The Microchip Cold War: Why Tiny Semiconductors Are Triggering Massive Market Moves

Geopolitical Tensions Drive Historic Government Spending and Create New Investment Paradigms Across All Asset Classes

This is Part 7 of our comprehensive semiconductor industry primer series. If you're new to this series, check out our previous articles to build your foundational understanding of this critical industry:

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

In the summer of 2022, when President Joe Biden signed the CHIPS and Science Act into law, few observers fully grasped that they were witnessing the opening salvo of what would become the most expensive technological arms race in modern history. Fast-forward to 2025, and the reverberations of this $280 billion commitment continue to reshape not just the semiconductor landscape, but the entire global financial ecosystem. What began as a response to supply chain vulnerabilities has evolved into a full-scale battle for digital sovereignty, with nations deploying fiscal arsenals that would make Cold War defense spending seem modest by comparison.

The numbers tell only part of the story. Between the United States' historic semiconductor subsidies, the European Union's ambitious €43 billion mobilization through the European Chips Act, and China's estimated $150 billion domestic investment push, governments worldwide are committing unprecedented resources to secure their technological independence. But beneath these headline figures lies a more complex narrative—one where geopolitical tensions are fundamentally rewiring traditional investment patterns across every major asset class, creating opportunities and risks that astute investors cannot afford to ignore.

The Dawn of Digital Sovereignty

The concept of digital sovereignty—a nation's ability to maintain control over its technological infrastructure and data—has emerged as the defining strategic imperative of the 21st century. Unlike previous industrial revolutions where geographic advantages could be leveraged through traditional trade relationships, the semiconductor revolution has created a winner-takes-all dynamic where technological dependence translates directly into strategic vulnerability. This reality crystallized during the COVID-19 pandemic when semiconductor shortages exposed the fragility of globalized supply chains, forcing automotive manufacturers to idle production lines and consumer electronics companies to delay product launches indefinitely.

The transformation has been particularly striking in how governments have abandoned decades of free-market orthodoxy in favor of aggressive industrial policy. The semiconductor industry, once viewed through the lens of comparative advantage and efficient capital allocation, is now explicitly treated as a matter of national security. This shift represents more than policy evolution; it signals a fundamental restructuring of how capital flows operate in the global economy, with investment decisions increasingly influenced by geopolitical considerations rather than purely economic metrics.

What makes this transformation especially significant for financial markets is the scale and speed of the transition. Traditional industrial policy initiatives often unfold over decades, allowing markets to gradually adjust expectations and pricing models. The semiconductor sovereignty race, however, has compressed this timeline dramatically, with governments announcing multi-hundred-billion-dollar commitments within months of each other, creating massive capital flows that are reshaping everything from sovereign debt markets to currency relationships.

America's Silicon Strategy: The CHIPS Act Revolution

The United States' approach to semiconductor sovereignty centers on the CHIPS and Science Act, a legislative behemoth that represents the largest federal investment in manufacturing since World War II. The act's $52.7 billion in semiconductor-specific funding is complemented by $174 billion in broader science and technology investments, creating a comprehensive ecosystem designed to rebuild America's technological manufacturing base. This isn't merely about subsidizing existing companies; it's about fundamentally restructuring the global semiconductor supply chain with the United States at its center.

The financial mechanics of the CHIPS Act reveal sophisticated policy design aimed at maximizing private sector leverage. The legislation combines direct subsidies ($39 billion), loan guarantees, research funding ($13 billion), and a 25% investment tax credit for manufacturing equipment to create multiple incentive layers. This multi-pronged approach ensures that companies receive immediate cash flow benefits while building long-term production capacity, effectively de-risking what would otherwise be prohibitively expensive manufacturing investments.

By March 2024, the act had already catalyzed between 25 and 50 potential projects with projected total investments of $160-200 billion and 25,000-45,000 new jobs. Major semiconductor manufacturers like Taiwan Semiconductor Manufacturing Company (TSMC) committed to building advanced fabrication facilities in Arizona, while Intel announced massive expansions of its domestic production capacity. These commitments represent more than corporate strategy shifts; they signal a fundamental rewiring of global semiconductor manufacturing that will influence trade patterns, employment demographics, and regional economic development for decades.

However, the implementation has not been without challenges. Bureaucratic hurdles and skilled worker shortages have created delays in grant distribution, while the technical requirements for advanced semiconductor manufacturing have exposed gaps in America's industrial workforce1. The legislation requires that 40% of new permanent workers possess two-year technician degrees and 60% hold four-year engineering degrees or higher, creating unprecedented demand for specialized technical education and training programs.

Europe's Digital Ambitions: The Continental Response

The European Union's response to the semiconductor challenge through the European Chips Act represents perhaps the most ambitious industrial policy initiative in the bloc's history. Entering into force in April 2025, the legislation aims to double the EU's global semiconductor market share to 20% by 2030, a target that would require massive increases in both manufacturing capacity and technological capability. The €43 billion mobilization through 2030 is structured through three strategic pillars designed to address different aspects of semiconductor sovereignty.

The first pillar, the Chips for Europe Initiative, allocates €3.3 billion in EU funds expected to be matched by member state contributions, focusing on bridging the critical gap between research and commercial manufacturing. This approach recognizes a fundamental weakness in Europe's semiconductor ecosystem: while the continent possesses world-class research capabilities, it has historically struggled to translate technological breakthroughs into large-scale manufacturing operations. The initiative will support advanced pilot production lines, develop cloud-based design platforms, and establish competence centers across member states.

The second and third pillars focus on manufacturing incentives and supply chain security, respectively, creating a comprehensive framework for European semiconductor independence. Unlike the more centralized approach of the United States, the EU strategy emphasizes coordination across member states while respecting national sovereignty over industrial policy. This distributed approach reflects both the political realities of European integration and a strategic recognition that semiconductor manufacturing requires diverse capabilities that can be optimized across different geographic regions.

The European approach is particularly noteworthy for its emphasis on quantum computing and next-generation semiconductor technologies. While American and Asian competitors focus heavily on current-generation manufacturing capabilities, Europe is positioning itself as a leader in emerging technologies that could define the next phase of the semiconductor revolution. This forward-looking strategy reflects both European technological strengths and a realistic assessment that competing directly with established manufacturing powers requires technological leapfrogging rather than incremental improvements.

Taiwan's Silicon Shield: The Geopolitical Linchpin

Taiwan's position in the global semiconductor ecosystem creates one of the most complex geopolitical dynamics in modern international relations. Taiwan Semiconductor Manufacturing Company (TSMC) alone produces over 60% of the world's semiconductors and more than 90% of the most advanced chips, making the island nation indispensable to global technology supply chains. This dominance has created what analysts call Taiwan's "silicon shield"—the understanding that any military conflict in the Taiwan Strait would trigger immediate and catastrophic disruptions to global technology production.

The financial implications of Taiwan's semiconductor concentration extend far beyond the technology sector. Modern automobiles contain hundreds of semiconductor chips, while data centers, telecommunications networks, and industrial automation systems all depend on advanced processors manufactured almost exclusively in Taiwan. A disruption to Taiwanese production would cascade through virtually every sector of the global economy, making Taiwan's semiconductor industry a systemic risk factor that transcends traditional geographic or sectoral investment boundaries.

Taiwan's semiconductor market, valued at $40.5 billion in 2022 and projected to reach $66.06 billion by 2031, represents more than economic growth—it embodies the island's strategic insurance policy. The technical expertise required to operate advanced semiconductor manufacturing cannot be easily replicated, creating high barriers to entry that have preserved Taiwan's competitive advantages even as other nations invest heavily in domestic capabilities. However, this same specialization creates vulnerabilities, as Taiwan's economy becomes increasingly dependent on a single industry operating in an increasingly tense geopolitical environment.

Recent developments, including TSMC's expansion into Arizona and increased cooperation with American semiconductor initiatives, reflect Taiwan's strategy of distributing production capabilities while maintaining technological leadership6. This approach allows Taiwan to reduce geopolitical risks while preserving its strategic importance to allied nations. For investors, this dynamic creates complex risk-reward calculations where traditional market fundamentals must be weighed against geopolitical scenarios that could fundamentally alter global technology supply chains.

Supply Chain Diversification: The Great Restructuring

The global semiconductor industry's response to geopolitical tensions has triggered the largest supply chain restructuring in modern industrial history. Companies that previously optimized for cost efficiency and just-in-time delivery are now prioritizing supply chain resilience and geographic diversification, even when these strategies increase short-term costs. This transformation represents a fundamental shift from globalization's efficiency-focused model toward a security-focused approach that explicitly trades economic optimization for strategic autonomy.

The scale of this restructuring becomes apparent when examining individual company strategies. Intel's commitment to building advanced manufacturing facilities across multiple continents reflects not just business expansion but strategic hedging against geopolitical disruptions. Similarly, Samsung's investments in American production capacity and European research facilities demonstrate how leading semiconductor companies are creating geographically distributed operations that can continue functioning even if individual regions face disruptions.

This diversification creates both opportunities and challenges for financial markets. Construction and engineering companies are experiencing unprecedented demand for specialized semiconductor manufacturing facilities, while equipment manufacturers benefit from multiple nations simultaneously building domestic production capabilities. However, the transition also creates short-term inefficiencies and higher costs that impact corporate profitability and pricing dynamics across technology-dependent sectors.

The timeline for supply chain diversification extends well beyond typical business planning horizons, with most new semiconductor manufacturing facilities requiring 3-5 years to become operational and additional time to achieve full production capacity. This extended timeline means that current investment decisions will influence global semiconductor supply chains well into the 2030s, creating long-term structural changes that investors must incorporate into their strategic planning.

Multi-Asset Implications: How Chip Wars Reshape Every Market

The semiconductor sovereignty race creates investment implications across every major asset class, fundamentally altering traditional portfolio construction and risk management approaches. Understanding these cross-asset impacts is essential for investors navigating an environment where technological competition increasingly drives macroeconomic policies and market dynamics.

Government Bonds: Fiscal Expansion Meets Strategic Investment

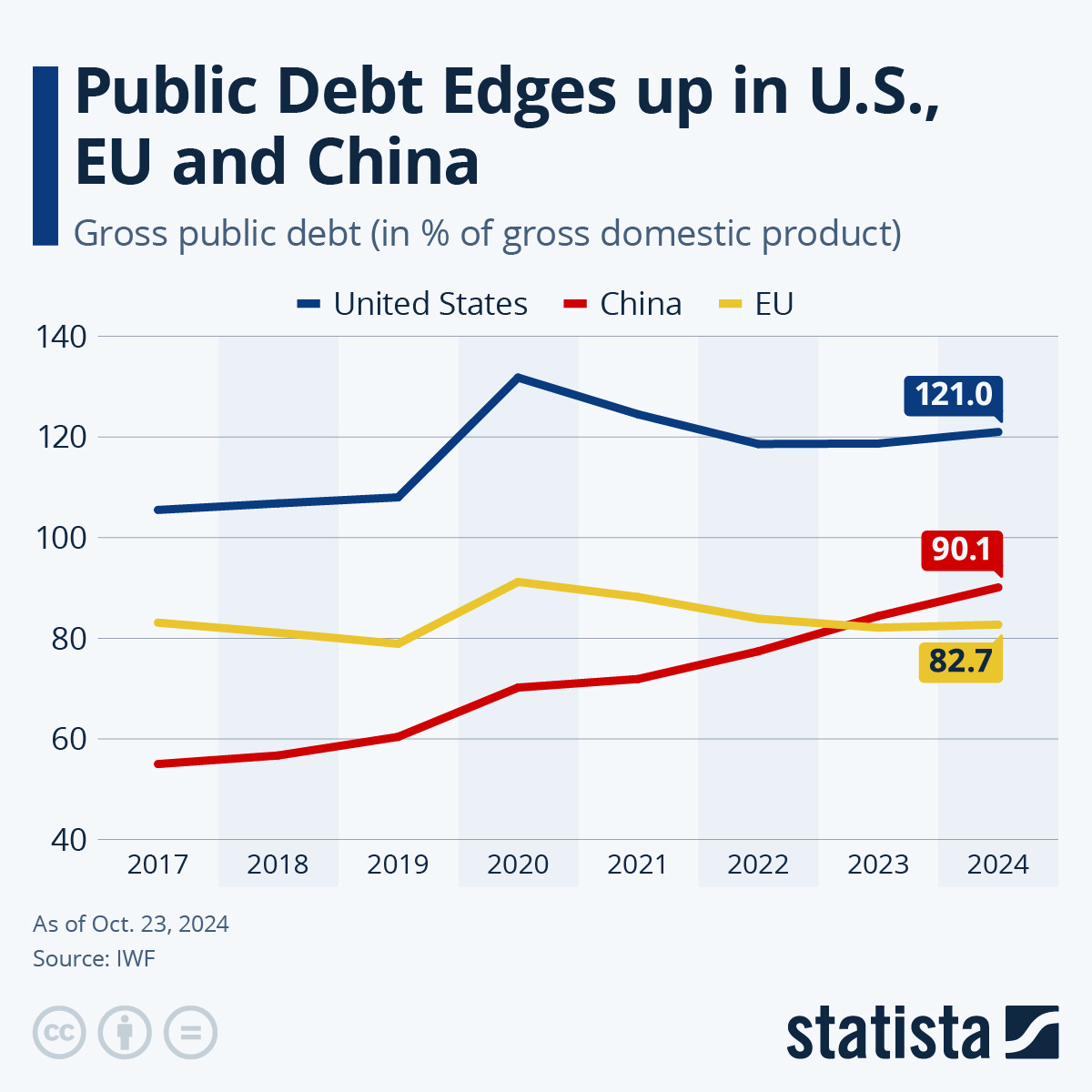

The massive government commitments to semiconductor development represent significant fiscal expansion that directly impacts sovereign debt markets. The United States' $280 billion CHIPS Act commitment, combined with the EU's €43 billion mobilization, represents hundreds of billions in additional government spending that must be financed through debt issuance. This spending differs from traditional fiscal stimulus in both its long-term nature and its productivity-enhancing characteristics, creating complex implications for bond investors.

Unlike countercyclical spending designed to support demand during economic downturns, semiconductor investments represent structural economic transformation with multi-decade payoff periods. This distinction is crucial for bond investors because productivity-enhancing investments typically support long-term economic growth while potentially increasing short-term deficit spending. The result is a more favorable long-term fiscal outlook that may justify higher near-term debt levels, particularly for countries successfully building competitive semiconductor capabilities.

The global nature of semiconductor competition also creates interesting relative value opportunities in sovereign debt markets. Countries investing heavily in semiconductor capabilities may experience short-term fiscal pressure but longer-term economic benefits, while countries failing to invest may face strategic economic disadvantages that ultimately impact their fiscal sustainability. This dynamic suggests that traditional debt-to-GDP ratios may become less reliable indicators of fiscal health for countries engaged in strategic technology competition.

Duration and inflation considerations add additional complexity to semiconductor-related government bond analysis. Manufacturing-focused investments typically have long implementation timelines but can contribute to disinflationary pressures once operational through improved productivity and supply chain resilience. Bond investors must therefore balance short-term inflationary pressures from fiscal expansion against longer-term disinflationary effects from increased domestic production capacity.

Equities: Defense, Technology, and Industrial Renaissance

Equity markets reveal perhaps the most direct semiconductor sovereignty impacts, with clear winners and losers emerging across multiple sectors. Defense and cybersecurity companies benefit from increased government spending on technological security, while traditional technology companies face both opportunities from domestic investment and challenges from supply chain restructuring costs.

The defense sector implications extend beyond traditional military contractors to include cybersecurity firms, critical infrastructure providers, and specialized technology companies supporting government semiconductor initiatives. Companies like Lockheed Martin, Raytheon, and Northrop Grumman benefit from increased defense spending on technological capabilities, while cybersecurity specialists gain from heightened focus on protecting semiconductor infrastructure and intellectual property.

Semiconductor equipment manufacturers represent another clear beneficiary category, as multiple nations simultaneously build domestic manufacturing capabilities. Companies like Applied Materials, Lam Research, and KLA Corporation benefit from unprecedented global demand for semiconductor manufacturing equipment, driven by government subsidies rather than traditional market cycles. This demand pattern creates unusually stable revenue visibility for equipment manufacturers while potentially extending traditional industry cycles.

Construction and engineering firms specializing in advanced manufacturing facilities experience exceptional demand as countries race to build domestic semiconductor capabilities. These companies benefit from both direct government contracts and private sector investments incentivized by government subsidies, creating multiple revenue streams from semiconductor-related construction activity.

However, traditional technology companies face more complex dynamics. While domestic production capabilities reduce supply chain risks, the transition period creates higher costs and potential disruptions. Companies heavily dependent on Asian manufacturing must balance short-term cost increases against long-term supply chain security benefits, creating divergent stock performance based on individual companies' supply chain strategies and financial flexibility.

Foreign Exchange: Trade Policy and Capital Flow Disruption

Currency markets reflect semiconductor competition through both direct trade policy impacts and indirect capital flow effects. Countries successfully building competitive semiconductor capabilities attract significant foreign direct investment from multinational companies seeking to benefit from government incentives, while nations falling behind may experience capital outflows as businesses seek more secure supply chain options.

The United States dollar has generally strengthened relative to currencies of countries heavily dependent on semiconductor imports, reflecting both the strategic value of domestic production capabilities and the fiscal strength demonstrated by large-scale technology investments. This dynamic may persist as long as semiconductor competition continues to drive government spending and foreign direct investment toward countries with advanced manufacturing capabilities.

Trade policy considerations add additional complexity to semiconductor-related currency analysis. Countries imposing export restrictions on semiconductor technology or manufacturing equipment may experience short-term current account improvements but longer-term competitive disadvantages that ultimately weaken their currencies. Conversely, countries investing heavily in domestic capabilities may experience short-term current account deterioration but longer-term export growth that supports currency strength.

The emergence of semiconductor-related trade agreements and technology partnerships also creates new currency correlation patterns. Countries participating in semiconductor alliances may experience increased currency correlation as their economies become more closely linked through technology trade and investment flows, while countries excluded from these partnerships may find their currencies increasingly isolated from global technology capital flows.

Commodities: Industrial Metals and Energy Demand

Semiconductor manufacturing requires significant quantities of specialized materials, creating substantial impacts on commodity markets as countries expand domestic production capabilities. Silicon, rare earth elements, and industrial metals like copper and aluminum all experience increased demand from semiconductor facility construction and operation, while energy consumption from chip manufacturing creates additional demand for reliable, clean electricity generation.

The construction phase of semiconductor facility development requires enormous quantities of steel, concrete, and specialized construction materials, creating temporary but significant demand spikes in construction-related commodities. These projects also require sophisticated clean room environments with extensive air filtration and climate control systems, driving demand for specialized HVAC equipment and related materials.

Operational semiconductor manufacturing is exceptionally energy-intensive, with advanced fabrication facilities consuming electricity comparable to small cities. This energy intensity means that countries building domestic semiconductor capabilities must also invest in substantial electrical generation and distribution infrastructure, creating secondary demand for energy-related commodities and equipment.

Water consumption represents another significant commodity consideration, as semiconductor manufacturing requires ultra-pure water in enormous quantities. Countries developing semiconductor capabilities in water-scarce regions may face additional infrastructure investments and resource management challenges that impact regional commodity markets and water rights valuations.

Real Estate: Industrial and Specialized Infrastructure

The semiconductor sovereignty race creates unprecedented demand for specialized industrial real estate, particularly properties suitable for advanced manufacturing facilities. These facilities require unique characteristics including vibration-free foundations, electromagnetic interference shielding, and proximity to reliable utility infrastructure, making suitable locations scarce and valuable.

Geographic clustering effects amplify real estate impacts as semiconductor companies tend to locate near research universities, specialized suppliers, and skilled workforce concentrations. This clustering creates regional real estate booms in areas selected for major semiconductor investments, while potentially reducing demand in regions losing manufacturing capacity to domestic production incentives.

The long-term nature of semiconductor investments also influences real estate valuation models, as these facilities typically operate for decades once constructed. This durability makes semiconductor-related real estate particularly attractive for long-term investors seeking stable, inflation-protected returns, while the specialized nature of the facilities creates potential obsolescence risks if technology standards change significantly.

Conclusion: Navigating the New Semiconductor-Driven Reality

The semiconductor sovereignty race represents more than industrial policy or technological competition—it embodies a fundamental transformation in how nations conceptualize economic security and how markets price geopolitical risk. As we've explored throughout this analysis, the impacts extend far beyond the technology sector itself, creating investment implications across government bonds, equities, currencies, commodities, and real estate markets that will persist for decades.

For investors, this transformation requires abandoning traditional market analysis approaches that separate technological developments from macroeconomic and geopolitical considerations. The semiconductor industry has become so fundamental to modern economic activity that developments in chip manufacturing capabilities directly influence national competitive advantages, trade relationships, and fiscal policies in ways that transcend traditional sector boundaries.

The current phase of semiconductor competition is still in its early stages, with most major government initiatives launched within the past three years and many promised manufacturing facilities still under construction. This timing suggests that the most significant market impacts may lie ahead rather than behind us, as new production capabilities come online and geopolitical tensions continue to influence investment and trade patterns.

Perhaps most importantly, the semiconductor sovereignty race demonstrates how technological competition increasingly drives government policy and market dynamics in the modern economy. Understanding these connections—and their implications across all asset classes—has become essential for investors seeking to navigate an environment where traditional economic relationships are being rewritten by the imperatives of digital sovereignty and technological security.

As we conclude this examination of semiconductor geopolitics, it's clear that tiny microchips have indeed triggered massive market moves, reshaping the global financial landscape in ways that will influence investment decisions for generations to come. The microchip cold war is far from over, and its financial implications will continue to evolve as nations compete for technological supremacy in an increasingly digital world.

This completes Part 7 of our semiconductor industry primer series.

Sources

https://nordicinnovators.com/funding-programmes/eu/european-chips-act/

https://www.insightaceanalytic.com/report/taiwan-semiconductors-market-/1895

https://www.emsnow.com/restructuring-the-global-semiconductor-supply-chain/

https://www.clydeco.com/en/insights/2024/04/u-s-issues-updated-semiconductor-export-controls-a

https://www.mossadams.com/articles/2024/05/notice-of-funding-chips-act

https://www.nist.gov/document/chips-america-fact-sheet-federal-incentives

https://www.hfsresearch.com/research/semiconductor-supply-chain-diversification/

https://www.sciencedirect.com/science/article/pii/S2405844024170053

https://efecs.eu/presentations/09.15-Marco-Ceccarelli-Chips-Fund.pdf

https://www.kotaksecurities.com/investing-guide/articles/the-curious-case-of-india-defence-stocks/

https://www.theindiaforum.in/technology/geopolitical-limits-indias-semiconductor-ambitions

https://bisresearch.com/industry-report/semiconductor-cybersecurity-market.html

https://thevoltpost.com/taiwan-semiconductor-strategic-policy-2025/