From Vacuum Tubes to AI Gold Rush: The $700 Billion Revolution That Rewrote Investment Rules

How Seven Decades of Silicon Innovation Created Today's Most Lucrative Multi-Asset Opportunity

The semiconductor industry's remarkable journey from laboratory curiosity to the backbone of the global economy represents one of the most profound investment transformations in modern financial history. What began as a quest to replace unreliable vacuum tubes has evolved into a $626 billion industry that drives artificial intelligence, powers smartphones in every pocket, and fundamentally reshapes how capital flows across every major asset class. This technological revolution has created investment opportunities that extend far beyond traditional technology stocks, influencing everything from venture capital allocation to industrial real estate valuations and commodity prices.

This is Part 2 of our comprehensive primer on the semiconductor industry, designed to equip investors with the historical context necessary to understand today's market dynamics. While Part 1 introduced the fundamental concepts, this installment traces the remarkable arc of innovation that transformed a Bell Labs experiment into the foundation of modern finance. By understanding this evolution, investors can better appreciate why semiconductors have become the ultimate multi-asset catalyst, influencing portfolio construction across every major investment category.

The Vacuum Tube Era and the Seeds of Revolution

The story of semiconductors begins not with silicon, but with glass. For the first half of the twentieth century, vacuum tubes dominated electronics, powering everything from early computers to radio amplifiers. These bulky devices, while revolutionary for their time, carried inherent limitations that would eventually demand a technological breakthrough. Vacuum tubes suffered from excessive power consumption, requiring higher operating voltages and generating substantial waste heat that reduced overall system efficiency. Their physical bulk made portable applications nearly impossible, while their fragility led to frequent failures and costly maintenance requirements1.

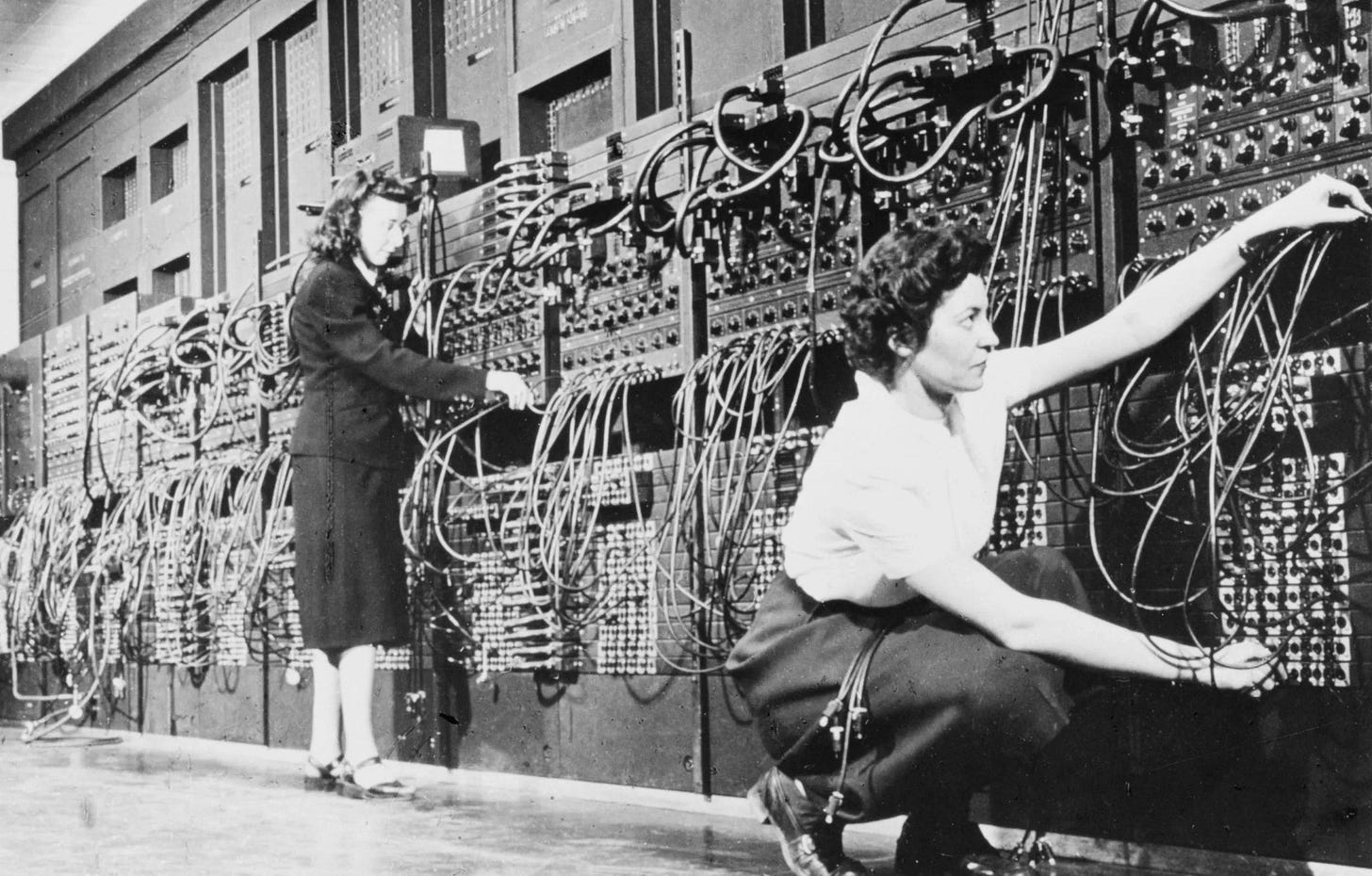

Perhaps most critically for the emerging computer industry, vacuum tubes presented a scalability crisis. Early computers like ENIAC contained thousands of vacuum tubes, creating systems that were not only room-sized but prone to constant breakdowns. The economic implications were staggering - organizations investing in early computing technology faced enormous operational costs due to the need for specialized cooling systems, frequent component replacement, and dedicated maintenance staff. This reliability problem created a clear market opportunity for any technology that could deliver similar functionality with greater dependability and lower operational costs.

The investment landscape of the 1940s reflected these technological constraints. Electronics companies faced fundamental trade-offs between performance and reliability, limiting the scalability of electronic solutions across industries. Capital allocation in technology ventures was constrained by the physical limitations of vacuum tube technology, creating an environment ripe for disruption. The stage was set for an innovation that would not only solve these technical challenges but fundamentally alter the trajectory of technological investment for decades to come.

The Bell Labs Breakthrough: December 1947

On December 16, 1947, at Bell Laboratories in New Jersey, theoretical physicist John Bardeen and experimental physicist Walter Brattain achieved what would become known as the most significant technological breakthrough of the century. Working under the guidance of William Shockley, who had organized a solid-state physics group to find semiconductor replacements for unreliable vacuum tubes, they successfully demonstrated the first semiconductor amplifier. Their device consisted of two closely-spaced gold contacts applied to a small slab of high-purity germanium, with the voltage on one contact modulating the current flowing through the other, amplifying the input signal up to 100 times.

The economic significance of this moment cannot be overstated. When Bell Labs publicly announced the transistor at a press conference in New York on June 30, 1948, a company spokesman prophetically claimed that "it may have far-reaching significance in electronics and electrical communication". This understated prediction would prove to be one of the greatest understatements in investment history. The transistor solved every major limitation of vacuum tubes - it was smaller, more reliable, consumed less power, and generated less heat. Most importantly for investors, it opened the door to mass production techniques that would drive costs down exponentially over time.

The initial market reception, however, was measured. Despite its revolutionary potential, the early transistor faced adoption challenges due to its delicate mechanical construction and limited understanding of its applications. Many thousands of units were produced in metal cartridge packages as the Bell Labs "Type A" transistor, but widespread commercial adoption would take several years. This initial period created early investment opportunities for those prescient enough to recognize the technology's transformative potential, while also demonstrating the typical lag between technological breakthrough and market adoption that continues to characterize semiconductor investment cycles today.

The Integrated Circuit Revolution and the Birth of Moore's Law

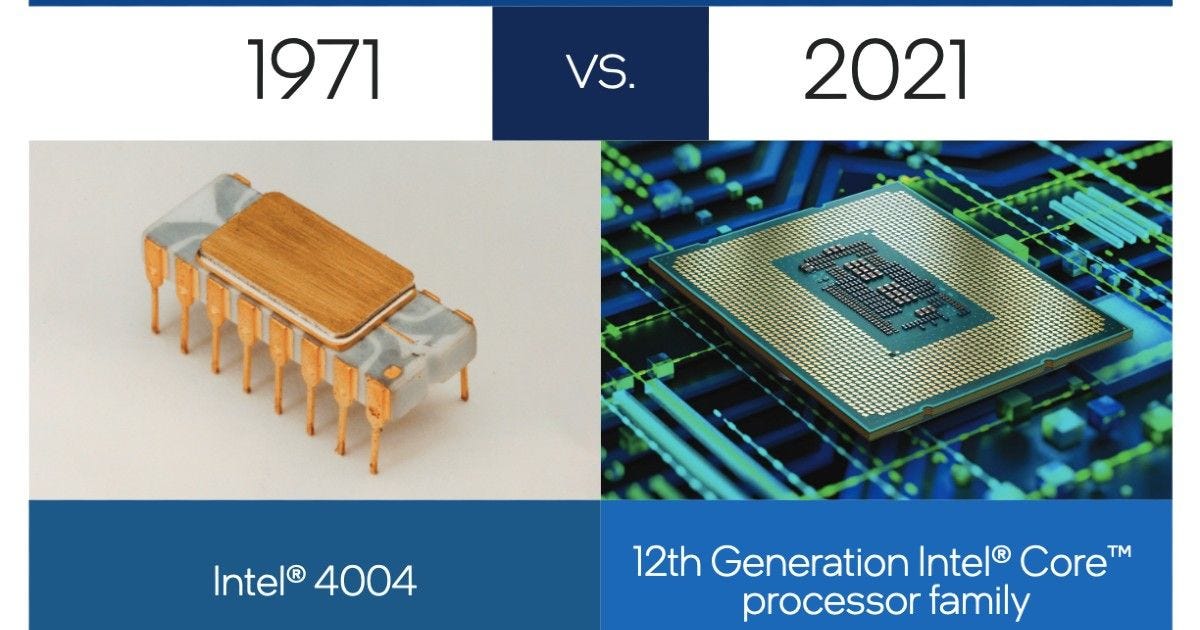

The next critical breakthrough came with the development of integrated circuits and the subsequent introduction of the microprocessor. The Intel 4004, released in November 1971, represented the first commercially marketed microprocessor chipset and marked both a technological and economic milestone in computing. Priced at $60 (equivalent to $466 in 2024), this 4-bit processor demonstrated the commercial viability of large-scale integration using MOS silicon gate technology, which enabled twice the transistor density and five times the operating speed compared to existing technology.

The 4004's development story illustrates the complex interplay between customer demand and technological innovation that drives semiconductor investment cycles. The project originated in 1969 when Busicom Corp. commissioned Intel to design a family of seven chips for electronic calculators. Intel engineer Marcian Hoff's proposal for a simpler architecture based on data stored on RAM made a single-chip CPU possible, fundamentally changing the economics of electronic systems. This shift from custom hardware to programmable processors created new business models and investment opportunities that extended far beyond the semiconductor industry itself.

During this same period, Intel co-founder Gordon Moore articulated what would become known as Moore's Law. In his 1965 Electronics Magazine article, Moore projected that the number of transistors per square inch on a microchip would double each year while manufacturing costs per component would halve. He later revised this to doubling every two years, creating an empirical observation that has guided semiconductor industry development and investment for over five decades. Moore's Law became more than a technical roadmap - it evolved into an economic framework that enabled long-term capital planning and created predictable growth trajectories that investors could model and anticipate.

The implications of Moore's Law extended far beyond chip manufacturing. As the cost of computing fell dramatically, semiconductors became the technology platform underpinning how the world works, communicates, and consumes. This cost reduction enabled the adoption of semiconductors across an ever-widening span of technologies, creating successive waves of investment opportunities that would define the modern economy. Today, the computing power of a single integrated circuit is roughly 2 billion times what it was in 1960, representing one of the most dramatic performance improvements in any industrial sector4.

Three Eras of Market Transformation

The Personal Computer Revolution

The introduction of the IBM Personal Computer on August 12, 1981, marked the beginning of the first great semiconductor-driven market transformation. Powered by an Intel 8088 processor and based on open architecture principles, the IBM PC created a standardized platform that enabled an entire ecosystem of compatible hardware and software companies. This standardization proved crucial for investment flows, as it created predictable demand patterns and enabled economies of scale that drove down costs while expanding markets.

The PC revolution fundamentally altered technology investment patterns. Prior to the 1980s, IBM had been primarily known as a provider of business computer systems, but the microcomputer market had grown to $15 billion in sales by 1979 with projected annual growth exceeding 40%. This explosive growth attracted capital from across the technology sector, creating new public and private investment opportunities while establishing the semiconductor industry as a core component of diversified technology portfolios. The open architecture approach also enabled the rise of specialized component manufacturers, creating a complex supply chain that would become increasingly important to global economic stability.

The Mobile Explosion

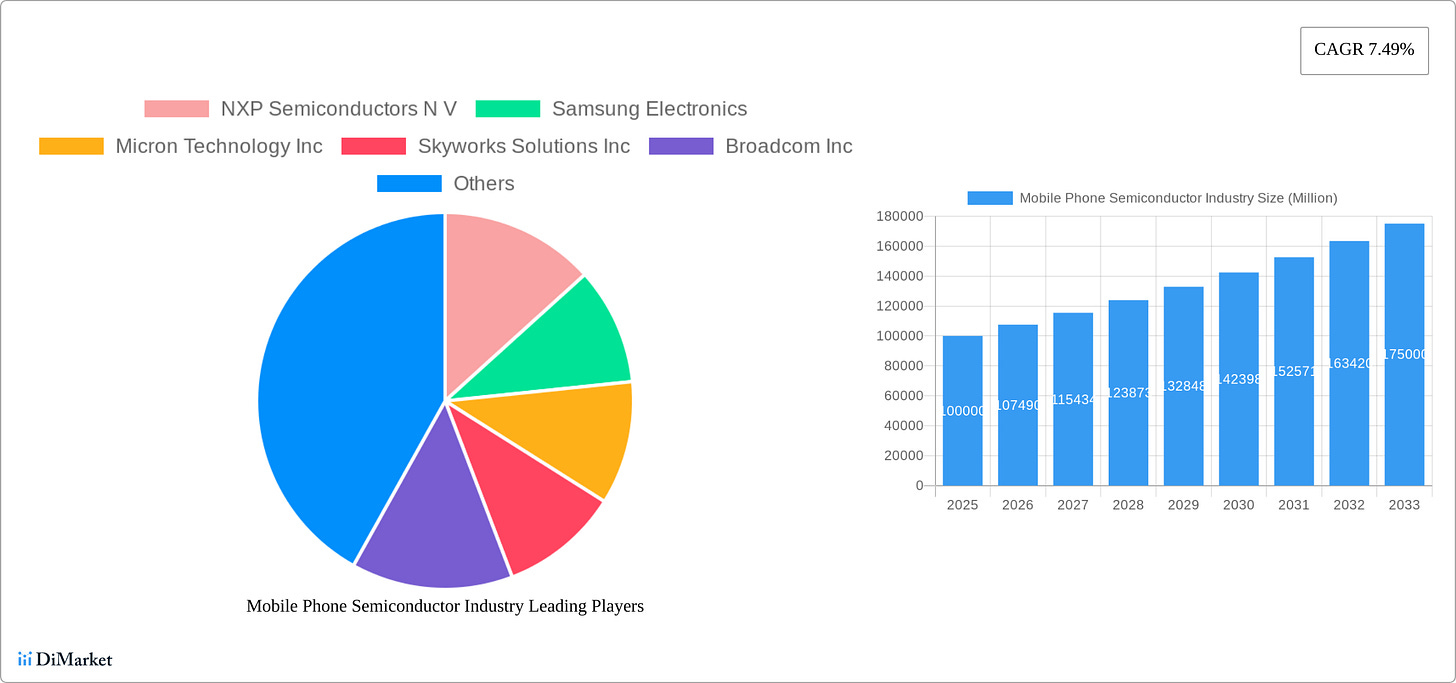

The second major transformation began with the widespread adoption of mobile phones and accelerated with the smartphone revolution. The mobile phone semiconductor industry exemplifies how technological advancement creates sustained investment opportunities across multiple cycles. Currently valued at significant levels with a projected compound annual growth rate of 7.49% from 2025 to 2033, the mobile semiconductor market continues to drive innovation in processor design, memory solutions, and specialized chips for applications like artificial intelligence and machine learning.

The mobile revolution created new investment dynamics characterized by rapid product cycles and intense competition among major players like Qualcomm, Samsung, and MediaTek. This competitive environment drives continuous innovation and cost reductions, making advanced mobile semiconductor technology accessible to broader consumer markets while creating sustained revenue growth for successful companies. The increasing demand for high-performance smartphones with features like 5G connectivity, improved camera capabilities, and enhanced processing power continues to fuel demand for sophisticated semiconductors, creating predictable upgrade cycles that investors can model and anticipate.

The Data Center and AI Era

The most recent transformation has been driven by artificial intelligence and cloud computing, which have elevated data centers to become the second-largest market for semiconductors. Global semiconductor revenue soared to $626 billion in 2024, marking an 18.1% jump from the previous year, largely driven by insatiable demand for AI and generative AI technologies. Data center semiconductor revenue totaled $112 billion in 2024, up from $64.8 billion in 2023, representing the dramatic impact of AI on infrastructure investment.

Graphics processing units (GPUs) and AI processors used in data center applications have become key drivers for the entire chip sector, reshaping competitive landscapes and creating new categories of specialized semiconductors. This transformation extends beyond pure technology plays, influencing real estate investment in data center properties, utility companies managing increased power demand, and infrastructure companies building the physical networks required to support AI workloads. The explosion in AI-related workloads has fueled massive investment in data center infrastructure, creating interconnected investment opportunities across multiple sectors and asset classes.

Conclusion: The Continuing Revolution

The semiconductor industry's evolution from vacuum tubes to artificial intelligence represents more than technological progress - it exemplifies how sustained innovation creates cascading investment opportunities across every major asset class. Each major breakthrough, from the transistor's invention in 1947 to today's AI processors, has fundamentally altered economic relationships and created new categories of investment opportunities that extend far beyond the technology sector itself. Understanding this historical progression provides crucial context for evaluating current market dynamics and positioning portfolios for future technological waves.

The industry's current transformation around artificial intelligence and data center applications represents the latest chapter in this ongoing story, but the underlying patterns remain consistent. Breakthrough technologies emerge from specialized research and development, require significant capital to scale, and eventually create broad economic impacts that influence every aspect of financial markets. The $626 billion semiconductor market projected to reach $705 billion in 2025 represents not just an industry growing in size, but a fundamental driver of global economic transformation that will continue to reshape investment opportunities for decades to come.

For modern investors, the semiconductor industry's history demonstrates the importance of maintaining exposure to technological innovation while understanding the complex multi-asset implications of breakthrough technologies. The industry's influence now extends from venture capital funding of early-stage innovations to real estate investment in data center infrastructure, creating interconnected opportunities that require sophisticated analysis and strategic positioning. As we move forward into an era defined by artificial intelligence and quantum computing, the lessons learned from seven decades of semiconductor innovation provide essential guidance for navigating the investment landscape of tomorrow.

The revolution that began with replacing unreliable vacuum tubes has become the foundation of modern economic growth, and its influence continues to expand across every corner of global financial markets. Understanding this progression remains essential for investors seeking to participate in the ongoing transformation of how the world works, communicates, and creates value in an increasingly digital economy.

Sources

https://www.computerhistory.org/siliconengine/invention-of-the-point-contact-transistor/

https://www.csis.org/analysis/moores-law-and-its-practical-implications

https://w.media/data-centers-surge-to-second-largest-semiconductor-market-fueled-by-ai-boom-gartner/

https://www.datainsightsmarket.com/reports/mobile-phone-semiconductor-industry-14194

https://www.yolegroup.com/product/report/semiconductor-trends-in-datacenter-2024/

https://www.datainsightsmarket.com/reports/robotics-in-semiconductor-1536605

https://curvo.eu/backtest/en/market-index/sp-technology-select-sector

https://semiengineering.com/increasing-roles-for-robotics-in-fabs/

https://stockinsideout.com/market-data/historical-returns/nifty-it-historical-returns/

https://www.effectrode.com/knowledge-base/vacuum-tubes-and-transistors-compared/

https://www.drishtiias.com/to-the-points/paper3/semiconductor-revolution

https://www.britannica.com/technology/electronics/The-semiconductor-revolution

https://www.computerhistory.org/revolution/digital-logic/12/272