The Silicon Fault Lines: When Chips Fall, Markets Shatter

How Semiconductor Risks Are Rewriting the Rules of Portfolio Construction and Risk Management

The semiconductor industry stands as the invisible foundation of our modern world—powering everything from smartphones to autonomous vehicles, data centers to defense systems. Yet beneath this technological marvel lies a web of vulnerabilities so intricate and interconnected that when disrupted, they send shockwaves across global markets, reshaping asset correlations and challenging traditional investment wisdom. What happens when the chips don't just fall—they avalanche?

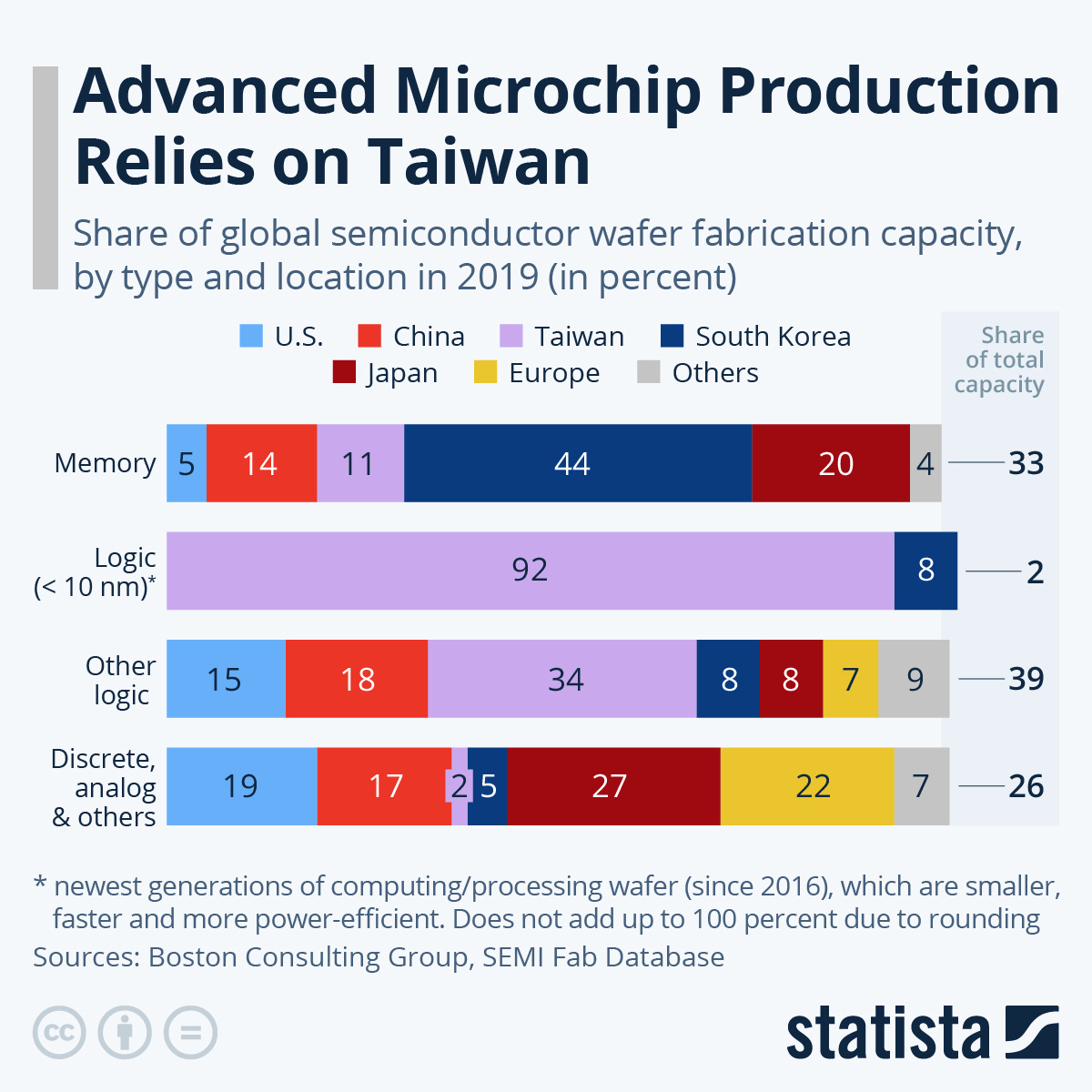

This crisis isn't hypothetical. It's happening right now. As you read this, Taiwan's advanced fabrication facilities face the ever-present threat of seismic activity, water shortages plague the world's most critical manufacturing hubs, and a single Dutch company controls over 90% of the machinery needed to produce cutting-edge processors. The semiconductor ecosystem has evolved into a house of cards built on technological marvels but standing on geological fault lines—both literal and metaphorical.

This is Part 10 of our comprehensive series on the semiconductor industry. For the complete exploration of this critical sector, visit our series hub where we've deconstructed everything from basic chip architecture to global supply chain dynamics:

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

The Anatomy of Fragility

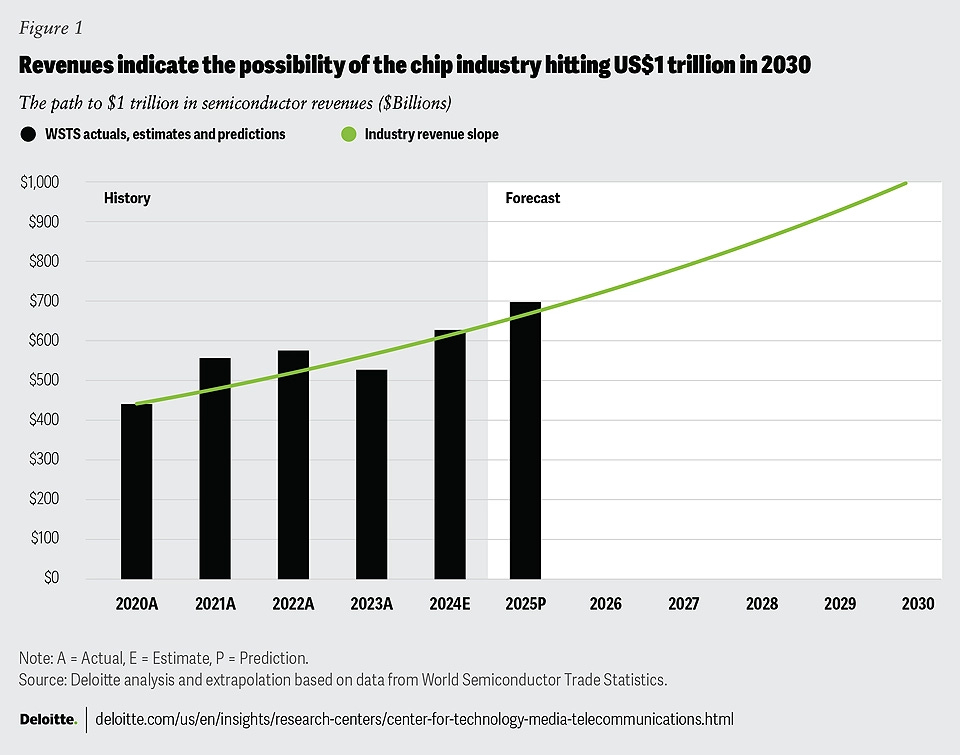

The semiconductor industry's remarkable growth trajectory—with global sales reaching $630.5 billion in 2024 and projected to hit $697 billion in 2025—masks an underlying structural vulnerability that would make even the most seasoned risk manager break into a cold sweat. The sector's concentration risks are not merely statistical anomalies; they represent single points of failure that could potentially paralyze global economic activity within weeks.

Consider Taiwan Semiconductor Manufacturing Company (TSMC), which produces 90% of the world's most advanced chips. This isn't just market dominance—it's a geographic concentration so extreme that it effectively places the global economy's nervous system on a single island prone to earthquakes, typhoons, and geopolitical tensions. When a 7.4 magnitude earthquake struck Taiwan in April 2024, it temporarily halted production at facilities responsible for chips powering everything from iPhones to Tesla vehicles. The tremor lasted minutes; the market anxiety persisted for weeks.

But TSMC represents only one layer of this vulnerability cake. ASML Holding, the Dutch giant, maintains an even more absolute monopoly, controlling over 90% of the extreme ultraviolet (EUV) lithography equipment market. These machines, priced upwards of $150 million each, are indispensable for manufacturing chips below 7 nanometers—the processors that power artificial intelligence applications and advanced computing systems. Without ASML's technology, the most sophisticated chip production simply cannot exist, creating what experts call a "technological chokepoint" that transcends traditional supply chain risks.

The water dependency adds another dimension to this fragility. Semiconductor fabrication is extraordinarily water-intensive, with advanced fabs consuming millions of gallons daily for cooling and cleaning processes. When drought conditions struck Taiwan in 2021, the government imposed water restrictions forcing TSMC to truck in water supplies and implement emergency conservation measures. The irony was stark: companies begging for rain while their stock prices soaked investors worldwide.

Historical Echoes and Market Memory

The semiconductor industry's boom-bust cycles aren't new phenomena, but their amplitude and global impact have intensified dramatically. The COVID-19 pandemic created what industry veterans now call the "perfect storm"—simultaneous demand explosions and supply chain collapses that revealed just how dependent modern life had become on these tiny silicon wafers.

The chip shortage that began in 2020 initially seemed like a temporary supply chain hiccup. Instead, it evolved into a multi-year crisis that cost automakers an estimated $210 billion in lost revenue in 2021 alone. Ford, General Motors, and Toyota—companies that had perfected just-in-time inventory management—found themselves idling assembly lines not because they lacked steel or engines, but because they couldn't secure $5 semiconductor chips. The automotive industry's transformation was immediate and lasting: companies began stockpiling chips, prioritizing higher-margin vehicles, and fundamentally restructuring their supply chain relationships.

The semiconductor shortage exposed a critical misunderstanding about industry priorities. Unlike traditional commodities where automotive companies might enjoy preferential treatment due to volume purchases, chip manufacturers prioritize high-margin clients—particularly those in the artificial intelligence and data center sectors. This hierarchy became painfully apparent as automakers found themselves competing against tech giants for limited production capacity, often losing out to companies willing to pay premium prices for advanced processors.

These disruptions created what economists term "structural breaks" in traditional market relationships. The semiconductor sector, which historically moved somewhat independently of broader market cycles, suddenly became the tail wagging the entire technology dog. The correlation between semiconductor performance and broader technology indices strengthened significantly, while semiconductor stocks began exhibiting volatility patterns approximately 1.5 times greater than the S&P 50011.

The Cyber Dimension: When Silicon Meets Sabotage

As if physical vulnerabilities weren't sufficient, the semiconductor industry faces an escalating cyber warfare front that threatens both intellectual property and production capabilities. The sector's digital transformation—ironically enabled by the very chips it produces—has created new attack vectors that traditional risk models struggle to quantify.

Intellectual property theft in the semiconductor industry isn't merely corporate espionage; it's economic warfare with trillion-dollar implications. Chip designs represent years of research and development, often costing billions to develop. When hackers successfully infiltrate these systems, they're not just stealing files—they're potentially accelerating competing nations' technological capabilities by decades. The 2020 TSMC breach exemplified this risk, with hackers allegedly stealing proprietary information and design details from leading tech companies.

The cyber threat landscape has evolved beyond traditional hacking to encompass supply chain infiltration and ransomware attacks specifically targeting design files. These attacks can encrypt critical chip designs, effectively holding new product launches hostage until ransom demands are met. The impact extends far beyond immediate financial losses; delays in chip production can cascade through entire technology ecosystems, affecting everything from smartphone launches to data center expansions.

State-sponsored cyber activities add another layer of complexity. The semiconductor industry sits at the intersection of commercial competition and national security interests, making it a prime target for government-backed hacking groups. These actors often pursue longer-term strategic objectives rather than immediate financial gains, seeking to understand technological capabilities, steal manufacturing processes, or potentially install backdoors for future exploitation.

Geopolitical Chess and Policy Earthquakes

The semiconductor industry has become ground zero for the new Cold War, with chips serving as both weapons and shields in an escalating technological arms race. The Biden administration's October 2022 export controls marked a watershed moment, transforming semiconductors from commercial products into strategic assets subject to unprecedented government oversight.

These policy interventions created immediate market dislocations. Companies found themselves navigating complex export licensing requirements, redesigning products to comply with technological restrictions, and fundamentally restructuring supply chains to avoid prohibited entities. The uncertainty surrounding policy implementation and potential escalation has introduced a new risk premium into semiconductor valuations, with investors struggling to price assets subject to rapidly evolving regulatory frameworks.

The Trump administration's return to power has intensified these dynamics, with proposed tariffs on semiconductor imports starting at 25% and potentially climbing higher. These measures aim to force foreign manufacturers like TSMC and Samsung to expand U.S. production, but they also threaten to increase costs for domestic manufacturers still heavily reliant on Asian supply chains. The semiconductor industry finds itself caught between competing policy objectives: the desire for domestic manufacturing capacity and the economic reality of global supply chain integration.

China's response has been equally strategic, implementing export controls on critical materials like germanium and gallium used in semiconductor production18. Germanium prices have surged 115% since these restrictions were implemented, while gallium prices have increased 75%18. These materials are essential for advanced chip production, and China's dominance in their supply chains—producing over 90% of global output—gives it significant leverage in this technological confrontation18.

Multi-Asset Implications: When Correlations Collapse

The semiconductor industry's structural vulnerabilities create cascading effects across multiple asset classes, challenging traditional portfolio construction methodologies and risk management frameworks. Understanding these cross-asset implications has become essential for modern portfolio management, as semiconductor disruptions increasingly serve as systemic risk catalysts rather than isolated sector-specific events.

Equity Markets: Beyond Tech Sector Contagion

Semiconductor stocks exhibit unique correlation patterns that defy simple categorization within technology sector allocations. Recent multifractal analysis of leading semiconductor companies—Intel, AMD, Nvidia, and Broadcom—reveals complex nonlinear relationships with major financial assets that traditional correlation measures fail to capture. These relationships intensify during stress periods, creating what researchers term "correlation explosions" that can rapidly destabilize diversified portfolios.

The semiconductor sector's correlation with the Dow Jones Industrial Average shows particularly pronounced asymmetric behavior. During market downturns, this correlation strengthens significantly, meaning semiconductor holdings provide less diversification precisely when investors need it most. Conversely, during upward market trends, semiconductor stocks paired with gold demonstrate stronger persistence, suggesting they may serve as effective hedges against inflationary pressures during certain market regimes.

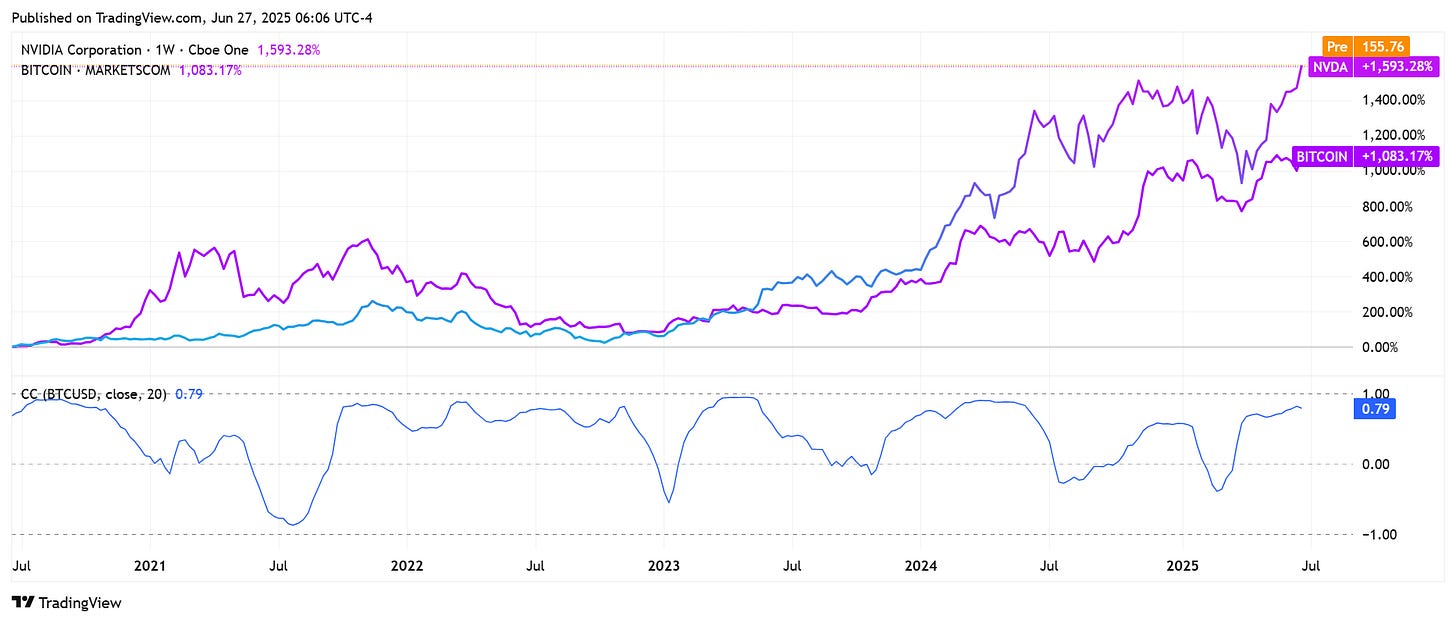

Nvidia and Broadcom exhibit the highest levels of multifractal cross-correlation with Bitcoin, reaching approximately 0.54 Hurst exponents. This relationship suggests that cryptocurrency markets may serve as leading indicators for certain semiconductor stocks, particularly those heavily exposed to artificial intelligence and mining applications. For portfolio managers, this creates both opportunities and risks—cryptocurrency volatility could herald semiconductor sector instability, but it might also signal emerging demand patterns for specialized chips.

The sector's relationship with currency markets adds another layer of complexity. Semiconductor stocks show long-term negative correlations with the Euro-Dollar exchange rate, with exponents around 0.46 across major companies. This pattern reflects the global nature of semiconductor supply chains and the dollar-denominated nature of most chip transactions, creating natural hedging dynamics that sophisticated investors can exploit.

Fixed Income: The Bond Vigilante Awakening

The semiconductor industry's capital intensity creates unique dynamics in corporate credit markets that extend far beyond traditional technology sector analysis. Advanced semiconductor fabrication facilities require capital investments exceeding $20 billion per plant, creating debt structures that are particularly sensitive to both operational disruptions and policy changes4.

Corporate bonds issued by semiconductor companies exhibit elevated sensitivity to geopolitical events, with credit spreads widening significantly during trade tension escalations. The sector's exposure to export controls and tariff policies creates what credit analysts term "policy duration risk"—the potential for sudden regulatory changes to materially alter cash flow projections and debt servicing capabilities.

Government bond markets face indirect but significant exposure to semiconductor industry dynamics through fiscal policy implications. Semiconductor manufacturing subsidies—such as those provided under the CHIPS Act—represent substantial government expenditures that can influence sovereign debt dynamics. The proposed $52 billion in CHIPS Act funding, while substantial, pales in comparison to the estimated $1 trillion in private investment expected in semiconductor manufacturing between 2025 and 2030.

International government bonds face additional pressures from semiconductor industry developments. Japan's recent poor auction results and record-high 30-year government bond yields partly reflect concerns about the country's ability to maintain its position in the global semiconductor supply chain while managing massive fiscal commitments. Similarly, Taiwan's government bonds incorporate a "geopolitical risk premium" that fluctuates with semiconductor industry developments and cross-strait tensions.

Commodities: The Raw Materials Imperative

Semiconductor manufacturing's dependence on rare earth metals and specialized materials creates direct linkages between chip industry dynamics and commodity markets. The industry's growth trajectory—projected to reach $1 trillion by 2030—implies proportional increases in demand for these critical materials.

Germanium and gallium markets exemplify this relationship, with prices more than doubling following China's export restrictions. These materials are essential for advanced chip production, particularly for applications requiring high-frequency operation and extreme temperature resistance. The price volatility in these markets reflects not just supply-demand fundamentals but also the strategic importance of semiconductor production capabilities in global technological competition.

Silver and copper markets face increasing pressure from semiconductor industry expansion. Advanced chip packaging requires substantial quantities of these metals, and the industry's shift toward more sophisticated packaging technologies—driven by the end of Moore's Law scaling—implies accelerating demand growth. For commodity investors, semiconductor industry developments serve as leading indicators for industrial metals demand patterns.

Water rights and infrastructure investments represent an emerging commodity class linked to semiconductor production. Advanced chip manufacturing requires enormous quantities of ultra-pure water, creating investment opportunities in water treatment technologies and regional water rights. Climate change effects on water availability in key manufacturing regions could transform water from a utility cost into a strategic resource commodity.

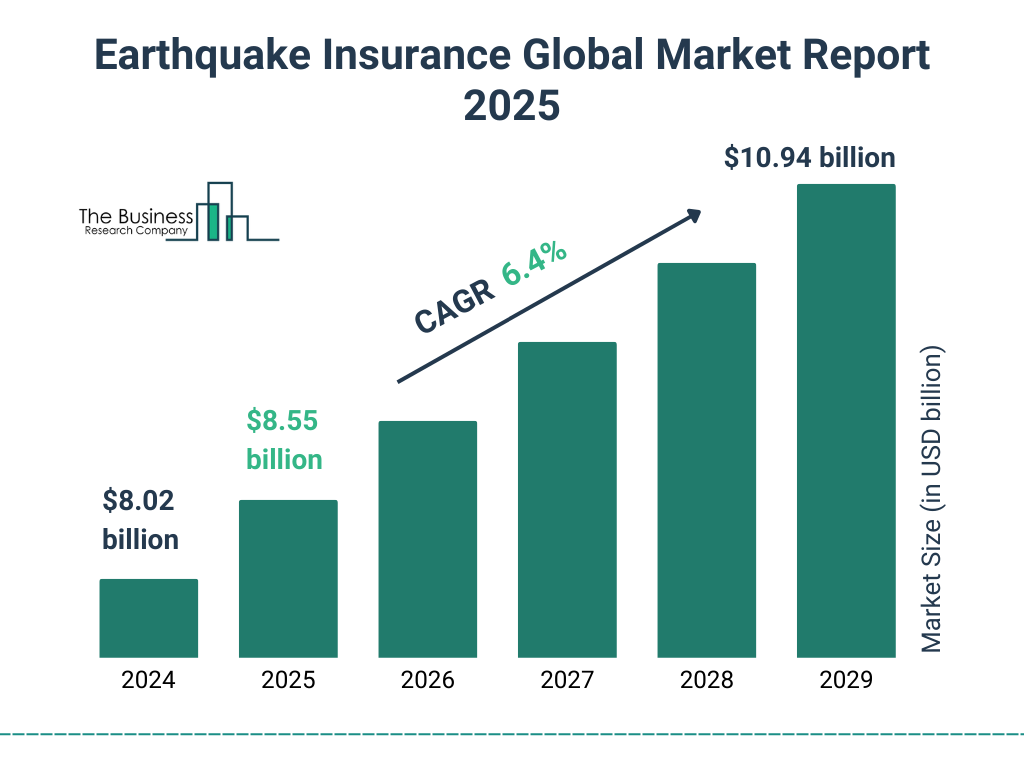

Alternative Investments: Parametric Solutions and Catastrophe Bonds

The semiconductor industry's unique risk profile has catalyzed innovation in alternative investment products designed to capture or hedge these specific exposures. Parametric insurance products have emerged as particularly relevant tools, offering coverage triggered by specific events rather than traditional indemnity calculations.

Earthquake parametric products covering Taiwan have gained significant traction among semiconductor industry participants. These instruments pay predetermined amounts when seismic activity exceeds specified thresholds in critical manufacturing regions, providing immediate liquidity without requiring complex damage assessments. One semiconductor company mentioned purchasing parametric earthquake coverage specifically for Taiwan-based suppliers due to the lack of suitable indemnity products and the desire for rapid response capabilities.

Catastrophe bonds linked to semiconductor supply chain risks represent a growing market opportunity. These instruments provide investors with attractive risk-adjusted returns while offering issuers protection against specific disruption scenarios. The semiconductor industry's global importance and the quantifiable nature of production disruptions make it well-suited for catastrophe bond structures.

Reinsurance-linked investment products offer another avenue for both hedging semiconductor exposure and capturing associated risk premiums. Lloyd's of London and WTW have identified significant protection gaps in semiconductor supply chain coverage, with 81% of survey respondents citing lack of insurance solutions as a major medium-term challenge. This supply-demand imbalance creates opportunities for alternative capital providers willing to underwrite these specialized risks.

Semiconductor supply chain stress testing has evolved beyond traditional scenario analysis to incorporate discrete event simulation methodologies. These advanced models enable portfolio managers to quantify potential losses under various disruption scenarios, from natural disasters to cyberattacks to geopolitical interventions. The resulting resilience curves help inform position sizing and hedging decisions across multiple asset classes.

Real Estate and Infrastructure: The Fab Economy

The semiconductor industry's geographic concentration creates substantial real estate and infrastructure investment implications that extend far beyond traditional technology property categories. Advanced semiconductor facilities require unique infrastructure specifications—stable power supplies, ultra-pure water access, seismic isolation, and specialized transportation networks—that command premium valuations in suitable locations.

The CHIPS Act's domestic manufacturing incentives have triggered a real estate boom in selected U.S. regions. Arizona, Texas, and Ohio have emerged as primary beneficiaries, with land values near proposed semiconductor facilities experiencing substantial appreciation. This trend creates both opportunities and risks for real estate investors, as the success of these investments depends heavily on the successful execution of multi-billion dollar manufacturing projects subject to complex regulatory and technological challenges.

International real estate markets face different dynamics. Taiwan's property values incorporate both positive cash flow effects from semiconductor industry presence and negative geopolitical risk premiums. This creates a unique asymmetric risk-return profile for Taiwan real estate investments, with substantial upside potential if geopolitical tensions ease but significant downside exposure if supply chain diversification accelerates.

Data center real estate represents another semiconductor-linked investment category experiencing rapid evolution. The artificial intelligence boom has dramatically increased demand for specialized data center facilities capable of supporting high-performance computing workloads. These properties require substantially more power and cooling capacity than traditional data centers, creating new subcategories within real estate investment trusts focused on AI-optimized infrastructure.

Portfolio Construction in the Silicon Age

Traditional portfolio optimization methodologies struggle to capture the complex, nonlinear relationships that semiconductor industry dynamics create across asset classes. The sector's influence extends far beyond its nominal weight in major indices, creating what researchers term "tail-risk amplification effects" that can rapidly destabilize seemingly well-diversified portfolios.

Modern portfolio construction must incorporate semiconductor-specific stress testing scenarios that go beyond historical correlation analysis. Discrete event simulation models can help investors understand how various disruption scenarios—from Taiwan earthquake events to ASML production halts to Chinese rare earth export bans—might cascade through their holdings. These models reveal hidden correlations that emerge only during crisis periods, when traditional diversification benefits disappear precisely when they're most needed.

The semiconductor sector's crash probability analysis suggests particular caution for momentum-oriented strategies. Research indicates that industries with two-year alpha exceeding 90 percentage points face approximately 50% probability of experiencing 40% or greater declines within the subsequent two years. The semiconductor sector's current two-year alpha of 91 percentage points places it squarely within this high-risk category, suggesting that even optimistic investors should consider position sizing and hedging strategies.

Options markets provide both hedging tools and risk indicators for semiconductor exposure. The VanEck Semiconductor ETF (SMH) regularly exhibits defensive put-to-call ratios exceeding 2.4:1 during earnings seasons, indicating institutional awareness of sector-specific volatility risks. These elevated implied volatility levels create opportunities for sophisticated investors to monetize volatility expectations while providing downside protection.

Currency hedging becomes particularly important for semiconductor-exposed portfolios given the sector's complex international supply chain structure30. Semiconductor companies face exposure to multiple currency regimes simultaneously—dollar-denominated sales, yen-denominated equipment purchases, won-denominated manufacturing costs, and euro-denominated materials expenses. Traditional currency hedging strategies may prove inadequate for capturing these multi-dimensional exposures.

The Path Forward: Building Resilient Portfolios in an Interconnected World

The semiconductor industry's evolution from a cyclical technology sector to a systemic risk catalyst demands fundamental changes in how investors approach portfolio construction and risk management. The sector's unique combination of technological complexity, geographic concentration, and geopolitical sensitivity creates challenges that require sophisticated solutions.

Successful navigation of semiconductor-related risks requires moving beyond traditional sector allocation frameworks toward dynamic risk budgeting approaches that can adapt to changing correlation structures. This includes implementing real-time monitoring systems that track key semiconductor industry indicators—from Taiwan Strait tensions to ASML order backlogs to Chinese rare earth export statistics—and adjust portfolio positioning accordingly.

The development of semiconductor-specific investment products offers new tools for both hedging and alpha generation. Parametric insurance products, catastrophe bonds, and specialized ETFs enable more precise risk management while providing access to returns unavailable through traditional asset classes. These instruments represent not just portfolio diversification tools but entirely new categories of investable assets.

As we stand at the intersection of technological advancement and geopolitical confrontation, the semiconductor industry serves as both catalyst and canary in the coal mine for broader systemic risks. The chips may be small, but their implications for global markets are enormous. Understanding these dynamics isn't just about technology investing—it's about surviving and thriving in an increasingly interconnected and fragile global economy.

The silicon fault lines run deeper than most investors realize, and when the next major disruption strikes—whether from natural disasters, cyber attacks, or geopolitical escalation—portfolios built on traditional risk assumptions may find themselves on the wrong side of history. The time to prepare is now, while the markets are still calm and the chips are still flowing. Because when the chips finally fall, they're going to take a lot more than technology stocks down with them.

Continue exploring our comprehensive semiconductor series to deepen your understanding of this critical industry's impact on global markets and investment strategies:

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

Sources

https://www.linkedin.com/pulse/asmls-monopoly-indias-strategic-dilemma-global-race-2025-shukla-gzw1c

https://www.infosys.com/iki/research/semiconductor-industry-outlook2025.html

https://techhq.com/2021/03/asian-drought-dries-up-the-global-semiconductor-supply-chain/

https://fordauthority.com/2024/01/fallout-from-chip-shortage-expected-to-persist-for-years/

https://luckboxmagazine.com/techniques/intermediate/the-semiconductor-trade-correlation-volatility/

https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2025/global-semiconductor-industry-outlook-2025.pdf

https://www.blog.baldengineering.com/2024/09/rising-prices-of-critical-metals.html

https://www.lse.co.uk/news/take-five-chips-and-trouble-in-bond-land--ds65pxelztt8vzc.html

https://www.reinsurancene.ws/semiconductor-supply-chain-risk-protection-gaps-lloyds-wtw/

https://www.idaireland.in/latest-news/insights/semiconductor-industry-outlook

https://datalynq.com/post/the-growing-need-for-robust-cybersecurity-in-the-semiconductor-industry

https://www.casact.org/sites/default/files/database/forum_15spforum_koch.pdf

https://www.semiconductors.org/policies/tax/market-data/?type=post

http://www.diva-portal.org/smash/get/diva2:1878404/ATTACHMENT01.pdf

https://blog.validea.com/semiconductor-etfs-are-breaking-out-heres-what-the-data-tells-us/

https://repositorio.comillas.edu/rest/bitstreams/421571/retrieve

https://www.sourcengine.com/blog/semiconductor-industry-news

https://www.aalbun.com/blog/avoiding-semiconductor-intellectual-property-theft

https://www.artemis.bm/news/cyber-parametric-ils-gain-momentum-as-cat-bond-market-evolves-am-best/

![News] ASML Claims the World Counts on China for Legacy Chips; So Do Chip Equipment Giants | TrendForce News News] ASML Claims the World Counts on China for Legacy Chips; So Do Chip Equipment Giants | TrendForce News](https://substackcdn.com/image/fetch/$s_!3mKS!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F26dd3452-ebb5-43ef-adc1-fa808f7ef29c_624x624.png)