The $697 Billion Semiconductor Empire: How AI Titans Are Reshaping Global Markets

How AI’s Insatiable Demand for Chips Is Rewiring Global Markets and Capital Flows in 2025

The semiconductor industry stands at an unprecedented inflection point in 2025, with artificial intelligence demand catalyzing a fundamental restructuring of global supply chains, manufacturing capabilities, and investment flows. The industry is projected to reach approximately $697 billion in 2025, marking an 11% year-over-year increase, while foundries alone are expected to achieve 20% revenue growth driven by insatiable AI chip demand. This transformation extends far beyond technology metrics, creating seismic shifts in asset allocations, geographic risk premiums, and sectoral valuations that sophisticated investors cannot afford to ignore. From Taiwan's TSMC commanding premium multiples on advanced node monopolies to memory manufacturers experiencing dramatic margin expansions amid tight supply conditions, the semiconductor value chain presents both concentrated opportunities and systemic risks that ripple through global markets.

The New Semiconductor Paradigm

Part 6 of our comprehensive semiconductor series -

Semiconductors A-Z: Order of Posts

Semiconductors are the invisible foundation of the modern world. From powering smartphones and laptops to enabling artificial intelligence, electric vehicles, and national defense systems, these tiny silicon-based components have quietly become the most strategically valuable resources of the 21st century. Yet despite their importance, the semiconductor…

The year 2025 has ushered in what can only be described as the semiconductor industry's most dramatic transformation since the PC revolution of the 1980s. Unlike previous technology cycles driven by consumer adoption curves, the current upheaval stems from artificial intelligence's voracious appetite for computational power, fundamentally altering demand patterns, supply chain dynamics, and market valuations across the entire ecosystem.

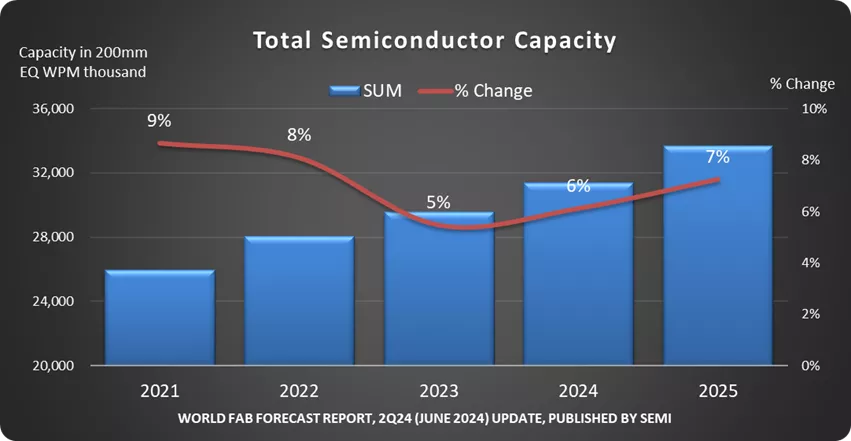

The numbers tell a compelling story of an industry in hypergrowth mode. Semiconductor companies are projected to allocate approximately $185 billion to capital expenditures in 2025, expanding global manufacturing capacity by 7% to meet surging demand. High-bandwidth memory (HBM) demand alone grew by 150% in 2023, over 200% in 2024, and is projected to expand by another 70% in 2025. This isn't merely a cyclical upturn; it represents a structural shift in how digital infrastructure operates, with profound implications for asset managers, institutional investors, and anyone seeking to understand where capital flows will concentrate in the coming decade.

The geographic concentration of semiconductor capabilities has created unique investment dynamics. Taiwan's dominance in advanced chip manufacturing, the Netherlands' monopoly on extreme ultraviolet lithography equipment, and South Korea's leadership in memory production have transformed these markets from regional plays into global systemic risks. When TSMC's utilization rates fluctuate or ASML's guidance shifts, the reverberations extend far beyond technology indices, influencing currency markets, sovereign bond spreads, and even geopolitical risk assessments.

The Great AI-Driven Expansion of 2025

The semiconductor industry's recovery from the 2022-2023 downturn has exceeded most analysts' expectations, driven primarily by artificial intelligence applications across data centers and edge computing. After experiencing widespread negative operating margins and capital expenditure cuts during the inventory surplus period, the sector has emerged with renewed strength and pricing power. The foundry industry wrapped up 2024 with an impressive 22% year-over-year growth, marking a strong recovery phase that has continued into 2025.

This expansion differs qualitatively from previous semiconductor cycles. Rather than broad-based demand across consumer electronics, automotive, and industrial applications, growth is concentrated in specific high-value segments. AI-driven demand has created a hierarchy within the industry, where companies positioned in advanced nodes, high-bandwidth memory, and specialized packaging technologies command premium valuations and margins. Leading-edge nodes including 3nm and 5/4nm maintain strong utilization rates in 2025, while mature node recovery remains sluggish due to weak cyclical demand in traditional applications.

The capital intensity of this expansion cannot be overstated. The transition to 3nm and 2nm process nodes requires unprecedented investments in fabrication facilities, with some estimates suggesting individual fab construction costs exceeding $20 billion. This capital requirement has accelerated industry consolidation while creating significant barriers to entry, fundamentally altering competitive dynamics and market structure.

Industry Titans and Their Strategic Domains

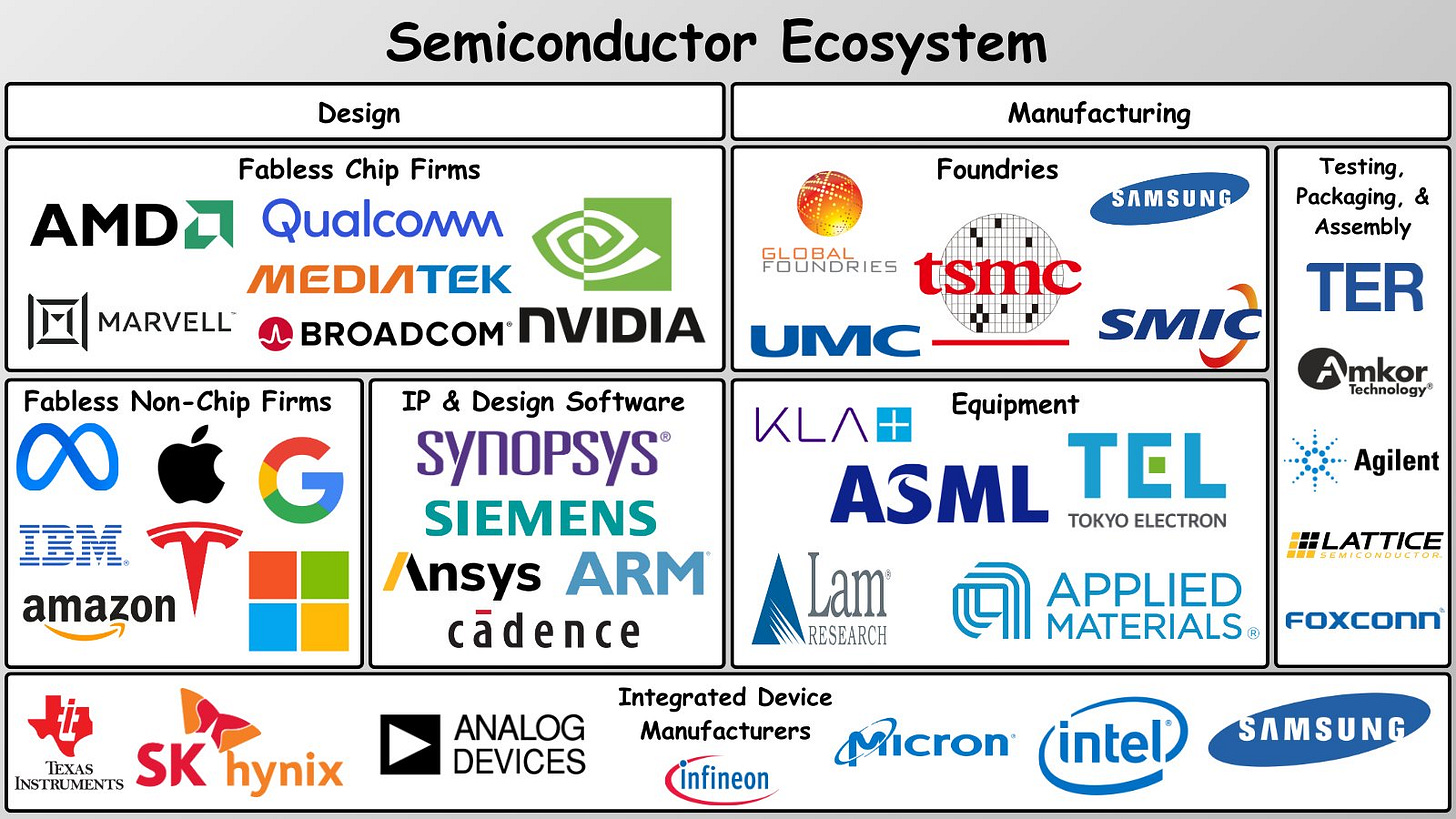

The Fabless Innovators: Design Without Manufacturing

The fabless semiconductor model has emerged as perhaps the most profitable segment of the industry, with companies like NVIDIA, Apple, and Qualcomm capturing enormous value through design expertise while outsourcing manufacturing to foundries. NVIDIA's position in AI accelerators has transformed it from a graphics chip company into the de facto standard for machine learning infrastructure, commanding gross margins that would be impossible in traditional integrated device manufacturing models.

Apple's semiconductor strategy exemplifies the fabless approach's strategic advantages. By designing custom silicon for its devices while leveraging TSMC's manufacturing capabilities, Apple has achieved both performance differentiation and cost optimization. This model allows companies to focus capital on research and development rather than fabrication facilities, creating more attractive return profiles for equity investors while generating substantial intellectual property moats.

Qualcomm's dominance in mobile processors and emerging leadership in automotive semiconductors demonstrates how fabless companies can achieve market leadership across multiple end markets. The company's licensing model creates recurring revenue streams that provide stability during cyclical downturns, making fabless stocks particularly attractive to income-focused investors seeking technology exposure with dividend characteristics.

Foundry Powerhouses: The Manufacturing Backbone

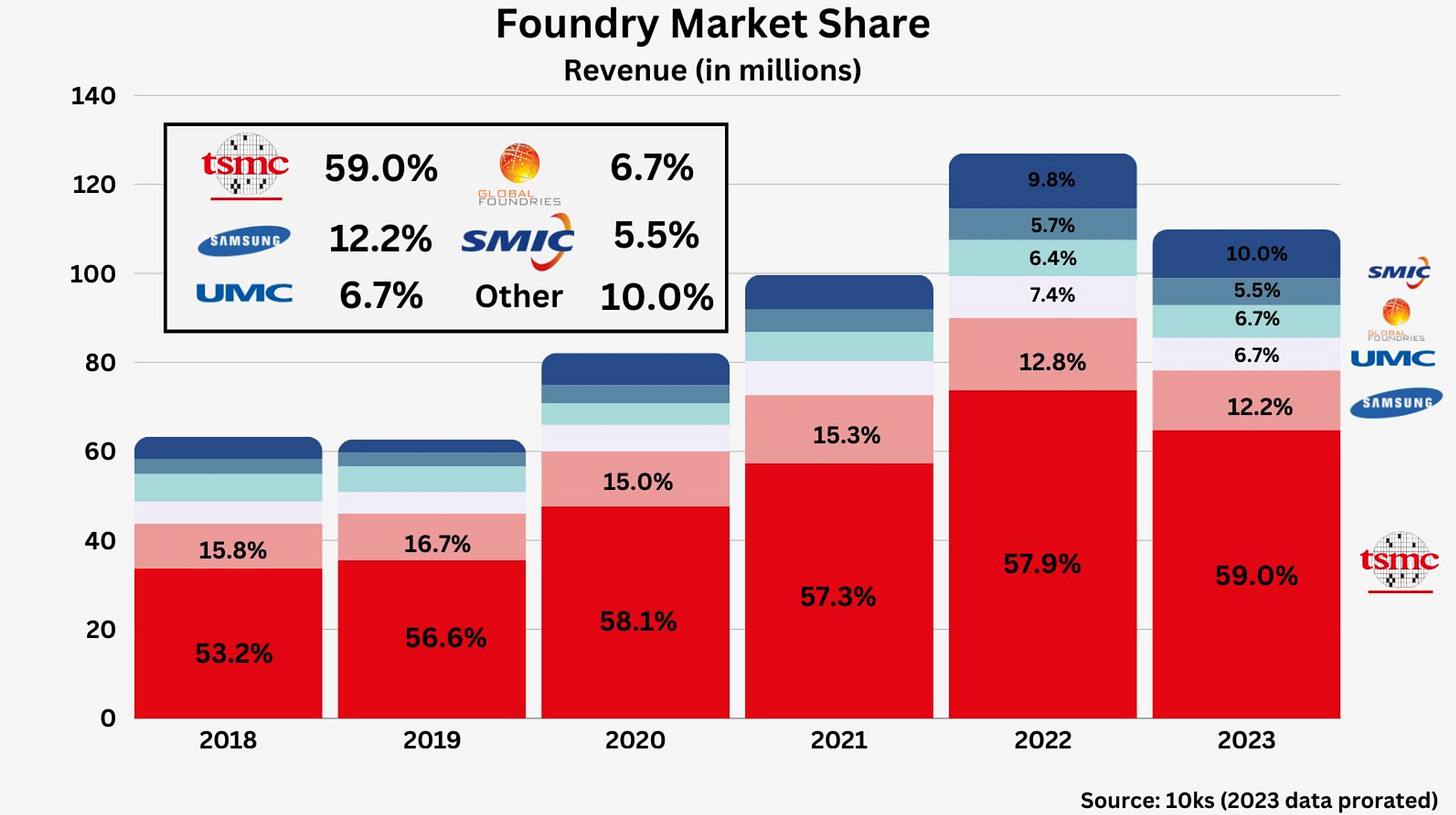

Taiwan Semiconductor Manufacturing Company (TSMC) stands as the industry's most strategically important entity, commanding approximately 54% of global foundry market share and virtually monopolizing advanced node production below 7nm. The company's technological leadership in 3nm and 2nm processes has created a concentration risk that extends far beyond individual investment portfolios, influencing global technology competitiveness and geopolitical dynamics6.

Samsung's foundry operations represent the primary challenge to TSMC's dominance, though the South Korean company faces significant technological gaps in advanced node yields and manufacturing efficiency. Intel's foundry ambitions through its IDM 2.0 strategy add another dimension to competitive dynamics, though the company's success remains uncertain given its historical focus on internal production rather than contract manufacturing.

The foundry industry's utilization patterns reveal critical insights into demand sustainability. While leading-edge nodes maintain robust utilization driven by AI demand, mature node utilization recovery has been sluggish, suggesting a bifurcated market where technological leadership commands premium pricing while commodity manufacturing faces margin pressure2.

Equipment Giants: The Enablers of Progress

ASML's position as the sole supplier of extreme ultraviolet (EUV) lithography equipment creates perhaps the most concentrated chokepoint in the global technology supply chain. The Dutch company's machines, costing upwards of $200 million each, are essential for producing advanced semiconductors, making ASML's performance a leading indicator for industry capital expenditure trends3.

Despite slower-than-expected demand in 2024, ASML is positioned for acceleration in sales growth during 2025, with revenue expectations ranging between €30 billion and €35 billion, indicating growth of 7% to 25%. This wide guidance range reflects uncertainty about customer capital expenditure timing rather than fundamental demand destruction, as semiconductor manufacturers cannot achieve advanced node production without ASML's equipment.

Applied Materials' second quarter 2025 results demonstrate the equipment sector's recovery momentum, with 7% year-over-year revenue growth and record earnings per share4. The company's broad capabilities across deposition, etch, and inspection equipment provide exposure to multiple semiconductor manufacturing steps, creating more diversified revenue streams than single-process specialists.

Memory Market Dynamics: From Surplus to Scarcity

The memory market's transformation from oversupply to constrained capacity exemplifies the semiconductor industry's cyclical nature amplified by AI demand. Total memory market revenue is expected to surpass $250 billion by 2025, driven by high-bandwidth memory requirements for AI applications and datacenter infrastructure upgrades.

The shift toward HBM production has created supply constraints for traditional DRAM products, as suppliers face a 4:1 bit tradeoff between HBM and DDR5 production. This dynamic has tightened the DRAM market significantly, supporting stable revenue growth and margin expansion for manufacturers like Micron and SK Hynix5. NAND suppliers are similarly benefiting from datacenter adoption of high-capacity SSDs, with 30TB and 60TB drives becoming standard for AI workloads requiring efficient data storage.

Memory manufacturers' capital allocation strategies reflect this demand shift, with investments heavily concentrated on HBM production capabilities and high-density storage solutions. This focus on premium products has improved the sector's profit profile while creating potential supply bottlenecks in traditional memory markets.

Geographic Power Centers and Market Implications

The semiconductor industry's geographic concentration creates unique investment opportunities and risks that extend far beyond technology sector allocations. Taiwan's position as the global leader in advanced chip manufacturing makes the Taiwan Weighted Index essentially a leveraged play on global technology demand, while also concentrating geopolitical risk in ways that traditional portfolio diversification cannot mitigate.

The United States maintains leadership in chip design and equipment manufacturing, with companies like Intel, NVIDIA, AMD, and Qualcomm driving innovation while firms like Applied Materials and Lam Research provide critical manufacturing tools. This positioning creates complex trade relationships where U.S. intellectual property enables Asian manufacturing, generating revenue streams that flow across borders in ways that complicate traditional economic analysis.

South Korea's dominance in memory production through Samsung and SK Hynix creates a direct linkage between Korean equity markets and global memory pricing cycles. The Korean won's performance often correlates with memory spot prices, creating currency overlay opportunities for sophisticated investors capable of parsing supply and demand fundamentals6.

The Netherlands' unique position through ASML's EUV monopoly has transformed a relatively small European economy into a critical node in global technology infrastructure. Dutch equity markets and the euro's performance increasingly reflect semiconductor capital expenditure cycles, creating opportunities for macro investors to express technology views through European assets6.

Multi-Asset Implications: A Comprehensive Investment Framework

Equity Markets: Sectoral Rotation and Geographic Arbitrage

The semiconductor industry's transformation creates multiple layers of equity market opportunities that extend far beyond traditional technology sector analysis. Semiconductor-focused ETFs have experienced dramatic performance divergence based on their underlying exposure to different industry segments. Funds with heavy foundry weightings, particularly those exposed to TSMC, have outperformed broad technology indices, while equipment-focused ETFs have shown higher volatility reflecting capital expenditure timing uncertainty.

Geographic equity arbitrage opportunities have emerged from the industry's concentration patterns. Taiwan's equity market trades at a significant premium to regional peers when measured against semiconductor cycle indicators, suggesting that investors are paying up for foundry exposure despite geopolitical risks. Conversely, European markets with semiconductor exposure, particularly those including ASML and Infineon, may offer relative value given their critical positions in the global supply chain without the geopolitical risk premiums embedded in Asian markets.

Active equity managers are increasingly implementing sector rotation strategies based on semiconductor cycle positioning. Fabless companies typically outperform during demand acceleration phases due to their asset-light models and pricing power, while equipment manufacturers often lag due to customer capital expenditure timing. Memory manufacturers exhibit the highest cyclical volatility, creating opportunities for managers capable of timing capacity and pricing cycles.

Fixed Income: Credit Quality and Currency Considerations

The semiconductor industry's capital intensity creates distinct credit market opportunities across different industry segments. Foundry operators like TSMC command investment-grade ratings despite massive capital expenditure requirements due to their strategic positioning and cash generation capabilities. These credits often trade tighter than sovereign bonds from their home countries, reflecting the market's assessment of their systemic importance and competitive moats.

Equipment manufacturers present more complex credit profiles, with companies like ASML exhibiting strong balance sheets but facing customer concentration risks. Applied Materials' recent results demonstrate the sector's ability to generate substantial cash flows during expansion cycles, supporting credit quality even amid heavy research and development spending4. Memory manufacturers historically exhibit the most volatile credit metrics due to their exposure to commodity pricing cycles, though current tight supply conditions have improved their fundamental credit profiles significantly.

Currency markets increasingly reflect semiconductor industry dynamics, particularly in economies with concentrated exposure to chip manufacturing. The Taiwan dollar's performance correlates strongly with semiconductor capital expenditure cycles, as foundry investments drive foreign direct investment flows. The Korean won exhibits similar sensitivity to memory pricing cycles, creating opportunities for currency overlay strategies based on memory market fundamentals.

Commodities and Materials: The Physical Infrastructure

The semiconductor industry's expansion has created substantial demand for specialized materials and commodities that extend far beyond traditional technology inputs. Silicon wafer demand has tightened significantly as foundries expand capacity, creating opportunities in specialized materials companies that supply ultra-pure silicon ingots. Rare earth elements required for advanced chip packaging have experienced price volatility as supply chains adapt to increased demand from AI applications.

Energy commodities face complex impacts from semiconductor manufacturing expansion. While chip fabrication requires enormous electricity consumption, creating incremental demand for power generation, the efficiency improvements in AI chips relative to traditional computing architectures may ultimately reduce total energy consumption per computational unit. This dynamic creates both short-term bullish and long-term bearish scenarios for power markets depending on adoption timing.

Water resources present an often-overlooked constraint on semiconductor manufacturing expansion. Advanced chip production requires substantial ultra-pure water supplies, making water rights and treatment technologies increasingly valuable in regions with significant foundry operations. This creates opportunities in water infrastructure investments that indirectly benefit from semiconductor industry growth.

Alternative Investments: Private Equity and Real Estate

The semiconductor industry's transformation has created substantial opportunities in alternative investment strategies that traditional public market exposure cannot access. Private equity firms are increasingly targeting semiconductor intellectual property licensing opportunities, acquiring patent portfolios from companies seeking to monetize research and development investments without operational complexity.

Real estate investment trusts focused on data center properties have become indirect beneficiaries of semiconductor industry growth, as AI chip demand drives hyperscale data center construction. These REITs often provide more stable income streams than direct semiconductor equity exposure while maintaining correlation to industry growth trends.

Venture capital and growth equity strategies focused on semiconductor startups present high-risk, high-reward opportunities as the industry's technological complexity creates numerous niche specialization opportunities. Edge AI chip designers, specialized memory controllers, and novel packaging technologies represent areas where small companies can achieve significant market positions before potential acquisition by industry giants.

Risk Management and Portfolio Construction Considerations

The semiconductor industry's concentration risks require sophisticated portfolio construction approaches that extend beyond traditional sector allocation frameworks. Geographic concentration in Taiwan and South Korea creates systematic risks that cannot be diversified through traditional global equity allocations. Political risk insurance and currency hedging strategies become essential components of semiconductor-focused investment approaches.

Supply chain disruption risks have evolved beyond traditional operational concerns to encompass geopolitical tensions, natural disasters, and technological obsolescence. The industry's just-in-time manufacturing approaches and long lead times for specialized equipment create vulnerability to disruption that can cascade through global technology markets. Portfolio managers must consider these tail risks when sizing semiconductor positions within broader technology allocations.

Technological disruption represents both opportunity and risk within semiconductor investing. While AI demand currently drives growth, emerging technologies like quantum computing, neuromorphic chips, or entirely new computing paradigms could obsolete current semiconductor architectures. Maintaining exposure to research and development intensive companies while avoiding overconcentration in any single technological approach becomes critical for long-term performance.

Conclusion: Navigating the Semiconductor Investment Landscape

The semiconductor industry's evolution into a $697 billion ecosystem driven by artificial intelligence demand has created investment opportunities that extend far beyond traditional technology sector analysis. The concentration of capabilities across geographic regions and specialized companies has transformed semiconductor investing into a complex web of geographic, currency, commodity, and sector-specific considerations that require sophisticated analytical frameworks to navigate successfully.

The multi-asset implications of semiconductor industry developments will likely intensify as AI adoption accelerates and geopolitical tensions around technology access continue evolving. Investors who can successfully parse the industry's complex value chains, understand the strategic implications of capacity constraints, and position across asset classes to capture both growth opportunities and hedging requirements will likely outperform those relying on traditional sector allocation approaches.

As this series on the semiconductor industry demonstrates, understanding the technical, economic, and geopolitical dimensions of chip manufacturing has become essential for modern portfolio management. The industry's role as the foundation of digital infrastructure ensures that semiconductor dynamics will continue influencing global markets in ways that extend far beyond technology stock performance, making deep industry knowledge an increasingly valuable component of investment success.

The coming quarters will test whether current valuations and supply-demand dynamics can sustain the industry's growth trajectory, but the fundamental drivers of AI adoption and digital transformation suggest that semiconductor industry developments will remain central to global investment themes for the foreseeable future. Investors who can successfully navigate this complexity while managing the associated risks will likely find substantial opportunities in this critical sector of the global economy.

Sources

https://www.infosys.com/iki/research/semiconductor-industry-outlook2025.html

https://www.techinsights.com/blog/memory-market-outlook-ai-demand-and-tight-supply-drive-resurgence

https://currentaffairs.adda247.com/top-10-countries-dominating-the-semiconductor-industry-in-2025/

https://money.usnews.com/investing/articles/best-semiconductor-etfs-to-buy

https://en.wikipedia.org/wiki/Semiconductor_industry_in_Taiwan

https://www.welcome-to-nl.nl/semiconductor-industry-netherlands

https://www.ceicdata.com/en/indicator/taiwan/short-term-government-bond-yield

https://www.techinsights.com/blog/five-key-trends-power-semiconductors-2025

https://worldpopulationreview.com/country-rankings/semiconductor-manufacturing-by-country

https://www.nasdaq.com/articles/silicon-motion:-the-markets-best-merger-arbitrage-opportunity

https://www.idaireland.in/latest-news/insights/semiconductor-industry-outlook

https://www.startus-insights.com/innovators-guide/semiconductors-trends-innovation/

https://www.nerdwallet.com/article/investing/best-semiconductor-stocks

https://epic-photonics.com/news-media/april-2025-mergers-acquisitions-and-investment-highlights/

https://www.allaboutcircuits.com/news/business-deals-already-firing-up-semiconductor-industry-2025/

https://techxplore.com/news/2025-06-tsmc-profit-soaring-ai-demand.html

https://www.nasdaq.com/articles/prediction-taiwan-semiconductor-stock-could-surge-129-next-5-years

https://www.manufacturingdive.com/news/tsmc-earnings-q1-2025-tariffs-trump/745828/

https://www.mordorintelligence.com/industry-reports/semiconductor-industry-landscape

https://www.linkedin.com/pulse/semiconductor-industry-trends-2025-innovations-market-banafa-wwmec

https://www.microchipusa.com/industry-news/important-semiconductor-industry-acquisitions

https://topnews.in/tsmc-stock-price-remains-down-despite-strong-q1-2025-and-bullish-outlook-2417096

https://www.mexem.com/blog/asml-stock-drops-as-2025-forecast-sparks-market-rout

https://www.eerstekamer.nl/overig/20230619/dutch_semiconductor_industry_value/document

https://in.investing.com/rates-bonds/taiwan-10-year-bond-yield

https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-first-quarter-fiscal-2026

https://www.cnbc.com/2025/03/20/micron-mu-q2-earnings-2025.html

https://www.techmonitor.ai/hardware/silicon/sk-hynix-q1-2025-earnings-ai-chips-tariffs

https://markets.ft.com/data/equities/tearsheet/summary?s=ASML%3AAEX

https://investors.micron.com/static-files/df96216e-3e07-4b97-a4ef-df0a5fa684d6

https://news.skhynix.com/sk-hynix-announces-1q25-financial-results/