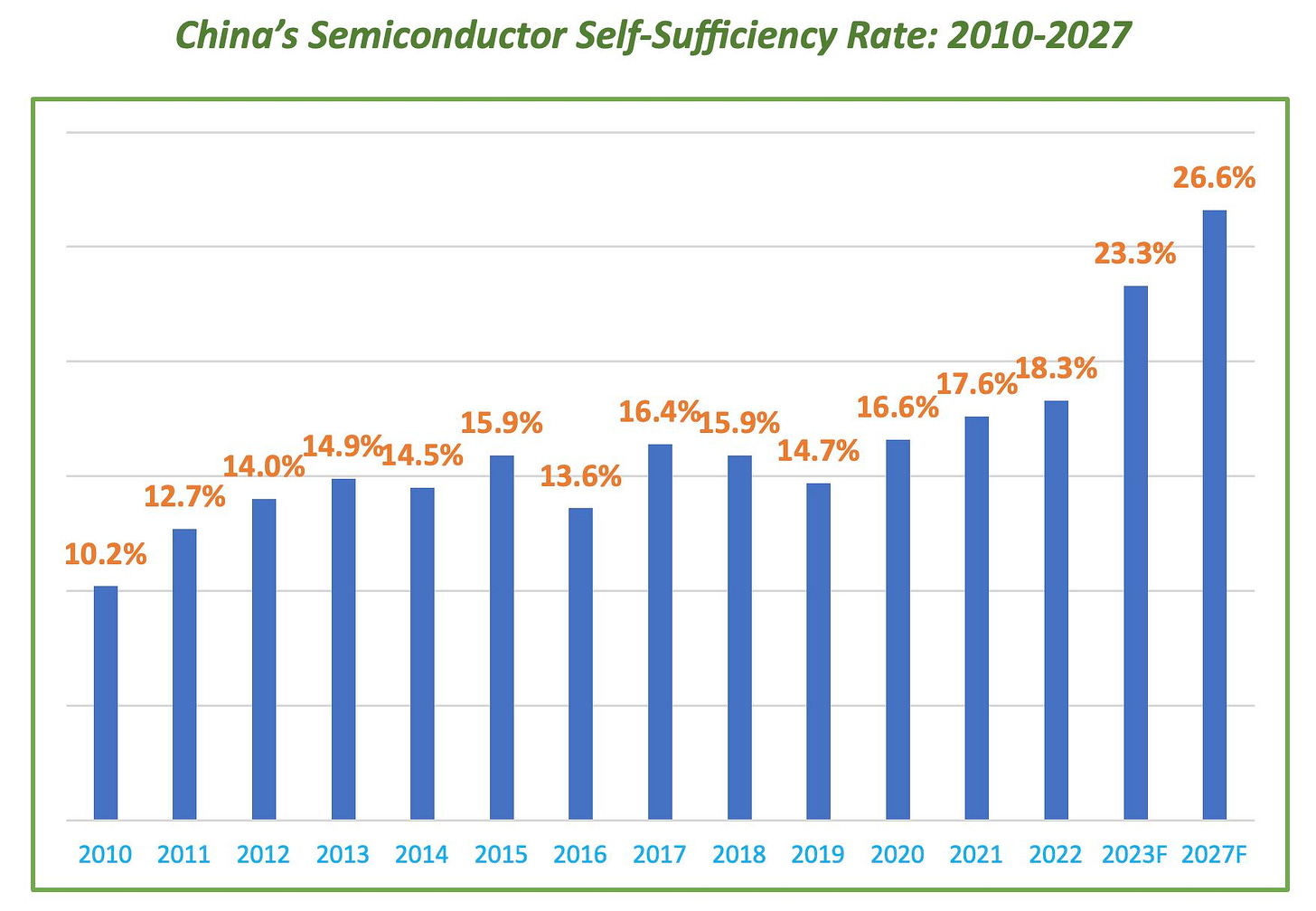

The Middle Kingdom's semiconductor ambitions, once heralded as the unstoppable force that would challenge Western technological dominance, are revealing cracks that run deeper than the most pessimistic analysts had predicted. Despite cumulative investments exceeding $300 billion through various state funds and initiatives, China's semiconductor self-sufficiency remains stubbornly stalled at just 23.3% as of 2023, falling dramatically short of the ambitious 70% target set for 2025.

The challenges facing China's chip industry extend far beyond the headline-grabbing US export restrictions. At the heart of the problem lies a series of internal inefficiencies that no amount of state funding can immediately solve. The country's flagship foundry, Semiconductor Manufacturing International Corporation (SMIC), has been plagued by yield issues and production disruptions. In recent quarters, unexpected incidents during routine maintenance have compromised process accuracy, leading to significant yield drops that lasted over a month and are expected to impact revenues by up to 6%.

The talent crisis represents perhaps the most intractable challenge. Despite producing twice as many semiconductor research papers as the United States, China struggles with what industry insiders call the "institutional knowledge gap"—the practical expertise required to operate advanced manufacturing processes efficiently. This has led to a peculiar situation where Chinese engineers excel in theoretical chip design but falter when translating concepts into mass production.

Even more concerning for China's long-term prospects is the corruption and misallocation of resources that has plagued state-backed semiconductor investments. The absence of effective oversight and perverse incentives from discretionary local government funding have rendered many chip innovation efforts ineffective, with some projects devolving into what analysts describe as "Ponzi-like schemes".

The equipment challenge adds another layer of complexity. While China has made progress in developing domestic lithography equipment, announcing scanners capable of 65-nanometer resolution, this remains dramatically behind ASML's sub-10-nanometer capabilities. The gap represents not months or even years of development time, but what experts characterize as requiring "large technology breakthroughs" to bridge.

India's Calculated Gamble: From Outsider to Contender

In stark contrast to China's struggles, India has emerged as the semiconductor industry's most intriguing dark horse, pursuing a strategy that blends pragmatic international partnerships with ambitious domestic capacity building. The subcontinent's approach represents a masterclass in leveraging geopolitical tensions to create economic opportunity.

India's semiconductor strategy is built on a foundation of international collaboration that China, due to export restrictions, cannot access. The country has signed comprehensive partnerships with Singapore, targeting collaboration in semiconductor supply chains, and reached agreements with the United States for joint semiconductor manufacturing plants focusing on infrared, gallium nitride, and silicon carbide semiconductors. Perhaps most significantly, India has secured partnerships with Japanese equipment giant Tokyo Electron, which plans to establish comprehensive equipment delivery and support systems by 2026.

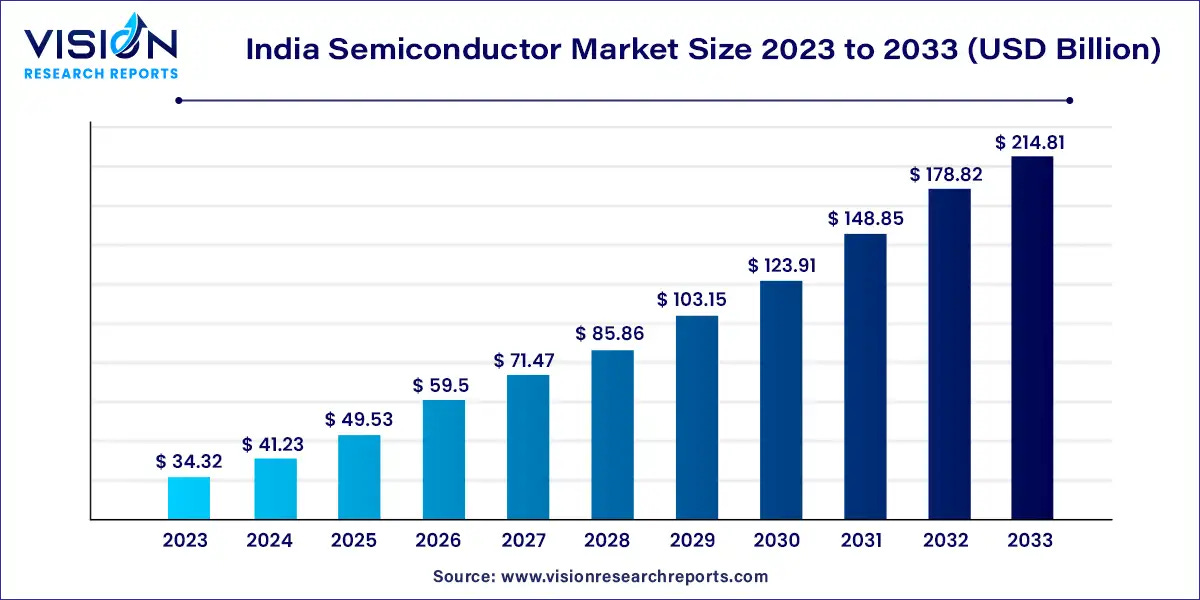

The scale of India's commitment is staggering. The government has approved $15.2 billion in investments for three major semiconductor plants, including the country's first fabrication facility led by Tata Group in partnership with Taiwan's Power Chip. This facility alone expects to produce 50,000 wafers per month and manufacture 3 billion chips annually. Union Minister Ashwini Vaishnaw has announced that India will launch its first indigenous semiconductor chip by the end of 2025, targeting the 28-90 nanometer range that accounts for 60% of global chip demand.

India's strategic focus on mature nodes rather than cutting-edge technology represents a shrewd calculation. While advanced nodes grab headlines, the 28-90nm segment serves automotive, telecommunications, power equipment, and railway applications—sectors experiencing explosive growth in India's domestic market. This approach allows India to build capabilities in areas where it can achieve meaningful scale without directly competing with TSMC and Samsung in the most advanced technologies.

The partnership with global players extends beyond manufacturing. Micron Technology, along with Tata Electronics, CG Power, and Kaynes Technology, have all received approval for significant investments. These collaborations provide India with access to not just capital, but critical intellectual property and manufacturing expertise that would take decades to develop independently.

However, India faces its own challenges. The country confronts a critical skills gap of 320,000 to 350,000 professionals in specialized areas such as VLSI design, chip fabrication, and advanced packaging. To address this, India is implementing aggressive workforce development programs, including degree apprenticeships and work-integrated learning initiatives designed to create the talent pipeline necessary for sustained growth.

Intel's Intercontinental Renaissance: America's Chip Champion Strikes Back

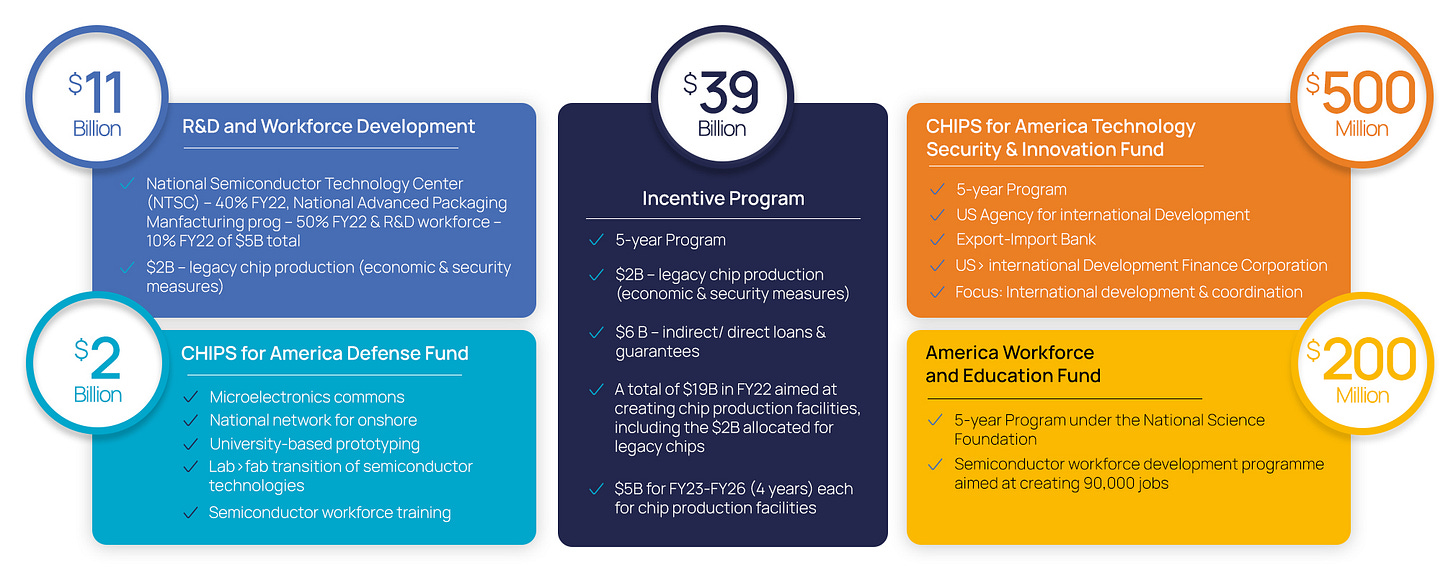

While Asia dominates manufacturing capacity, Intel's strategic expansion across both American and European markets represents the most significant Western response to the changing semiconductor landscape. The company's ambitious $100 billion expansion plan across Arizona, New Mexico, Ohio, and Oregon, supported by $7.86 billion in CHIPS Act funding, signals a fundamental shift in global semiconductor geography.

Intel's European strategy is equally bold, with plans to invest over €33 billion across the continent. The centerpiece is a €17 billion mega-site in Germany that will house Intel's most advanced manufacturing technologies. This European expansion is not merely about manufacturing capacity; it represents Intel's bid to create a "Silicon Junction" that could serve as the foundation for a more resilient European semiconductor ecosystem.

The company's recent organizational restructuring, which carved out its foundry business into an independent subsidiary with its own board, creates new possibilities for external investment and strategic partnerships. This structure could allow Intel to raise the significant capital needed for its global expansion while maintaining operational focus on both its traditional IDM business and its emerging foundry services.

Intel's strategy extends beyond traditional silicon manufacturing. The company is actively pursuing partnerships with private equity firms, including negotiations with Apollo Global Management for an $11 billion funding package for its Ireland facility16. This approach allows Intel to expand manufacturing capacity without straining its balance sheet, while providing institutional investors with exposure to the semiconductor sector's growth.

The geopolitical timing of Intel's expansion cannot be understated. As the only US-based leading-edge chipmaker, Intel's success is viewed as critical to American technological sovereignty. The company's Arizona expansion has already reached significant construction milestones, with cleanroom facilities becoming "weather tight" and initial production phases beginning.

The Chokepoints: Talent, Tools, and Capital

Across all three narratives—China's struggles, India's ambitions, and Intel's resurgence—common constraints emerge that will determine the ultimate winners in the semiconductor race.

The global talent shortage represents perhaps the most significant bottleneck. McKinsey projects that the semiconductor industry will face a shortage of more than 100,000 engineers in each major region by 2030. This shortage is particularly acute in specialized areas like AI chip design, quantum computing, and advanced manufacturing processes. The competition for skilled workers has intensified dramatically, with companies offering increasingly attractive compensation packages, relocation assistance, and flexible work arrangements to attract talent.

Equipment constraints add another layer of complexity. The semiconductor industry's reliance on specialized manufacturing equipment creates natural bottlenecks that no amount of financial investment can immediately overcome. ASML's virtual monopoly on extreme ultraviolet lithography equipment means that even well-funded expansion plans can be delayed by equipment availability. The company ships only dozens of its most advanced systems annually, creating a natural constraint on global capacity expansion.

Capital expenditure requirements continue to escalate across the industry. Semiconductor Intelligence estimates that global capex reached $155 billion in 2024, with projections of $160 billion for 2025. However, this spending is dominated by just three companies—Samsung, TSMC, and Intel—which account for 57% of total industry investment. For emerging players like India's new entrants, the capital requirements for meaningful scale remain daunting.

The supply chain for semiconductor equipment itself has become a critical consideration. Legacy tool management, particularly for mature nodes that many emerging players are targeting, requires sophisticated supply chain strategies to ensure parts availability and minimize downtime. This creates additional barriers for new entrants who lack established relationships with equipment suppliers.

Multi-Asset Implications: The Great Realignment

The semiconductor industry's transformation is creating unprecedented opportunities and risks across multiple asset classes, fundamentally altering traditional investment paradigms and correlation patterns.

Equity Markets: The New Geography of Technology

The semiconductor shift is reshaping equity market dynamics in ways that extend far beyond traditional technology sectors. Semiconductor ETFs have become critical vehicles for capturing this transformation, with funds like the VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX) seeing significant volatility as investors attempt to position for the new landscape. SMH, with over $21 billion in assets, has delivered a 24.7% annualized return over the past decade despite recent volatility.

Technology diversification indices are experiencing fundamental composition changes as the semiconductor race reshapes market leadership. The traditional dominance of US-based semiconductor companies is being challenged by the emergence of new players and the fragmentation of global supply chains. Investors are increasingly turning to global technology ETFs that provide exposure across multiple regions, recognizing that technological leadership may no longer be concentrated in a single geography.

The automotive sector presents a particularly compelling case study in cross-sector implications. As electric vehicle adoption accelerates and automotive chips become more sophisticated, companies like Tesla, BMW, and Toyota are finding their valuation increasingly tied to semiconductor supply chain security rather than traditional automotive metrics. This has created new correlation patterns between automotive stocks and semiconductor equipment manufacturers.

Fixed Income: Sovereign Debt and Development Finance

Government-backed infrastructure bonds have emerged as a critical asset class for semiconductor investment. The US CHIPS Act has already announced $32 billion in grants and $6 billion in loans across 48 projects, creating a new category of government-sponsored industrial development debt. These instruments offer investors exposure to semiconductor growth while providing government backing, creating a unique risk-return profile.

Sovereign wealth funds are increasingly allocating capital to semiconductor themes, recognizing the strategic importance of chip technology for national competitiveness. Kuwait's sovereign wealth fund, for example, is exploring semiconductor packaging companies and AI infrastructure investments as part of a broader technology reallocation strategy. This trend is creating new demand patterns in both developed and emerging market sovereign debt.

Development bank financing has become crucial for emerging market semiconductor initiatives. The European Investment Bank's €1 billion loan to NXP Semiconductors for research and development investments across multiple EU countries represents the scale of institutional support being deployed. Similar financing mechanisms are being explored in Asia and Latin America, creating new asset classes that blend development finance with technology investment.

Commodities and Materials: The New Resource Wars

The semiconductor industry's expansion is creating unprecedented demand for specialized materials and commodities that extend far beyond traditional silicon. Rare earth elements, essential for advanced chip manufacturing, are experiencing supply chain concentration risks as China controls significant portions of global production. This has created new investment opportunities in alternative mining projects and recycling technologies.

Industrial gases represent another critical commodity play, with companies like Linde and Air Liquide becoming essential partners in semiconductor expansion projects. The specialized nature of semiconductor-grade gases creates natural monopolies and pricing power that translates into attractive investment characteristics.

Water resources are emerging as an unexpected semiconductor theme, as chip manufacturing requires enormous quantities of ultra-pure water. Regions pursuing semiconductor manufacturing must invest heavily in water treatment and recycling infrastructure, creating opportunities in environmental services and water technology companies.

Alternative Investments: Private Equity and Infrastructure

The capital-intensive nature of semiconductor manufacturing is creating new opportunities in private equity and infrastructure investing. Apollo Global Management's negotiations with Intel for $11 billion in financing for the Ireland facility represent the scale of private capital being deployed. These investments offer institutions direct exposure to semiconductor manufacturing assets with long-term contracted cash flows.

Infrastructure funds are increasingly viewing semiconductor facilities as essential public infrastructure, similar to utilities or transportation assets. The strategic importance of chip manufacturing for national security has led to government support that enhances the risk-return profile of these investments. Opportunity Zone funds, like The Semiconductor Fund's $35 million raise, are targeting semiconductor investments in economically disadvantaged areas, combining tax advantages with growth exposure.

Real estate investment trusts focused on technology infrastructure are adapting to serve semiconductor tenants, requiring specialized clean room facilities and robust power infrastructure. This has created a niche within industrial REITs that commands premium valuations due to the specialized nature of semiconductor manufacturing space.

Currency and Macroeconomic Implications

The semiconductor trade war is creating new currency dynamics as countries attempt to reduce dependence on foreign chip suppliers. Countries with strong domestic semiconductor capabilities, such as Taiwan and South Korea, are experiencing currency appreciation pressures as global demand for their manufacturing capacity intensifies.

Trade flows are being fundamentally altered as semiconductor supply chains fragment along geopolitical lines. Traditional export-import relationships are being supplanted by regional trading blocs, creating new arbitrage opportunities and hedging requirements for multinational corporations. The bifurcation of the semiconductor industry into Western and Chinese spheres is creating parallel currency systems for technology trade.

Central bank policies are increasingly considering semiconductor supply chain security as a factor in monetary policy decisions. The strategic importance of chip manufacturing for economic competitiveness has led some central banks to provide preferential financing for semiconductor investments, creating new transmission mechanisms for monetary policy.

Conclusion: The New Silicon Certainties

As 2025 unfolds, the semiconductor industry's transformation from a globalized, efficiency-driven sector to a fragmented, security-focused landscape is accelerating beyond most analysts' expectations. China's struggles with internal inefficiencies despite massive state investment reveal the limits of top-down industrial policy in complex technological sectors. India's strategic partnerships and focus on mature nodes demonstrate how emerging economies can leverage geopolitical tensions to build meaningful capabilities. Intel's transcontinental expansion represents the West's most ambitious attempt to regain manufacturing sovereignty.

For investors, the implications extend far beyond technology stocks. The semiconductor race is reshaping government bond markets through massive infrastructure spending, creating new commodity demand patterns, and generating entirely new asset classes in private markets. The traditional correlation patterns that have guided portfolio construction for decades are being rewritten as semiconductor supply chain security becomes a macroeconomic factor comparable to energy independence.

The winners in this new landscape will be those who recognize that semiconductor investment is no longer purely a technology bet—it has become a geopolitical, macroeconomic, and infrastructure theme that touches every corner of the global economy. As the silicon iron curtain solidifies, the multi-asset implications will only intensify, creating both tremendous opportunities and significant risks for those positioned on either side of the great chip divide.

The race to self-sufficiency is far from over, but the early returns suggest that success will belong not to those with the deepest pockets, but to those with the most strategic partnerships, the most efficient talent development programs, and the most realistic assessments of their competitive advantages. In the semiconductor industry's new reality, catching up may be possible—but only for those willing to fundamentally reimagine how the global technology ecosystem operates.

Sources

https://www.eetasia.com/china-semiconductor-markets-pivotal-moment/

https://techcrunch.com/2024/02/29/india-semiconductor-investments-fab-facility/

https://www.policycircle.org/policy/indias-semiconductor-push/

https://technologymagazine.com/articles/us-invests-billions-in-intel-for-domestic-chip-production

https://www.intel.com/content/www/us/en/corporate-responsibility/intel-in-germany.html

https://www.theregister.com/2024/05/13/intel_11b_ireland_plant/

https://newsroom.intel.com/manufacturing/arizona-expansion-marks-construction-milestone

https://money.usnews.com/investing/articles/best-semiconductor-etfs-to-buy

https://www.investing.com/academy/etfs/best-technology-etfs-to-watch/

https://www.nxp.com/company/about-nxp/newsroom/NW-SECURES-LOAN-ADVANCE-INNOVATION

https://economicsobservatory.com/whats-happening-in-chinas-semiconductor-industry

https://www.foxconn.com/en-us/press-center/events/foxconn-events/740

https://resources.altium.com/p/indias-new-semiconductor-fab-capacity-2024