Rare Earth Shockwave: China's Covert Moves to Seize Global Supply

How China's Stealth Policy Shifts in Rare Earth Exports Are Triggering Market Upheaval and Reshaping Global Industries

In a dramatic move that sent shockwaves through global markets, China has begun implementing subtle yet decisive changes in its rare earth export policies—shifts that promise to upend supply chains and dramatically alter pricing dynamics. For instance, recent market data shows that neodymium is now trading at approximately $92 per kilogram, while dysprosium has surged to nearly $340 per kilogram over the past 18 months. These staggering figures, combined with a reported 10% reduction in production quotas, have intensified concerns among international buyers and investors. In a bid to consolidate its strategic grip, Beijing has tightened export licensing and increased state stockpiling, signaling its readiness to weaponize rare earth resources in geopolitical disputes. This article explores how these covert policy tweaks are reshaping the landscape for commodities, equities, and fixed-income assets—providing a clear warning to competitors and an urgent call for diversification among global supply chains.

Why Rare Earth Matters

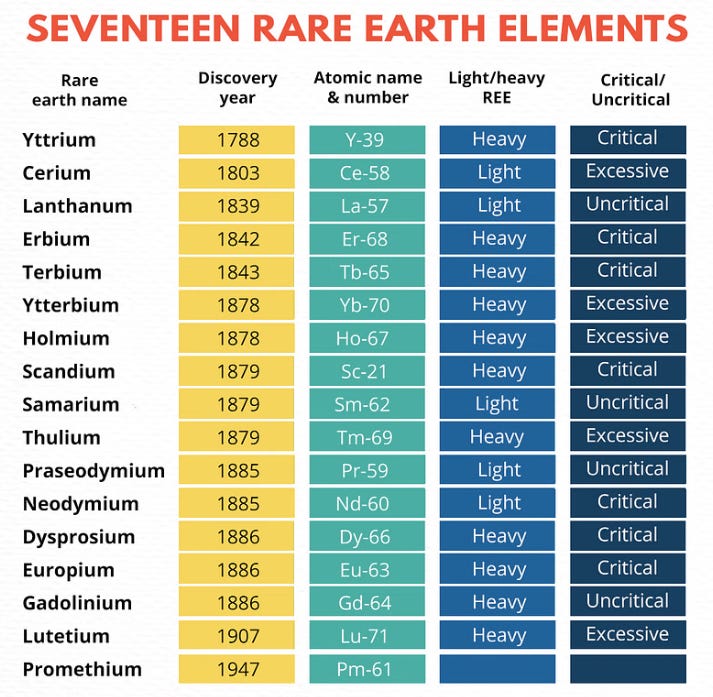

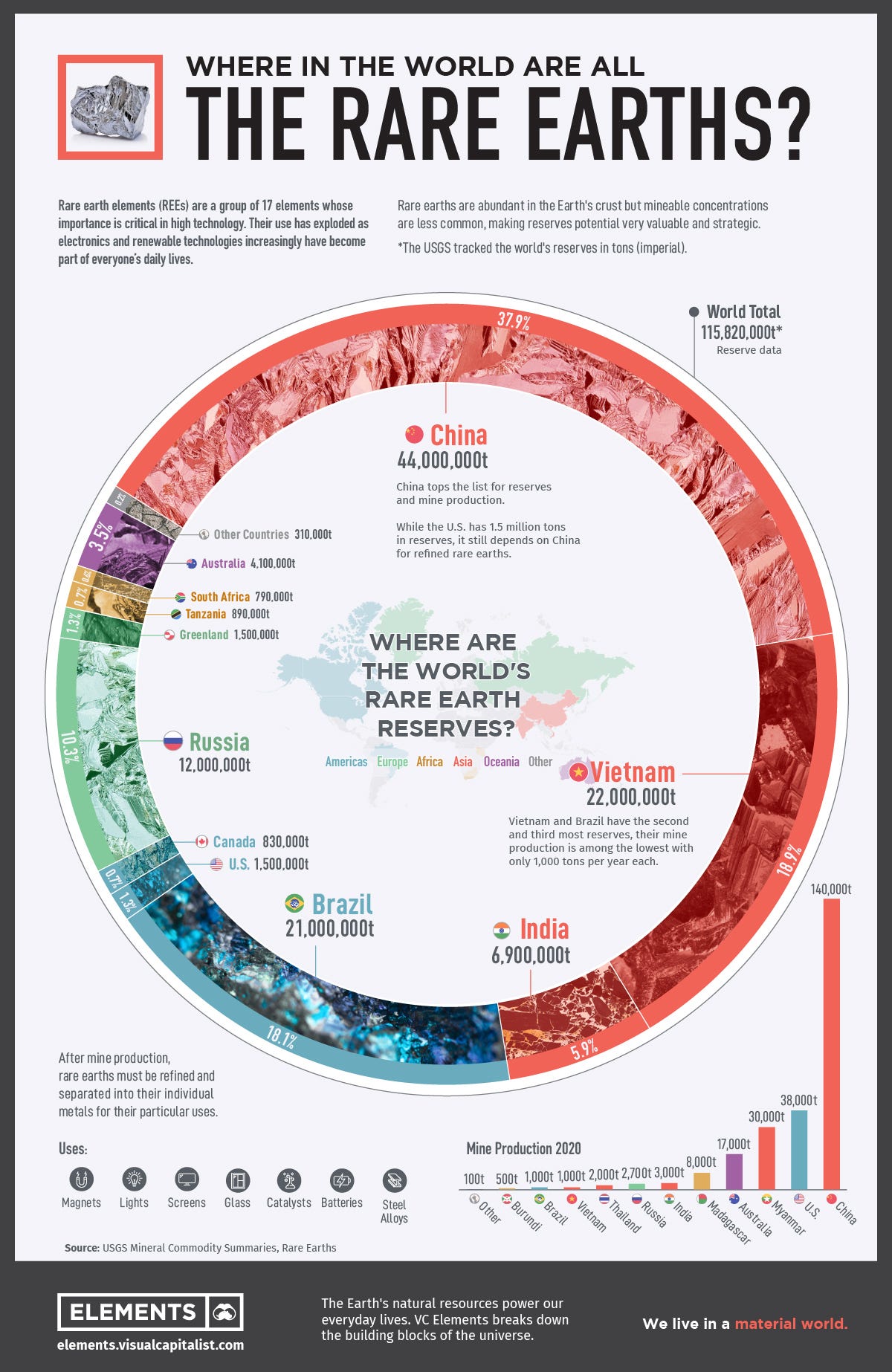

Rare earth elements (REEs) are indispensable to modern technology and national security, despite their misleading name. Unlike most minerals, REEs are not necessarily scarce in the Earth's crust; however, they rarely occur in concentrations that can be economically exploited, which makes their extraction and processing both complex and costly. These elements underpin a wide array of critical applications—from the powerful permanent magnets used in wind turbines and electric vehicle motors to advanced materials in smartphones, defense systems, and high-performance computing.

The strategic importance of rare earths extends into national security as well. They are essential for the production of precision-guided munitions, radar systems, and other military hardware. A disruption in the supply of these elements can therefore have cascading effects, potentially crippling both civilian high-tech industries and defense capabilities. Furthermore, given that a significant portion of the global supply is controlled by a single country, any shifts in export policies or production quotas can lead to volatile price swings and supply chain uncertainties worldwide.

In essence, rare earths are the unsung heroes of our modern industrial landscape—critical to driving the energy transition, advancing technological innovation, and securing national defense. Understanding their importance is the first step in assessing the broader market and geopolitical implications of policy shifts in this sector.

China’s Policy Shifts: A Closer Examination

Rather than imposing overt bans or sweeping trade restrictions, China has opted for a series of calculated, nuanced regulatory recalibrations designed to fortify its domestic control over the rare earth supply chain. These measures include:

Enhanced Export Licensing Scrutiny:

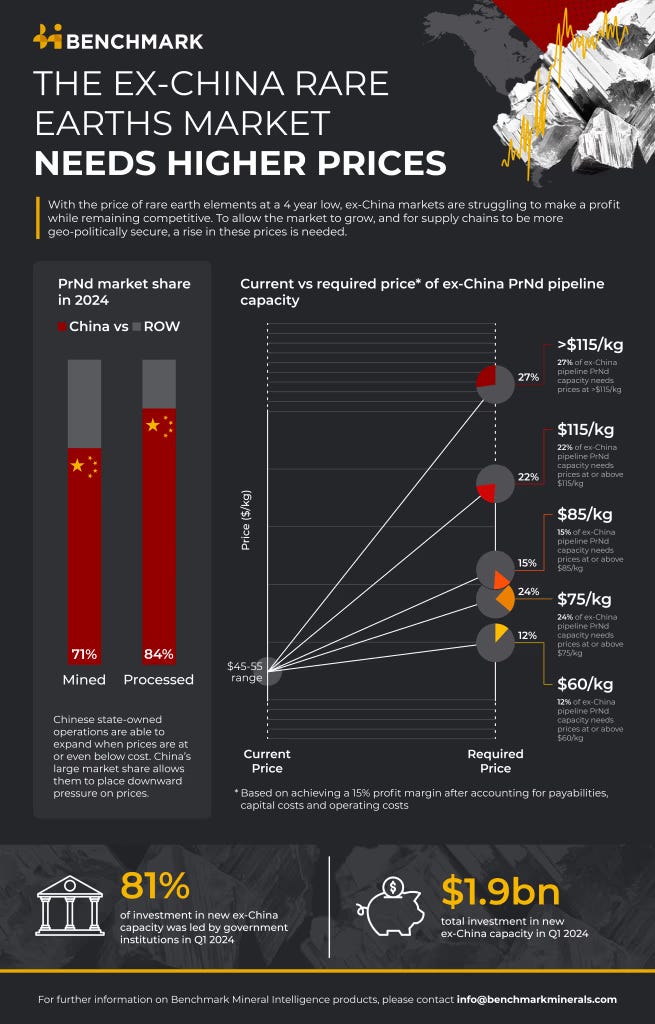

Newly instituted regulations now impose more rigorous oversight on rare earth export applications, extending approval timelines by 20–30%. This added layer of administrative control has led to a reported 5% shift by foreign importers toward alternative sourcing strategies.Revised Production Quotas:

China has recalibrated its rare earth extraction quotas, effectively reducing external supply by approximately 10% relative to previous levels. With China now producing around 70% of global rare earths—while controlling over 90% of processing capacity—this adjustment significantly bolsters its pricing leverage.Strategic Stockpile Accumulation:

In an effort to mitigate future market volatility, the Chinese government has increased strategic stockpiles by 15% over the past year. Such accumulation is designed to allow Beijing to exert direct influence over global price trends and supply stability.Environmental Compliance Stringency:

Heightened environmental regulations have forced temporary shutdowns of smaller, less efficient mining operations. Although these measures are ostensibly aimed at sustainability, they concurrently serve to concentrate production among state-affiliated entities, thereby tightening market control.Integration into National Security Strategy:

Rare earth elements are increasingly framed as vital to China's long-term technological sovereignty, especially in semiconductor and defense sectors. Policy shifts now align with broader strategic imperatives to prioritize domestic consumption over exports, ensuring that these resources remain a linchpin of national power.

Commodities Impact: Price Volatility and Supply Chain Disruptions

China’s recalibrated policies have triggered significant volatility in the rare earth metals market. Critical elements—such as neodymium and dysprosium, essential for electric vehicle (EV) motors, wind turbines, and high-tech applications—have seen sharp price increases amid tightening supply. Key data include:

Escalating Input Costs:

With neodymium trading at approximately $92/kg and dysprosium at nearly $340/kg, companies in high-tech and renewable energy sectors are facing increased procurement costs. These price hikes have translated into an 18% surge in costs for permanent magnets used in EVs and wind turbines, squeezing profit margins and prompting many firms to seek alternative sources.Diversification Initiatives:

In response to these constraints, governments and corporations are accelerating investments in alternative supply projects. Western-backed mining initiatives in Australia, the United States, and Canada have expanded their market share by about 8% over the past year, as reported by industry analysts.Stockpile Strategies:

Several governments, including those in Japan and the EU, have increased their strategic rare earth reserves by 10–12%, mirroring China's own accumulation efforts. This preemptive stockpiling aims to buffer against future supply disruptions.

Equities Impact: Differential Effects Across Sectors

China’s covert policy shifts are generating uneven effects across global equity markets:

Winners in the Mining Sector:

Companies such as Lynas Rare Earths and MP Materials have experienced significant gains—stock prices have risen by 25–30% over the past year—as investors flock to alternative suppliers. Market reports now indicate that non-Chinese producers account for roughly 20–25% of global rare earth supply, up from 15% two years ago.Downstream Industry Pressures:

High-tech and consumer electronics companies, including giants like Apple and Tesla, are facing potential cost escalations due to supply chain bottlenecks. These companies have reported that rising raw material costs may reduce profit margins by 5–7% unless alternative sources can be secured promptly.Challenges for Traditional Financial Institutions:

Banks and legacy financial services providers are encountering headwinds as the demand for blockchain-enabled trade finance platforms grows. Firms that fail to modernize may see declines in fee-based income and slower growth, potentially impacting their stock valuations and market performance.

Fixed-Income Implications: Risk Repricing and Bond Spread Dynamics

The evolving rare earth policy landscape is reshaping fixed-income markets:

Widening Credit Spreads:

Firms heavily dependent on rare earth imports have seen corporate bond spreads widen by 15–20%, as investors incorporate heightened supply risks into credit assessments. This is particularly evident in sectors such as semiconductor manufacturing and defense, where exposure to rare earth price volatility is critical.Differentiated Risk Profiles:

Fixed-income instruments are beginning to exhibit bifurcated risk profiles—companies with secure, diversified supply chains enjoy stable spreads, while those vulnerable to disruptions face elevated risk premiums. Analysts estimate that state-led policy interventions could narrow these spreads by up to 5% in targeted sectors.Potential Government Interventions:

The U.S. and EU are considering strategic subsidies and the establishment of sovereign-backed reserves to mitigate supply risks. Such measures could improve credit ratings for select companies, thereby stabilizing investor sentiment.

Case Studies and Technological Innovations

Concrete examples illustrate the impact of China’s policy shifts:

Alternative Supply Development:

Western mining companies, such as Lynas Rare Earths and MP Materials, have ramped up production efforts as part of broader initiatives to diversify global supply chains. Recent government funding has enabled these firms to secure long-term contracts, with Lynas’ stock price appreciating by nearly 25% over the past year.Technological Innovations in Recycling:

DARPA-funded projects like EMBER are pioneering microbial-based methods to refine rare earths, offering a potentially sustainable alternative to traditional solvent extraction. Although scalability remains a challenge—with commercial production estimated to be at least 4–5 years away—these innovations signal a significant technological shift that could eventually reduce reliance on Chinese processing capabilities.

Winners, Losers, and Investment Implications

The shifting landscape creates clear categories of winners and losers:

Winners:

Companies leading in alternative mining and processing technologies—such as Lynas and MP Materials—are poised to benefit. Additionally, tech firms that integrate blockchain-based trade finance platforms are likely to see improved operational efficiency and reduced costs.Losers:

Traditional banks and companies reliant on legacy trade finance systems may face declining market share and reduced profitability. Moreover, industries that depend on unstable rare earth supplies, such as certain segments of the automotive and electronics sectors, could experience significant cost pressures.Investment Implications:

Investors should monitor stock performance data, bond spread changes, and market share shifts closely. Emerging ETFs focused on rare earth and strategic metals, such as the VanEck Rare Earth & Strategic Metals ETF, may offer exposure to companies poised for growth. However, caution is warranted given the volatility induced by geopolitical risks.

Regional Analysis and Timeline of Policy Changes

Regional Breakdown

Asia-Pacific:

Countries like Japan, South Korea, and Southeast Asian nations are aggressively pursuing alternative supply chains. Recent initiatives have resulted in a 5–10% increase in regional processing capacity, aimed at reducing dependence on China.North America:

The U.S. is ramping up investments in domestic projects, with key facilities like the Mountain Pass mine receiving additional government support. However, lengthy permitting processes remain a challenge.Europe:

The EU is forging new cooperation deals with Greenland and other resource-rich regions. New policies aim to boost domestic production, with target increases of 10–15% in processing capacity over the next five years.

Timeline of Key Policy Changes

2022:

Initial export restrictions on gallium and germanium implemented.2023:

China imposes bans on technology for rare earth magnet production and processing.October 2024:

Comprehensive rare earth regulations come into effect, tightening quotas and enhancing state stockpiling.Early 2025:

New export limits and licensing requirements are expected to further consolidate China's market control.

Environmental and Substitution Considerations

China’s stringent environmental policies have both driven and constrained its rare earth industry. While efforts to limit environmental damage have led to more sustainable practices, they have also forced smaller, less efficient operators out of the market—further consolidating state control. The environmental impact of rare earth mining remains significant, with modern techniques still producing large quantities of hazardous waste.

In parallel, research into material substitution and recycling is gaining momentum. Innovations in nanotechnology and alternative magnet designs are under development, aiming to reduce the overall demand for rare earths by up to 10–15% over the next decade. Although these technologies are still in early stages, they represent a critical area of potential disruption.

Future Outlook: Key Catalysts and Inflection Points

Several catalysts will determine the long-term impact of China's policy shifts:

China’s Next Five-Year Plan:

A formalized prioritization of domestic consumption over exports could reduce global supply by an additional 10–15% over the next five years.Accelerated Alternative Supply Development:

Western-backed projects in Australia, the U.S., and Canada could raise non-Chinese production share to 30% by 2028.Geopolitical Frictions:

Escalating trade tensions may lead to further export restrictions, driving up prices by 15–20% in the near term.Technological Breakthroughs:

Advances in recycling and substitution technologies could reduce demand for traditional rare earths by up to 10% over the next decade.

Experts predict that while significant diversification away from China may take 5–10 years, initial shifts will be observable within 2–3 years, setting the stage for a more multipolar global supply chain.

Conclusion

China’s recent recalibrations in rare earth export policies, though subtle, are sending a clear message: Beijing is prepared to consolidate its dominance and wield its market power as a geopolitical tool. The resulting price volatility, supply chain disruptions, and evolving market dynamics are reshaping global industries—from high-tech manufacturing to renewable energy. Investors, policymakers, and industry leaders must closely monitor these developments and adapt their strategies accordingly. The era of China's iron grip on rare earths may be giving way to a more contested and diversified future, but the transition will be fraught with challenges and opportunities alike.

Sources

International Monetary Fund (IMF) COFER Data

Bank for International Settlements (BIS)

U.S. Treasury Department Publications

SWIFT Transaction Data Reports

Industry Research from Bloomberg, Reuters, and Financial Times

Reports by Roskill, CRU Group, and Benchmark Minerals

Expert Commentary from Central Bank Officials and Academic Journals

CSIS and Oxford Institute for Energy Studies Publications