The Hidden Empire: How Ukraine's Gas and China's Metals Hold Silicon Valley Hostage

Strategic Resource Scarcity Reshapes Global Investment Paradigms

In the shadowy world of semiconductor manufacturing, a few grams of Ukrainian neon gas can shut down a $50 billion chip fabrication facility, while a Chinese embargo on gallium can send shockwaves through trillion-dollar technology giants. The semiconductor industry, projected to reach $697 billion in 2025, operates on a foundation more fragile than glass—dependent on a constellation of strategic materials so specialized and geographically concentrated that they've become the ultimate leverage points in modern geopolitical warfare. This is the untold story of how invisible elements buried deep in the periodic table have emerged as the puppet strings controlling the global economy.

This article is Part 4 of our comprehensive semiconductor industry primer series. For the complete journey from silicon wafer to geopolitical weapon, explore our previous installments:

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

The Foundation: Critical Materials and Their Vulnerabilities

The modern semiconductor exists at the intersection of physics and geopolitics, where the properties of exotic materials determine not just technological capability but national security. Silicon, the industry's namesake, represents merely the foundation of a complex material ecosystem that extends far beyond the basic wafer. The true power lies in the rare elements that enable the quantum mechanical properties essential for advanced computing—materials so scarce and specialized that their supply chains have become pressure points for entire nations.

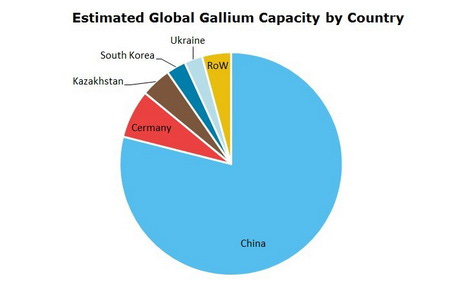

Gallium stands as perhaps the most strategically significant of these materials, essential for creating gallium arsenide (GaAs) and gallium nitride (GaN) compounds that enable faster electron mobility and higher power efficiency in semiconductors. China's decision in December 2024 to ban exports of gallium, germanium, and antimony to the United States marked a watershed moment in resource-based economic warfare, demonstrating how control over these materials translates directly into technological leverage. The implications ripple far beyond immediate supply disruptions, fundamentally altering the risk profile of every technology company dependent on advanced chip architectures.

The neon gas crisis presents an even more dramatic illustration of supply chain vulnerability. Ukraine and Russia collectively controlled 70% of the global supply of semiconductor-grade neon gas, essential for the excimer lasers used in photolithography. When Russian forces intensified their attack on Ukraine in 2022, two Ukrainian companies that supplied 45% to 54% of the world's semiconductor-grade neon halted production entirely. The gas, a byproduct of steel production, cannot be easily replaced or quickly sourced elsewhere, creating a bottleneck that threatens the entire industry's production capacity.

Palladium, another critical component in semiconductor manufacturing equipment, faces similar geographical concentration risks with Russia serving as a major supplier. The metal's unique properties in catalytic processes and electrical contacts make it irreplaceable in certain manufacturing steps, yet its supply remains hostage to geopolitical tensions that can erupt without warning. These material dependencies create a complex web of vulnerabilities that no amount of technological sophistication can fully mitigate.

The EUV Revolution and Material Innovation

Extreme ultraviolet lithography represents the cutting edge of semiconductor manufacturing, enabling the creation of transistors at the 5nm and 3nm process nodes that power artificial intelligence and high-performance computing. The EUV photomask market, while relatively small in absolute terms, exhibits extraordinary growth rates of approximately 25% annually as manufacturers transition from older 193nm immersion lithography techniques.

EUV photomasks require materials and manufacturing precision that push the boundaries of current technology. The masks themselves must be defect-free at atomic scales, as any imperfection becomes magnified in the final chip design. Key players including Toppan Photomasks, Dai Nippon Printing Co., Photronics, and Hoya invest heavily in research and development to improve defect control and reduce costs, but the technological barriers remain formidable. High-numerical-aperture EUV lithography, the next evolutionary step, demands even more advanced materials and manufacturing techniques, further concentrating the industry among a handful of capable suppliers.

The geographic concentration of EUV photomask production in Asia-Pacific, particularly in regions with established semiconductor fabrication plants, creates additional supply chain vulnerabilities. The high cost of EUV lithography equipment and the intricate manufacturing processes create significant barriers to entry for new players, effectively limiting the global supply base to existing manufacturers who can afford the substantial capital investments required. This concentration amplifies the strategic importance of maintaining stable relationships with Asian suppliers and protecting the shipping lanes that connect manufacturing centers.

Multi-Asset Implications: Navigating the Resource Wars

Commodities and Physical Assets

The semiconductor industry's material dependencies create compelling investment opportunities across commodity markets, though the complexity of these supply chains demands sophisticated analysis. Gallium and germanium, now subject to Chinese export restrictions, trade in specialized markets where pricing can be extremely volatile due to limited supply sources and inelastic demand. Investors seeking exposure to these materials must navigate thin markets with significant bid-ask spreads and potential liquidity constraints during crisis periods.

Palladium futures offer more liquid exposure to semiconductor supply chain tensions, though the metal's dual role in automotive catalytic converters complicates price dynamics. The Russia-Ukraine conflict's impact on both neon and palladium supplies demonstrates how geopolitical events can create sharp price movements that benefit properly positioned commodity investors. Physical storage of these materials presents unique challenges, as semiconductor-grade purity requirements exceed typical commodity storage standards, limiting practical investment options for most institutional investors.

Rare earth elements, while not directly mentioned in semiconductor manufacturing processes, play crucial roles in the broader electronics ecosystem and offer diversified exposure to technology supply chain tensions. China's dominance in rare earth processing creates similar monopoly dynamics to those observed with gallium and germanium, suggesting that rare earth miners outside China could benefit from diversification efforts. The lengthy development timelines for new mining projects, however, mean that supply responses to price signals occur over years rather than months.

Equity Market Dynamics

Mining companies with exposure to semiconductor-critical materials offer leveraged plays on supply chain diversification trends. Western mining firms developing gallium and germanium production capabilities could experience significant multiple expansion as customers prioritize supply security over cost optimization. The challenge for equity investors lies in identifying companies with genuine production capabilities rather than exploratory projects that may never reach commercial viability.

Technology equipment manufacturers face a complex risk-reward profile as material costs fluctuate. Companies with strong supplier relationships and long-term contracts may outperform during supply disruptions, while those dependent on spot markets could face margin compression. The capital-intensive nature of semiconductor equipment manufacturing means that material cost increases cannot be quickly passed through to customers, creating temporary margin pressure that sophisticated investors can exploit through tactical positioning.

Semiconductor manufacturers themselves present the most direct equity exposure to material supply chain risks, though their size and diversification often dampen the impact of specific material shortages. Smaller, specialized chip companies with concentrated supplier bases offer more pure-play exposure to supply chain dynamics, but require careful analysis of individual supplier relationships and inventory management practices.

Fixed Income and Credit Markets

The semiconductor industry's capital intensity and long investment cycles create interesting dynamics in credit markets. Companies undertaking major capacity expansion projects, such as the $185 billion in capital expenditures planned for 2025, often rely heavily on debt financing. Material supply chain disruptions can delay these projects and strain cash flows, creating opportunities for credit investors who can accurately assess supply chain resilience.

Commodity-backed bonds and structured products linked to semiconductor materials offer institutional investors direct exposure to price volatility while providing yield enhancement. These instruments require sophisticated modeling of supply and demand dynamics, particularly given the thin markets and lumpy demand patterns characteristic of semiconductor materials. The correlation between material prices and broader semiconductor cycles creates additional complexity for credit analysis.

High-yield bonds from mining companies developing strategic material projects present asymmetric risk-reward profiles. Successful projects can generate substantial cash flows due to limited competition, while failed developments can result in total losses. The geopolitical premium embedded in projects located in stable jurisdictions adds another layer of complexity to credit analysis.

Structured Products and Derivatives

Long-duration commodity futures provide sophisticated investors with exposure to strategic material price trends while avoiding the operational complexities of physical ownership. The thin nature of many semiconductor material markets means that futures curves often exhibit significant contango or backwardation, creating opportunities for roll yield capture or calendar spread trading.

Structured derivatives linked to semiconductor supply chain indices offer institutional investors diversified exposure to the complex web of materials and suppliers. These products typically combine exposure to multiple commodities, logistics costs, and equity performance of key suppliers, providing a more comprehensive hedge against supply chain disruptions than single-commodity exposure.

Currency derivatives become particularly relevant given the geographic concentration of material supplies. The Chinese yuan's performance relative to the dollar directly impacts the economics of gallium and germanium sourcing, while the Ukrainian hryvnia's stability affects neon gas pricing. Multi-currency structured products can provide hedging for companies with significant material exposure while offering speculative opportunities for macro-oriented investors.

Conclusion: The New Resource Reality

The semiconductor industry's dependence on strategically critical materials has fundamentally altered the global investment landscape, transforming obscure elements and specialized chemicals into geopolitical weapons with trillion-dollar implications. Ukraine's neon gas and China's gallium exports now wield more market influence than traditional commodity powerhouses, while the precision requirements of advanced manufacturing create new categories of strategic assets that investors must understand and navigate.

The multi-asset implications of this resource concentration extend far beyond commodity markets, influencing equity valuations, credit spreads, currency relationships, and thematic investment flows. As the industry races toward $1 trillion in annual revenue, driven by artificial intelligence and advanced computing demands, the underlying material dependencies become increasingly critical to investment success5. The companies and nations that control these invisible empires of strategic materials will ultimately determine not just technological progress, but the distribution of economic power in the digital age.

For investors, the challenge lies not in predicting which specific materials will next become leverage points in global trade wars, but in building portfolios resilient to supply chain disruptions while positioned to benefit from the inevitable diversification efforts. The semiconductor industry's growth story remains compelling, but it now comes with a new category of risk that smart money cannot afford to ignore. In this hidden empire of strategic materials, those who understand the periodic table may ultimately outperform those who merely understand the market.

Sources

https://www.datainsightsmarket.com/reports/euv-photomasks-1648019

https://www.infosys.com/iki/research/semiconductor-industry-outlook2025.html

https://www.recyclingtoday.com/news/navigating-the-cobalt-supply-chain/

https://discoveryalert.com.au/news/tungsten-supply-chain-crisis-2025-disruptions-opportunities/

https://www.vaneck.com/us/en/investments/rare-earth-strategic-metals-etf-remx/

https://www.linkedin.com/pulse/indias-semiconductor-story-quietly-taking-shape-2025-joyjit-ga3jc

https://www.techinsights.com/blog/five-key-trends-power-semiconductors-2025

https://newsroom.lamresearch.com/moly-replacing-tungsten-semiconductors

https://www.smallcase.com/collections/what-are-semiconductor-stocks/

https://www.tickertape.in/blog/semiconductor-stocks-in-india/

https://www.atacarnet.in/blank/Valens-Semiconductor-Ltd.-Equity-Warrant-Stock-Analysis-and-Forecast

https://www.obermatt.com/en/index/rare-earth/top-10-stocks-2025-05-29-f836b749.html

https://www.industryarc.com/Report/16456/polysilicon-market.html

https://www.linkedin.com/pulse/comprehensive-outlook-polysilicon-semiconductor-market-sau3c

https://www.religareonline.com/knowledge-centre/commodities/commodity-derivatives/

https://www.investopedia.com/articles/optioninvestor/06/goldsilverfutures.asp

https://simcona.com/blog/electronic-component-shortages-adapt-supply-chain

https://cset.georgetown.edu/publication/china-rare-earth-export-ban/

https://www.itia.info/wp-content/uploads/2024/06/ITIA_TIIC_29052024.pdf

https://www.linkedin.com/pulse/tungsten-supply-crisis-threatens-defense-tech-industries-kuegc

https://www.responsiblemineralsinitiative.org/minerals-due-diligence/tungsten/

https://www.nerdwallet.com/article/investing/best-semiconductor-stocks

https://www.equitymaster.com/stockquotes/semicondt/list-of-semiconductor-sector

https://aliceblueonline.com/antiq/beginner/commodity-derivatives/